China can now bypass Wall Street when buying U.S. government debt and go straight to the U.S. Treasury, in what is the Treasury’s first-ever direct relationship with a foreign government, according to documents viewed by Reuters. The relationship means the People’s Bank of China buys U.S. debt using a different method than any other central bank in the world. The other central banks, including the Bank of Japan, which has a large appetite for Treasuries, place orders for U.S. debt with major Wall Street banks designated by the government as primary dealers. Those dealers then bid on their behalf at Treasury auctions. China, which holds $1.17 trillion in U.S. Treasuries, still buys some Treasuries through primary dealers, but since June 2011, that route hasn’t been necessary. The documents viewed by Reuters show the U.S. Treasury Department has given the People’s Bank of China a direct computer link to its auction system, which the Chinese first used to buy two-year notes in late June 2011. China can now participate in auctions without placing bids through primary dealers. If it wants to sell, however, it still has to go through the market..."

Links to global economy, financial markets and international politics analyses

Sunday, May 27, 2012

A Closer Look at Chinese Purchases of US Treasuries

"Reuters – U.S. lets China bypass Wall Street for Treasury orders

China can now bypass Wall Street when buying U.S. government debt and go straight to the U.S. Treasury, in what is the Treasury’s first-ever direct relationship with a foreign government, according to documents viewed by Reuters. The relationship means the People’s Bank of China buys U.S. debt using a different method than any other central bank in the world. The other central banks, including the Bank of Japan, which has a large appetite for Treasuries, place orders for U.S. debt with major Wall Street banks designated by the government as primary dealers. Those dealers then bid on their behalf at Treasury auctions. China, which holds $1.17 trillion in U.S. Treasuries, still buys some Treasuries through primary dealers, but since June 2011, that route hasn’t been necessary. The documents viewed by Reuters show the U.S. Treasury Department has given the People’s Bank of China a direct computer link to its auction system, which the Chinese first used to buy two-year notes in late June 2011. China can now participate in auctions without placing bids through primary dealers. If it wants to sell, however, it still has to go through the market..."

China can now bypass Wall Street when buying U.S. government debt and go straight to the U.S. Treasury, in what is the Treasury’s first-ever direct relationship with a foreign government, according to documents viewed by Reuters. The relationship means the People’s Bank of China buys U.S. debt using a different method than any other central bank in the world. The other central banks, including the Bank of Japan, which has a large appetite for Treasuries, place orders for U.S. debt with major Wall Street banks designated by the government as primary dealers. Those dealers then bid on their behalf at Treasury auctions. China, which holds $1.17 trillion in U.S. Treasuries, still buys some Treasuries through primary dealers, but since June 2011, that route hasn’t been necessary. The documents viewed by Reuters show the U.S. Treasury Department has given the People’s Bank of China a direct computer link to its auction system, which the Chinese first used to buy two-year notes in late June 2011. China can now participate in auctions without placing bids through primary dealers. If it wants to sell, however, it still has to go through the market..."

The next steps in ASEAN+3 monetary integration

"Now is probably not a great time to be talking about further monetary integration – even if it is in Asia. But this column argues that the ASEAN+3 has taken a number of significant steps recently to further deepen monetary integration. The next steps should be to introduce a regional weighted currency basket and expand membership.

On 3 May 2012, on the sidelines of the Asian Development Bank’s Annual Meeting in Manila, the ASEAN+3 took a number of significant steps to further deepen monetary integration in the region (Joint Ministerial Statement 2012). In the midst of a flurry of other activities and announcements – including the sharp increase in ADB lending last year and the launching of the ASEAN Infrastructure Fund – these important steps went relatively unnoticed.

The most significant outcome of the Manila meeting was the upgrading of the ASEAN +3 Finance Ministers Meeting (AFMM+3) to the ASEAN+3 Finance Ministers and Central Bank Governors’ Meeting (AFMGM+3); the central bank governors of the 13 member countries (plus Hong Kong) have been invited to join. In the past, the region’s firewall for crisis prevention and crisis resolution had been run solely by finance officials responsible for tax and expenditure policies. Officials responsible for monetary and exchange-rate policies were left out. This major gap has now finally been filled..."

"ECB Will be Insolvent and Costs May Exceed 1 Trillion Euros" Says IIF Director; If the ECB Prints, Would Germany Exit the Euro?

"According to IIF director Charles Dallara in a Bloomberg interview, "ECB will be insolvent if Greece were to exit the euro. Europe would have to first and foremost recapitalize its central bank."

Excuse me for asking but how would they attempt to do that? Print Euros?

Please consider Dallara Says Greek Euro Exit May Exceed 1 Trillion Euros

at http://globaleconomicanalysis.blogspot.com/2012/05/ecb-will-be-insolvent-and-costs-may.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29

Excuse me for asking but how would they attempt to do that? Print Euros?

Please consider Dallara Says Greek Euro Exit May Exceed 1 Trillion Euros

The cost of Greece exiting the euro would be unmanageable and probably exceed the 1 trillion euros ($1.25 trillion) previously estimated by the Institute of International Finance, the group’s managing director said.

The Washington-based IIF’s projection from earlier this year is “a bit dated now” and “probably on the low side,” Charles Dallara said in an interview in Rome today. “Those who think that Europe, and more broadly the global economy, are really prepared for a Greek exit should think again.”

The European Central Bank’s exposure to Greek liabilities is more than twice as big as the ECB’s capital, said Dallara, who represented banks in their negotiations with the Greek government on its debt restructuring. As a result, he predicted the bank would be unable to provide liquidity and stabilize the euro-area financial sector.

“The ECB will be insolvent” if Greece were to exit the euro, Dallara said. “Europe would have to first and foremost recapitalize its central bank.”

at http://globaleconomicanalysis.blogspot.com/2012/05/ecb-will-be-insolvent-and-costs-may.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29

Are The Europeans About To Start The Second Half Of Our Great Depression?

