at http://www.jimrogersinvestments.com/2014/02/the-money-printing-in-developed-world.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FWOHK+%28Jim+Rogers+Blog%29

Links to global economy, financial markets and international politics analyses

Friday, February 28, 2014

The Money Printing in the Developed World is causing distortions everywhere including China

"Jim Rogers: The high levels of debt in some areas. Some of

the provinces and companies have built up debt in recent years during the

recovery, since there has been so very much artificial liquidity all over the

world. All the money printing in the developed world is causing distortions

everywhere including China."

at http://www.jimrogersinvestments.com/2014/02/the-money-printing-in-developed-world.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FWOHK+%28Jim+Rogers+Blog%29

at http://www.jimrogersinvestments.com/2014/02/the-money-printing-in-developed-world.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FWOHK+%28Jim+Rogers+Blog%29

Which Stocks Will Make A Fortune For Investors This Year?

"...In addition to the geopolitical instability, we also have the Indians continuing to discuss repealing the import taxes on gold and especially silver. This would be a great thing for consumption because consumption will go way up. Indian gold demand was certainly climbing toward record highs before the government attempted to choke off the demand with punitive taxes.

In the end, the taxation didn’t really have the effect they wanted. The gold trade just went underground and there were massive amounts of gold being smuggled across the border from Pakistan. Of course this meant that the government of India was getting nothing out of it because all the money was going into the black economy.

The bottom line is they have a growing middle class in India, they don’t trust paper money, and so they are buying more gold and silver as their wages increase as a form of savings. This is the same thing we are seeing in China. People have to remember that gold was incredibly oversold in December. This created a fantastic buying opportunity that people were taking advantage of all over the world."

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/2/28_Which_Stocks_Will_Make_A_Fortune_For_Investors_This_Year.html

Thursday, February 27, 2014

Neither US Nor NATO Has Plans For What To Do If Russia Intervenes In Ukraine

"Neither the United States nor NATO has drawn up contingency plans for how they would respond if Russia were to intervene militarily in Ukraine's Crimea region, NATO's top military commander said on Thursday.

U.S. Air Force General Philip Breedlove, also commander of U.S. forces in Europe, said in an interview with Reuters and The Wall Street Journal that NATO had not changed the deployment of any military assets due to tensions over Ukraine.

"No, no, we have taken no actions to this moment. We are doing what everyone else is doing which is monitoring. We are trying to get to a full understanding of exactly what has transpired," Breedlove said..."

at http://www.businessinsider.com/us-has-no-plans-if-russia-invades-ukraine-2014-2#ixzz2uYOPw21C

Weekly Unemployment Claims "Unexpectedly" Rise; Claims in Recession Pattern?

"Weekly unemployment initial claims unexpectedly rose to 348,000 this week.

at http://globaleconomicanalysis.blogspot.com/2014/02/weekly-unemployment-claims-unexpectedly.html#ZdRGS3kMQdKplVAm.99

The number of Americans filing new claims for unemployment benefits unexpectedly rose last week, but the underlying trend suggested no shift in labor market conditions.

Initial claims for state unemployment benefits increased 14,000 to a seasonally adjusted 348,000, the Labor Department said on Thursday. Claims for the prior week were revised to show 2,000 fewer applications received than previously reported.

Economists polled by Reuters had forecast first-time applications for jobless benefits slipping to 335,000 in the week ended Feb. 22, which included the Presidents Day holiday.

While last week’s increase pushed them to the upper end of their range so far this year, it probably does not signal labor market weakness as claims tend to be volatile around federal holidays..."

at http://globaleconomicanalysis.blogspot.com/2014/02/weekly-unemployment-claims-unexpectedly.html#ZdRGS3kMQdKplVAm.99

Two Russian Warships Enter Black Sea Through Bosphorus; Another Docks In Cuba

"Russia may be awaiting a diplomatic resolution of the Ukraine crisis, but we wouldn't hold our breath especially with the deposed president Yanukovich set to conduct a press conference tomorrow fromRussia's Rostov-on-Don at 5pm local time, where we hardly anticipate a scaling back of the escalation in what is sure to not be an abdication from power. Instead, Putin continues to prepare for the worst and is openly signalling to the West that if he has to fight to regain influence in the Ukraine, he will, as a top Kremlin politician warned last week. As such it was not surprising to read that two Russian warships, the Minsk and the Kaliningrad which last week were sent out on deployment around Syria, crossed back into the Black Sea, most likely in direction Sevastopol, as the build up of Russian forces in the Crimea continues.