""Just when we think the worst is over - and let's face it we have been in this crisis for five years - we get the second half; are the Europeans about to start the second half our Great Depression with massive bank runs" are the Jaws-music-inspired words that recent media-favorite (yes, us too) Niall Ferguson uses in an interview with CBC. His main concern is that this kind of (bank-run) event can quickly spiral out of the control of even the ECB as he uncomfortably conjures the image of the initial US stabilization that occurred in 1930 to May 1931 only to be knocked back into a greater depression by the failure of Credit-Anstalt, which set off bank failures and eventually defaults in 1932 on many government debts. The deposit run potential is the single-biggest reason to care about Greek-exit - in itself it is not large enough economically to interfere with global growth but it is the message and contagion that it sends that is critical in bringing forth a pan-European banking crisis and implicitly spilling over to the US and Asia via global trade and banking transmission channels. An excellent brief interview that summarizes the exact fears that face Europe and implicitly the US, explains the rather simple solution of fiscal federalism and the fact that today's German politik is very different from 1989's Helmut Kohl-era with regard to their commitment to the Federal outcome. His conclusions are worrisome. Germany is the key - and there is not a good understanding of financial markets in Berlin..."

at http://www.zerohedge.com/news/are-europeans-about-start-second-half-our-great-depression

at http://www.zerohedge.com/news/are-europeans-about-start-second-half-our-great-depression

Panic/Euphoria Model Is In “Panic” Territory – So Where’s the Fear?

"With stocks declining in the last few weeks all the various sentiment

surveys point to excessive bearishness/excessive fear. That’s in spite of the fact that market based indicators such as the VIX Index are not showing very much fear at all. While this market is deeply oversold and due for a relief rally, these readings are suggestive that there is more downside before we see an intermediate term bottom..."

surveys point to excessive bearishness/excessive fear. That’s in spite of the fact that market based indicators such as the VIX Index are not showing very much fear at all. While this market is deeply oversold and due for a relief rally, these readings are suggestive that there is more downside before we see an intermediate term bottom..."

Hathaway: Central Banks & Wealthy Are Now Big Buyers of Gold

"Four-decade veteran John Hathaway told King World News, “I was in California last week and I met with a lot of people. They are buying physical gold. Wealthy, private investors are buying gold.” The prolific manager of the Tocqueville Gold Fund also said, “we are starting to see a lot of central bank buying of gold.” Hathaway had this to say about gold bouncing solidly off the low $1,500 level: “That’s very encouraging. That was a very good test of the December low at $1,523, and it seems to me we are in good shape for six months or more. It could be (gold gaining) for the next two years.”

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/5/25_Hathaway__Central_Banks_%26_Wealthy_Are_Now_Big_Buyers_of_Gold.html

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/5/25_Hathaway__Central_Banks_%26_Wealthy_Are_Now_Big_Buyers_of_Gold.html

Friday, May 25, 2012

When did the dollar overtake sterling as the leading international currency? Evidence from the bond markets

"Conventional wisdom states that the dollar took over as the leading international currency after the Second World War. This column presents new evidence from the bond markets suggesting it was much earlier in the 1920s. This implies that inertia and lock-in effects in international currencies are not all they’re cracked up to be and that the shift to a multipolar currency system might happen sooner than commonly believed.

The global economic and financial crisis has lent new impetus to discussions of the future of the international monetary and financial system. Some advocate moving to a multipolar system in which the US dollar shares its international currency role with the euro, the Chinese renminbi and/or the IMF’s Special Drawing Rights. At the Cannes Summit of November 2011, G20 Leaders committed to taking “concrete steps” to ensure that the international monetary system reflects “the changing equilibrium and the emergence of new international currencies”.

Some observers expect this change to develop spontaneously, as a natural consequence of the declining economic and financial dominance of the US and the increasingly multipolar nature of the global economy, together with the advent of the euro and gradual internationalisation of the renminbi. Sceptics object that the prospect of a shift to a multipolar monetary and financial system is remote. If it occurs, they insist, such a transition would take many decades to complete.

The view that a shift to a multipolar system is unlikely to occur rapidly is rooted in theoretical models where international currency status is characterised by network externalities (see for example Krugman 1980 and 1984; Matsuyama et al. 1993; Zhou 1997; Hartmann 1998; and Rey 2001). These give rise to lock-in and inertia effects, which benefit the incumbent.

Such models rest, in turn, on a conventional historical narrative, epitomised by Triffin (1960), according to which it took between 30 and 70 years, depending on the aspects of economic and international currency status considered, from when the US overtook Britain as the leading economic and commercial power and when the dollar overtook sterling as the dominant international currency. Allegedly, sterling remained the dominant international currency throughout the interwar years and even for a time after the Second World War.

Recent studies (Eichengreen and Flandreau 2009 and 2010) have challenged this conventional account, showing that the dollar in fact overtook sterling already in the mid-1920s as lead currency for financing and settling trade and the leading form of international reserves. This “new view”, to paraphrase Frankel (2011), also challenges broader implications of the conventional narrative. It suggests that inertia and the advantages of incumbency are not all they are cracked up to be. It challenges the notion that there is room for only one international currency in the global system, as well as the presumption that dominance, once lost, is gone forever.

In a recent paper (Chiţu et al. 2012), we reexamine the role of international currencies as vehicles and currencies of denomination for foreign investment. Specifically, we analyse the currency denomination of foreign public debt for 33 countries in the period 1914-1946. The results lend further support to the “new view”..."

at http://www.voxeu.org/index.php?q=node/8024

The global economic and financial crisis has lent new impetus to discussions of the future of the international monetary and financial system. Some advocate moving to a multipolar system in which the US dollar shares its international currency role with the euro, the Chinese renminbi and/or the IMF’s Special Drawing Rights. At the Cannes Summit of November 2011, G20 Leaders committed to taking “concrete steps” to ensure that the international monetary system reflects “the changing equilibrium and the emergence of new international currencies”.

Some observers expect this change to develop spontaneously, as a natural consequence of the declining economic and financial dominance of the US and the increasingly multipolar nature of the global economy, together with the advent of the euro and gradual internationalisation of the renminbi. Sceptics object that the prospect of a shift to a multipolar monetary and financial system is remote. If it occurs, they insist, such a transition would take many decades to complete.

The view that a shift to a multipolar system is unlikely to occur rapidly is rooted in theoretical models where international currency status is characterised by network externalities (see for example Krugman 1980 and 1984; Matsuyama et al. 1993; Zhou 1997; Hartmann 1998; and Rey 2001). These give rise to lock-in and inertia effects, which benefit the incumbent.

Such models rest, in turn, on a conventional historical narrative, epitomised by Triffin (1960), according to which it took between 30 and 70 years, depending on the aspects of economic and international currency status considered, from when the US overtook Britain as the leading economic and commercial power and when the dollar overtook sterling as the dominant international currency. Allegedly, sterling remained the dominant international currency throughout the interwar years and even for a time after the Second World War.

Recent studies (Eichengreen and Flandreau 2009 and 2010) have challenged this conventional account, showing that the dollar in fact overtook sterling already in the mid-1920s as lead currency for financing and settling trade and the leading form of international reserves. This “new view”, to paraphrase Frankel (2011), also challenges broader implications of the conventional narrative. It suggests that inertia and the advantages of incumbency are not all they are cracked up to be. It challenges the notion that there is room for only one international currency in the global system, as well as the presumption that dominance, once lost, is gone forever.

In a recent paper (Chiţu et al. 2012), we reexamine the role of international currencies as vehicles and currencies of denomination for foreign investment. Specifically, we analyse the currency denomination of foreign public debt for 33 countries in the period 1914-1946. The results lend further support to the “new view”..."

at http://www.voxeu.org/index.php?q=node/8024

Bank Of Russia To Buy “Considerable Figure" Of Gold Tonnage In 2012

"...The IMF central bank gold demand figures for April were very bullish and suggest that central bank demand in 2012 may be even higher than the 456.4 tons added last year – which was the most in almost five decades.

The World Gold Council estimates that central banks will buy as much as 400 tons this year.

The data yesterday suggests that demand may be even higher than these levels and there is also the near certainty that larger central banks, such as the People’s Bank of China, are quietly accumulating gold reserves and not reporting their purchases to the IMF - as was done previously.

Today, the deputy chairman of Russia's central bank, Sergey Shvetsov, said that the Bank of Russia plans to keep buying gold on the domestic market in order to diversify their foreign exchange reserves.

"Last year we bought about 100 tonnes. This year it will be less but still a considerable figure," Shvetsov told Reuters on the sidelines of a financial conference in Milan.

Russia's gold and foreign exchange reserves fell to $514.3 billion in the week ending May 18, from $518.8 billion a week earlier. However, they have risen from the $498.6 billion seen at the end of 2011.

Yesterday, Shvetsov said that Greece has plans for a parallel currency and that it is a “necessity” for Greece to leave the euro..."

Greece Has Proved That the ECB Bailout Scheme is Based On Nothing But Lies and Fraud

"I’ve assess the significance of the Greek elections in an earlier article.

However, there is one final element to Greece’s current predicament that is even more important than any of the above items. That element is the following:

The Second Greek Bailout has proven to be based on a total and complete lie on the part of the ECB and EU politicians.

If you’ll recall, during the Second Greek bailout, private Greek bondholders were told that they HAD to accept the terms of the bailout (a 70% haircut, and new bonds with lower interest rates and longer repayment periods). The alternative to this, as promoted by the ECB and EU politicians, was the total loss of money.

As you may or may not know, only 97% of private bondholders went for the deal. The remaining 3% (representing roughly €6.5 billion in Greek debt) decided they would maintain their bond holdings as they were and see if they got their money back.

Last Tuesday, Greece was scheduled to make €436 million in principle payments on this €6.5 billion. And it did. Every single penny.

And they didn’t even have to! Indeed, under normal conditions if Greece missed this payment deadline, it would have seven days to make the payment. However, this time around, Greece had 30 days to make the payment before it would be considered to be in default.

And Greece chose to pay bondholders every penny right on time.

Put another way, those Greek bondholders who DIDN’T go for the Second Bailout, just got their money back at 100 cents on the Dollar (compared to those who DID go for the Second Bailout and lost 70% of their money).

This has shown the ECB and EU bureaucrats to be complete and total liars. It also shows the entire bailout/ austerity measures process to be garbage. Private bondholders got screwed. Greece got more debt and an even weaker economy. In fact, the only group that has so far gotten through the Greek mess relatively well has been the ECB, which swapped out ALL of its Greek exposure for bonds that DIDN’T take a haircut..."

Welcome to the Currency War, Part 1: Iceland and the Tragedy of the Commons

"Think of devaluation as the monetary equivalent of the “tragedy of the commons”. In a nutshell, if everyone owns something, it is in each individual’s interest to grab what they can as quickly as possible, which soon depletes the resource.

With currencies, as with fisheries and sheep pastures, there’s an advantage for those who move first and pain for those who dither. Consider Iceland’s nearly-instantaneous recovery from its epic banking crash:..."

Bank Runs in Europe: Reflection of the Global Financial Crises of 2009

"We often talk of once bitten twice shy, or so the saying goes. The current financial crisis in Greece, which is mooted to have spread to Spain, is causing bank runs in Europe albeit fears that the ‘wind’ that swept across the globe in 2009 is on the horizon. Greece has lost more than one third of its bank deposits as investors continue to seek for safer havens for their money. Spain, on the other hand has already shaded out more than $50 billion through direct withdrawals from banks, despite losing more than $140 billion from investment sellouts.

Bank Runs in Europe Mirroring the 2009 Global Financial Crises

Toward the end of the year 2008, a similar scenario took place at the Wall Street that sounded the beginning of the global financial crises. The current bank runs in Europe, albeit at the early stages, is nothing very different to what marked the beginning of 2009 global financial crises. The current divestiture taking place in Greece and Spain can only spark global crises if not monitored.

Even U.S banks with operations in Europe have already started feeling the pinch, as reported early this year during in their end year financial statements. The likes of Citigroup Inc. (NYSE:C), Unicredit Group, headquartered in Milan with operations in 22 countries including the U.S, and Credit Suisse Group AG (NYSE:CS) headquartered in Zurich with operations in U.S, can bear witness to the impact of Greece financial crises. Some investors continue to substitute their Euro denominated assets with the pound or the dollar, while others seek the refuge of their investments in what appears to be stronger Euro zone countries, like Germany..."

Thursday, May 24, 2012

Richard Russell: Stay In Cash, Something, Something 'BIG' Is Heading Our Way

"Bearish newsletter guy Richard Russell finds the market action to be very strange and ominous.

at http://www.businessinsider.com/richard-russell-stay-in-cash-something-something-big-is-heading-our-way-2012-5#ixzz1voa47VB8

He's specifically concerned by the endless grinding down of the Dow in a manner that's steady but not yet panicky.

Here's his reaction after yesterday's market close, which was published on King World News

As of today's closing, Dow down 14 out of 16 sessions! This is one you can tell your kids about. And still no collapse in breadth, and still no crash. The only thing I can make out of it is that a lot of people are "standing their ground."

Maybe it's just the Dow that is dying, and the rest of the market is OK. But don't you believe it. The Dow represents the manufacturing capabilities of the United States, and when you see the Dow doing what it's doing, you can be sure that somewhere ahead business is going to take it on the chin..."

at http://www.businessinsider.com/richard-russell-stay-in-cash-something-something-big-is-heading-our-way-2012-5#ixzz1voa47VB8

Containment Theory Blows Sky High: German Manufacturing PMI Plunges to 45; French Manufacturing PMI Plunges to 44.4, Sharpest Contraction in 3 Years

"The Pollyannas who thought the European recession would be

short, shallow, and contained to the periphery have another thing coming. All

three ideas were downright silly as I have long stated.

French Manufacturing PMI Plunges to 44.4, Sharpest

Contraction in 3 Years

Markit reports French private sector output falls at

sharpest rate for over three years.

Key points:

Flash France Composite Output Index drops to 44.7 (45.9 in

April), 37-month low

Flash France Services Activity Index unchanged at 45.2

Flash France Manufacturing PMI falls to 44.4 (46.9 in

April), 36-month low

Flash France Manufacturing Output Index declines to 43.6

(47.5 in April), 36-month low..."

Central Banks Still Significant Buyers On Gold Dip

"While the gold tonnage demand from central banks in recent

months has been significant, gold remains a tiny fraction of most central

banks, especially emerging market creditor nations such as China, foreign

exchange reserves and therefore the trend is sustainable and indeed may

accelerate.

Central bank reserve diversification into gold may increase

given the Eurozone debt crisis and the risk of debt crisis spreading to Japan,

the UK and the U.S.

Indeed, there is the increasing possibility that some G8

debtor nations, such as the UK and Japan, may decide to once again add to their

gold reserves in order to protect their currencies and guard against the risk

of devaluations of the euro, dollar, yen, pound and a wider international

monetary crisis.

Price is not a determining factor in central bank buying

rather they are more likely being guided to secure an allocation of a

percentage of their overall foreign exchange reserves into gold bullion.

Sovereign government buying of gold is likely to support

gold at these levels and indeed could be the driver to higher prices in the

coming weeks and months."

Caesar Bryan - Global Investors Are Frightened At This Point

"With investors wondering where global markets are headed next, today King World News interviewed 25 year veteran Caesar Bryan. Gabelli & Company has over $31 billion under management and Caesar Bryan has managed the gold fund since its inception in 1994. Caesar told KWN that yesterday the “german bund yield fell below 2% for the first time ever.” Caesar also said this “reveals just how frightened people are at this point in time.” But first, here is what Caesar had to say about the battle taking place in key markets: “I think there’s a little bit of a battle going on. There’s clearly a lot of fear in capital markets around the world and that’s usually represented by a rush to short-term government bonds, in particular US dollar government bonds. With this type of fear and the need for liquidity, just about all assets get sold and gold is one of those assets.”

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/5/24_Caesar_Bryan_-_Global_Investors_Are_Frightened_At_This_Point.html

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/5/24_Caesar_Bryan_-_Global_Investors_Are_Frightened_At_This_Point.html

Wednesday, May 23, 2012

Gold Does Not Pay Interest (Neither Do Dollars in Your Wallet); Questions On Swapping Gold For Silver; Gold and Gold Shares Bottoming?

" Adam Fleming, Chairman of Wits Gold and Fleming Family &

Partners, discusses the gold bull market with GoldMoney's Chairman James Turk.

Topics include metal price action, the eurozone's debt crisis, and mining in

South Africa.

Adam points out that gold bull markets usually result in a

1:1 Dow/Gold ratio, something that he expects to see happen in the coming

years. In other words, it is still a great time to buy gold.

Adam is pessimistic about the eurozone, and thought plans

for European Monetary Union were delusional, on account of the differences in

culture and political economy between different European Union countries. He

also discusses his mining experience in South Africa, and why – contrary to

much negative press the country gets – it is actually still a great place to

live and work. He expects companies to increase their mining investments in the

Witwatersrand Basin, and thinks that this region will remain the world's

premier gold mining location.

This video was recorded on May 18 2012 in Jersey, British

Channel Islands..."

Japanese Debt Downgraded by Fitch; No Urgency for Japan (Until Sudden Panic Hits)

"With Japan's public debt about to hit 240% of GDP, Fitch

Downgrades Japan's Sovereign Rating

The ratings agency

Fitch on Tuesday lowered its assessment of Japan’s sovereign credit to A+, an

investment grade just above the likes of Spain and Italy, and criticized Tokyo

for not doing more to pare down its burgeoning debt.

Japan’s public debt will hit almost 240 percent of its gross

domestic product by the end of the year, Fitch warned.

The new rating also heightens the pressure on Prime Minister

Yoshihiko Noda to rein in spending and raise taxes at a delicate time, when the

Japanese economy is still recovering from natural and nuclear disasters last

year.

Mr. Noda has warned that Japan could eventually face a debt

crisis akin to that afflicting Europe and is staking his job on a plan to

double the consumption tax rate to 10 percent by late 2015. That increase, he

has argued, is necessary to pay for soaring welfare costs and pension payments..."

There Can Be Only One: China Sovereign Wealth Fund Says Renminbi Will Become Reserve Currency

"First the CIC stirs havoc in Europe, saying it would rather invest in Africa than in Brussels finmin summit caterers, which at this stage in the business cycle are the most profitable corporation imaginable... and now this:

- CIC'S JIN SAYS RENMINBI WILL BECOME GLOBAL RESERVE CURRENCY

Naturally, to parahprase titles of cheesy 80s movies, there can be only one.

So what would happen to the current one? Maybe the same as what happened to all the prior global "reserve" currencies:

Flowcharting The Eurocalypse

"We have laid out in great detail over the past few months the contagious paths, game-theoretical endgames, and transmission channels that would occur should a nation (Greece for example) leave the Euro. Yet the covered matter is not simple, which is why sometimes the best representation is the visual one. The Financial Times has outdone themselves with the best graphical (and audio walkthrough) representation of this process. From the collapse of the domestic banking system (and its possible social implications) to the creation of a new 'local' currency absent foreign capital aid, to the obvious 'who's next?' question that leads inevitably to exaggerated bank runs across other weak European nations and ultimately more pressure on already weak economies to exit the Euro - hastening a wholesale Euro-breakup. Eurocalypse now indeed."

Source: The Financial Times

Roubini : By Next Year You Could Have a Perfect Storm

"Nouriel Roubini : WELL, I SEE, 2% GROWTH IS BETTER THAN EUROPE THAT IS ONE BELOW U.S. POTENTIAL OF UNEMPLOYMENT BEING HIGH. BUT I WORRY ABOUT NEXT YEAR BECAUSE BY NEXT YEAR THERE IS A FISCAL DRIVE AND GIVEN THE FISCAL CLIFF AND WAGES ARE NOT GROWING REAL TERMS , SUSTAINABLE INCOME GROWTH THAT'S BEEN TAXES AND TRANSFERS. SOME OF THEM ARE GOING TO EXPIRE NEXT YEAR SO DOUBLE WHAMMY. FISCAL DRIVE AND ANOTHER DELEVERAGING ON HOUSE NOTES. THAN IF THE GROWTH IS ONLY 2% YOU GET THIS DRAG, GO TOWARDS 1% IS BACK TO STALLED SPEED, THE RISK OF A DOUBLE DIP IN A SITUATION IN WHICH EUROPE IS IN TROUBLE AND WE MIGHT HAVE A WAR WITH IRAN, THE ISSUE OF THE NUCLEAR PROLIFERATION, CHINA IS RUNNING DOWN, EVENTUAL HARD LANDING SO BY NEXT YEAR YOU COULD HAVE A PERFECT STORM. - in CNBC"

at http://nourielroubini.blogspot.com/2012/05/roubini-by-next-year-you-could-have.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+NourielRoubiniBlog+%28Nouriel+Roubini+Blog%29

at http://nourielroubini.blogspot.com/2012/05/roubini-by-next-year-you-could-have.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+NourielRoubiniBlog+%28Nouriel+Roubini+Blog%29

Agnico CEO Calls for $3,000+ Gold for the First Time Ever

"Today one of the top CEO’s in the world told King World News that gold will trade over $3,000 within twenty four months. Sean Boyd, CEO of $6.5 billion Agnico Eagle, also stated that prior to this, “I’ve never been at the $3,000+ number, ever, in 27 years.” Boyd also discussed the mining shares, but first, here is what Boyd had to say about the action in the gold market: “I think you’re in a situation right now where the problems in Europe are front page and it has hurt the euro. So the US dollar is stronger. If you look at the US dollar, that story is on page 3 or 4. It will be a front page story soon. The debt ceiling has to be raised and we really haven’t fixed a lot of the issues, whether it’s in the US or in Europe.”

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/5/22_We_See_Strong_Gold_Demand_From_China,_India_%26_Central_Banks.html

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/5/22_We_See_Strong_Gold_Demand_From_China,_India_%26_Central_Banks.html

Don Coxe - Most Incredible Opportunity Investors Will Ever See

"With continued turmoil in global markets, today King World News interviewed 40 year veteran Don Coxe, Strategy Advisor to BMO, which has $538 billion in assets. Coxe told KWN this is “the greatest transformation to occur at one time in the entire history of the human race.” He also stated, “This period we are living through now will be written about for thousands of years.” But first, here is what Coxe had to say about the start of his career: “I read in the paper one morning (in 1972) that the anchovy crop had failed off Peru. Now I had previously been General Counsel at the Canadian Federation of Agriculture, so I knew at that time that anchovies were a major, high protein food supplement for livestock.”

Don Coxe continues:

“So I came into the office and I said, ‘The anchovy crop has been destroyed and that means we’re going to have food inflation. We already have fuel inflation,’ so I said, ‘We’ve got to buy gold.’ We had to go to the board of directors of Mutual Life to approve it. They approved it. We bought in at $62 gold (in 1972), and we hung on until 1980. At that point gold was $700 (and we sold).

At that time it was clear that Paul Volcker was going to end inflation by driving interest rates to unheard of levels. That was the beginning of my investment career right there...."

John Embry - Banks Are Loaning Out “Allocated” Gold

"Today John Embry told King World News that customers holding “allocated” gold inside certain banking institutions have had their gold “loaned out.” Embry, who is Chief Investment Strategist of the $10 billion strong Sprott Asset Management, also told KWN, “Many of these customers will wake up one day and realize they entrusted their gold to the wrong people.” But first, here is what Embry had to say about what is happening in Europe and how it is impacting gold: “The pressure will be on the Germans today to fall off the austerity kick. The only alternative will seem to be that Germany will have to leave the euro and they are really not in a position to do that. The solution to keep the thing together is going to be more and more money creation and this is extraordinarily bullish for gold.”

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/5/23_John_Embry_-_Banks_Are_Loaning_Out_Allocated_Gold.html

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/5/23_John_Embry_-_Banks_Are_Loaning_Out_Allocated_Gold.html

Sunday, May 20, 2012

The Hilarious G-8 Declaration Decoded

"Rewriting the Camp David Declaration

– or what they couldn’t say and why they said what they did

Preamble

1. We, the Leaders of the Group of Eight, met at Camp David on May 18 and 19, 2012 to address major global economic and political challenges (and to get out of our countries for a few days where things are getting downright oppressive).

1. We, the Leaders of the Group of Eight, met at Camp David on May 18 and 19, 2012 to address major global economic and political challenges (and to get out of our countries for a few days where things are getting downright oppressive).

The Global Economy

2. Our imperative is to promote growth and jobs, but we are failing miserably and do not have a clue what to do…

3. The global economic recovery shows few signs of promise, significant headwinds persist and we have not agreements on key areas of need. Each day the ECB gets more overextended and is without a plan. Below we offer up some nice sounding verbiage that won’t do a thing…

4. Against this background, we commit to take all necessary steps to strengthen and reinvigorate our economies and combat financial stresses, recognizing that the right measures are not the same for each of us and that each of us is likely to fail do exactly what is needed. Germany is more likely to be too austere; Greece is more likely to be too slow to implement any meaningful reforms. Political impasse in Greece continues to point a loaded gun at the head of the euro-or would do so if the euro had a head. Instead the gun is pointed at its financial groin.

5. We welcome the ongoing discussion in Europe on how to generate growth, while maintaining a firm commitment to implement fiscal consolidation to be assessed on a structural basis. This phrasing means nothing to everybody in Europe (or something different to everyone)! We agree on the importance of a strong and cohesive Eurozone for global stability and recovery, and we affirm our interest in Greece remaining in the Eurozone while respecting its commitments. This statement is 180 degrees at odds with where Greece seems to be politically at the moment, but the G-8 can agree on it and it sounds good. It does not reflect any new or existing consensus in Greece, unfortunately. We all have an interest in the success of specific measures to strengthen the resilience of the Eurozone and growth in Europe. But, again, we haven’t the foggiest idea how to do get it. We support Euro Area Leaders’ resolve to address the strains in the Eurozone in a credible and timely manner and in a manner that fosters confidence, stability and growth, but we cannot agree on what these things are, so don’t hold your breath waiting for results..."

Saturday, May 19, 2012

Italy Deploys 20,000 Law Enforcement Officers to Protect Individuals and Sensitive Sites; Anecdotes From Italy via Canada: Taxed Out of House and Home

"The Atlanta Journal Constitution reports Italy deploys 20,000 to protect sensitive targets

at http://globaleconomicanalysis.blogspot.com/2012/05/italy-deploys-20000-law-enforcement.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29

Italy increased security Thursday at 14,000 sites, and assigned bodyguards to protect 550 individuals after a nuclear energy company official was shot and letter bombs directed to the tax collection agency.

Under the enhanced measures, Interior Minister Anna Maria Cancellieri deployed 20,000 law enforcement officers to protect individuals and sensitive sites. In addition, 4,200 military personnel already assigned throughout Italy will be redeployed according to new priorities.

at http://globaleconomicanalysis.blogspot.com/2012/05/italy-deploys-20000-law-enforcement.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29

Rumors, Denials, and Visions of Chaos

"While the G-8 leaders are schmoozing with President Obama during their slumber party at Camp David, and while the parallel NATO summit and its protests and rallies are wreaking havoc on the streets in Chicago, Europe is re-descending into rumor hell—where good rumors, as we found out last summer and fall, are head fakes that cause huge rallies in the markets, and where bad rumors, though passionately denied by all sides, turn out to be true.

The latest was that the European Central Bank and European Commission were preparing contingency plans for Greece’s exit from the Eurozone. Actually, it wasn’t even a rumor. EU Trade Commissioner Karel De Gucht declaredit during an interview: “A year and a half ago, there may have been the danger of a domino effect,” he said, “but today there are, both within the European Central Bank and the European Commission, services that are working on emergency scenarios in case Greece doesn't make it.”

A momentous statement. The first time ever that an EU official admitted the existence of contingency plans—though everyone had long assumed that they existed. Clearly, Europe’s political power brokers, disparate as they are, have gotten tired of bending to Greece’s wily political elite and their threats. Read.... The Greek Extortion Racket in its Final Spasm.

Alas, within hours, the very European Commission where De Gucht serves as the Trade Commissioner stabbed him in the back: “We completely deny that we are working on any such emergency plans,” said a spokesperson for the Commission. “We are concentrating all our efforts on supporting Greece and keeping it in the Eurozone. That is the scenario we are working on.”

The Rise of Nationalism Will End the Euro Before Year's End

"The collapse of Europe is occurring just as I forecast. While the media and even the politicians are failing to admit it, the EU in its current form is already breaking up. Indeed, if you step back and observe things from a larger perspective, you can almost watch the process in slow motion.

The collapse is taking shape via three key developments:

- The Rise of Nationalism (see the recent Greek, French and German elections)

- The shift to focusing on “growth”/ rejection of “austerity” which is essentially a rejection of the EU contract and Maastricht Treaty

- The end of the dominant political alliances.

All of these developments are Euro negative. Indeed, they reveal the core problem with the EU as a concept: how can one unite very different countries with long histories of conflict under one economic and monetary regime?

The answer is that one cannot. Voters were willing to go along with the idea (or at least submit to it) while the going was good. However, now that the we’ve entered a secular downturn in global growth, particularly for the western world which suffers from massive debt overhangs and age demographic issues, we are going to see EU member states focus more on domestic issues rather than saving the “grand idea” of the Euro.

This refocusing on domestic issues is a natural political consequence of economic contraction: those politicians who implemented the measures that are now seen to be the cause of the downturn will be held accountable (see Sarkozy). New faces will enter the political arena along with “new” ideas (I use quotations because few if any politicians in the EU have a clue what they’re really dealing with)..."

What Jamie Dimon Really Said: The CIA's Take

"The last time the body language (and ex-intelligence)

experts from Business Intelligence Advisors appeared on these pages, their

target was Ben Bernanke, and specifically his first ever post-FOMC press

conference. This time around, BIA has chosen the analyze what has been left

unsaid by none other than the head of JP Morgan in the context of his $2

billion (and soon to be far larger) loss which is still sending shockwaves

around the financial world. As a reminder, "Using techniques developed at

the Central Intelligence Agency, BIA analysts pore over management

communications for answers that are evasive, incomplete, overly specific or

defensive, potentially signaling anything from discomfort with certain

subjects, purposeful obfuscation, or a

lack of knowledge." So what would the CIA conclude if they were

cross-examining Jamie Dimon?

BIA Between the Lines: Risk? Forget About It: Jamie Dimon,

Chairman & CEO, JPMorgan Chase & Co.

JPM’s European exposure is likely riskier than Mr. Dimon

would like investors to believe.

Mr. Dimon is asked several questions about JPM’s exposure to

Europe. While he provides and quantifies the company’s amount of exposure, his

responses consistently reflect efforts to downplay the level of risk associated

with that exposure, suggesting that the firm’s risk profile may be more

aggressive than he would like to admit.

Specifically, when Mr. Dimon is asked what JPM’s exposure is

to troubled nations, he answers it is about $15 billion net of collateral and

ultimately acknowledges that the company could lose $5 billion. But Mr. Dimon

is also quick to state that “we stress it,” “not because we’re taking a bet,”

but they are “trying to manage exposure” in order to minimize concern about the

level of risk associated with that exposure. This language, however, belies a

sense that the company is taking a “bet” that they are “trying” to manage,

suggesting that JPM may be taking on more risk than Mr. Dimon wants to admit. Further,

Mr. Dimon states that “I’m not going to feel terrible” should the worst happen.

This is likely a preemptive effort to downplay the severity of the financial

impact should some countries default, suggesting that Mr. Dimon has concerns

that losing money in Europe is more of a possibility than he would like

investors to believe.

Further, when asked if it is possible to be completely sure

that hedges with counterparties are truly effective, Mr. Dimon does not answer

the question. He instead minimizes concern by explaining that “a lot” of the

collateral is cash and that collateral that is not cash is not Italian or

Spanish sovereign debt. These qualifications, however, suggest that there may

be some portion of collateral backing these hedges may not be as effective as

Mr. Dimon would like investors to believe.

More significantly, however, Mr. DImon emphasizes that “we

know the exposure to every single counter party.” This statement is meant to

assure investors that JPM is aware of their level of risk, but falls short of

assuring that the level of risk is appropriate. Further, Mr. Dimon casually

acknowledges that “yeah something could go wrong” but not “terribly wrong” in

an effort to downplay the severity of both the level of risk, and the potential

impact of default associated with JPM’s European exposure. This suggests that

the potential for losses is more significant and tangible than he attempts to

portray.

JPM may be increasing their European exposure more

aggressively than implied.

When asked about the potential for buying assets and

businesses from troubled European banks, Mr. Dimon begins his response by

emphasizing, for the second time during the interview, that “First of all we

really want Europe to recover.” While this statement is meant to be supportive

of European banks, it also represents a potential “truth-in-the-lie” --

literally suggesting that JPM has a strong, specific interest in seeing the

crisis resolved. This takes on more significance when Mr. Dimon’s acknowledges

that JPM has purchased assets, but attempts to downplay the extent to which the

company has done so by qualifying that there are “certain” assets and

divisions, “some” that they have bought, “some” they have made bids on and did

not get and “some” they are still evaluating. This effort to minimize JPM’s

activity in seeking out and acquiring these assets raises questions about how

much additional European exposure JPM has taken on in recent months and about

the level of risk associated with that exposure..."

Marc Faber: Looming Global Catastrophe?

"Dr. Doom Marc Faber , discusses the future of the euro and

whether a global catastrophe is on the way, with CNBC. : "I don't know

what will happen, but i know what should happen and what should happen is that

Greece exits the euro zone right away and defaults on all its obligation to

foreigners. if they have obligations to foreigners, it's the mistake of the

bureaucrats in Brussels"

"...They don't want to leave the euro zone because they

know that in the future the Drachma will be worth 70% less than a euro. that's

why they don't want to leave. equally they don't want to have austerity and

have their salaries and benefits cut by 50%. that would be necessary to bring

some order to Greece's household mess"

Gold/Silver & Mining Stocks Going From Today’s Cycle Bottoms to Parabolic Peaks by 2015

"Once every year gold and stocks form a major yearly cycle low while other

commodities form a major cycle bottom every 2 1/2 to 3 years. Occasionally all three of these major cycles hit at the same time….That’s what’s happening right now and it should lead to a powerful rally over the next 2 years, culminating in 2014 when the dollar forms its next 3 year cycle low..."

commodities form a major cycle bottom every 2 1/2 to 3 years. Occasionally all three of these major cycles hit at the same time….That’s what’s happening right now and it should lead to a powerful rally over the next 2 years, culminating in 2014 when the dollar forms its next 3 year cycle low..."

The Market Turmoil will Escalate in the Fall

"Jim Rogers : "I thought this would start in the fall -

this is an election year in America. They will print money and spend money

before the elections; a lot of people are spending money to keep the economy

going," - Jim Rogers told CNBC this Friday morning in Singapore..."

at http://jimrogers1.blogspot.com/2012/05/market-turmoil-will-escalate-in-fall.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FWOHK+%28Jim+Rogers+Blog%29

at http://jimrogers1.blogspot.com/2012/05/market-turmoil-will-escalate-in-fall.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FWOHK+%28Jim+Rogers+Blog%29

Friday, May 18, 2012

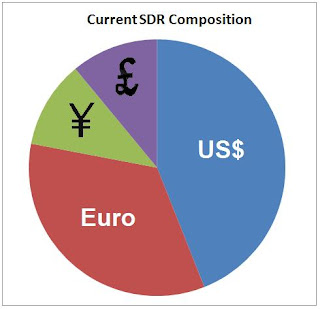

Devaluing the Dollar - Against What?

"When people talk about devaluing the dollar, as opposed to reissuing it completely, the natural question is, against what? What would one devalue it against officially if you do not wish to reinstitute a formal gold standard, which is clearly the preference of the Western central bank.

One likely candidate might be the SDR issued as a new currency for global trade, and for the pricing of international goods and commodities.

The major bone of contention as I have pointed out before would be the new 'basis' for the SDR. What Will the World's Reserve Currency Become? The BRICs are adamant for the inclusion of additional currencies and gold and silver to make a portfolio that is less weighted to the US, Europe, and England.

A country would have the option to retain their own national currency for domestic use.

This is regards to devaluation as opposed to a hyperinflation and reissuance in which case old dollars would be scrapped for 'new dollars' with a couple of zeroes knocked off.

A friend sent this information about the US Post Office my way today. The speculation on the 'new composition' of the SDR is mine. I am assuming that the number of Euro countries decreases.

at http://jessescrossroadscafe.blogspot.com/2012/05/devaluing-dollar-against-what.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+JessesCafeAmericain+%28Jesse%27s+Caf%C3%A9+Am%C3%A9ricain%29

One likely candidate might be the SDR issued as a new currency for global trade, and for the pricing of international goods and commodities.

The major bone of contention as I have pointed out before would be the new 'basis' for the SDR. What Will the World's Reserve Currency Become? The BRICs are adamant for the inclusion of additional currencies and gold and silver to make a portfolio that is less weighted to the US, Europe, and England.

A country would have the option to retain their own national currency for domestic use.

This is regards to devaluation as opposed to a hyperinflation and reissuance in which case old dollars would be scrapped for 'new dollars' with a couple of zeroes knocked off.

A friend sent this information about the US Post Office my way today. The speculation on the 'new composition' of the SDR is mine. I am assuming that the number of Euro countries decreases.

The US Post Office is using US$ to SDR conversion tables for international mail insurance --> US Postal Service US$ to SDR Policy and Tables

Earliest reference I could find to when the USPS started pricing in SDRs is 2009, which is well after the initial financial crisis.

IMF publishes daily tables on SDR values--> IMF SDR Daily Tables

Quick calc: at today's SDR rate of 1.52 SDR to 1 US$, if a new global dollar like currency was issued, then a current $1 US would buy you 66 cents of that new currency.

This is about a 34% drop in the $ value.

And that is probably best case scenario, since the daily SDR rate is priced

relative to 3 other currencies. If the US$ were to take a pounding prior to

issuance of a new currency, the exchange rate would be even less favorable to $ holders.

Summary: The pricing mechanism for replacing the greenback is in place. As

your anxiety level rises on the $, feel free to check daily to see what your bank deposits would be worth after a bank "holiday"."

at http://jessescrossroadscafe.blogspot.com/2012/05/devaluing-dollar-against-what.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+JessesCafeAmericain+%28Jesse%27s+Caf%C3%A9+Am%C3%A9ricain%29

Tom Ferguson: Senate Banking Chair Calls Jamie Dimon to Testify -– But JP Morgan Chase is His Biggest Contributor!

"Holding your breath about the fallout from J. P. Morgan Chase’s derivatives losses? Yesterday, if you believed Politico, you could exhale. Senate Banking Committee Chair Tim Johnson of South Dakota announced his panel would call JP Morgan Chase Chair Jamie Dimon to testify.

It’s good that the watchdog is barking, but we’d all better watch closely to see if it will bite. Here’s what Politico didn’t tell you. Political Money Line’s tabulations of PAC contributions show that securities and financial firms have given more money to Johnson than any other sector in the last three election cycles. In the current cycle, for example, almost two thirds of his $361, 582 in PAC money comes from such firms. In 2008, when he collected over $2 million in PAC contributions, the swag from that quarter amounted to over half a million dollars – and neither figure takes account of numerous individual contributions. Johnson calls his leadership PAC “South Dakota First,” but, not surprisingly, contributions to his campaign committee from New York and other states often run far ahead of receipts from his own state.

Alas, it gets worse. Here’s the real punch line. Which firm is Johnson’s single largest contributor? You guessed it: The Center for Responsive Politics’ count shows that in both the current election cycle and the cycles between 2005-2010, it is JP Morgan Chase "

Subscribe to:

Posts (Atom)