at http://www.zerohedge.com/news/2014-02-27/two-russian-warships-enter-black-sea-through-bosphorus-another-docks-cuba

From Bosphorus Nabal News:

Today, two Ropucha class landing ship from Russian Navy passed through Bosphorus returning from their Syrian deployment. As the political crisis in Ukraine particular in Crimea is increasing it is possible that Russian Navy wanted these valuable assets closer to home..."

at http://www.zerohedge.com/news/2014-02-27/two-russian-warships-enter-black-sea-through-bosphorus-another-docks-cuba

Grant Williams - This Will Send The Price Of Gold Skyrocketing

"Today one of the most highly respected fund managers in Singapore spoke with King World News about exactly what is going to send the price of gold skyrocketing. Grant Williams, who is portfolio manager of the Vulpes Precious Metals Fund, also spoke about what this will mean for investors around the world when this historic move unfolds in the gold market.

Eric King: “Grant, the gold market is very quiet here all of the sudden.”

Williams: “Yes, it sure is, Eric. There are plenty of things to be concerned about, but at this point gold is struggling to get through some fairly important technical levels around the $1,340 level. It’s had a hell of a run...."

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/2/27_Grant_Williams_-_This_Will_Send_The_Price_Of_Gold_Skyrocketing.html

Wednesday, February 26, 2014

US F-15s In Estonia Were Diverted To Intercept A Russian Spy Plane

"U.S. F-15s scheduled to perform a flyover in Estonia intercepted a Russian spy plane and then took part to the parade.

at http://theaviationist.com/2014/02/26/estonia-flyby-delayed/#ixzz2uSTObxmz

On February 24, Estonia celebrated its independence day.

A part of the celebrations was a military parade in the city of Pärnu. U.S. F-15C fighters belonging to the 48th Fighter Wing, currently deployed to Lithuania’s first air base in Zokniai, took part in the flyby but were forced to do double duty after being diverted to intercept a Russian plane.

Unfortunately, no details about the aircraft that was intercepted were released. The official statement by Estonian authorities only says: “Fighters identified the plane as a spy plane belonging to Russia.”

The U.S. Air Force has four F-15s from RAF Lakenheath deployed to Lithuania to help with air policing in the Baltic states. The aircraft have replaced the Belgian F-16AMs and, since January, guard the airspace over Latvia, Lithuania and Estonia. These countries' air defenses have been provided on a rotational basis by 14 NATO states since 2004.

Aircraft on Quick Reaction Alert at Siauliai are often scrambled by the Control and Reporting Post of Amari, Estonia, to intercept Il-20 spy planes, Tu-22M Backfire bombers, and Su-27 fighter jets, which skirt the Baltic States' air spaces as images posted in 2013 show..."

at http://theaviationist.com/2014/02/26/estonia-flyby-delayed/#ixzz2uSTObxmz

American Military Dominance In One Staggering Chart

"Despite a proposed slashing of U.S. Army personnel to pre-World War II levels, American military might is beyond question.

at http://www.businessinsider.com/chart-of-defense-spending-by-country-2014-2#ixzz2uSRjpbWM

This chart from April 2013, which is making the rounds again, shows that America's 2012 defense budget surpassed that of the next 10 countries combined.

Defense spending accounts for about 20 percent of all U.S. federal spending.

Another example of American military dominance is all of the world's aircraft carriers: The U.S. has 19 aircraft carriers (including 10 massive ones), compared to 12 operated by other countries.

at http://www.businessinsider.com/chart-of-defense-spending-by-country-2014-2#ixzz2uSRjpbWM

Debt Default Will Kill the Dollar-Brandon Smith

"Economic and political writer Brandon Smith thinks America is in deep financial trouble, and the Fed knows it. Smith contends, “First of all, I’d like to point out that at the end of last year, I brought up the prospect to the alternative economics community that the ‘taper’ was real, that the Fed would start cutting QE stimulus. I received a pretty negative response from that concept, which is understandable because a lot of people in alternative economics and the liberty movement are focused on the concept of hyperinflation through printing. I am pointing out through my articles on ‘taper’ that there is more than one way to kill the dollar. It’s not just about printing. There is also the issue about debt default and how that can kill the dollar’s world reserve status and kill the dollar’s value in the process. So, the ‘taper’ is a huge part of that process of debt default.”

Smith goes on to say, “I find it interesting the Federal Reserve institutes the ‘taper’ just before we saw major downturns in global manufacturing. The Baltic Dry Index is starting to crash again. We’re starting to see trouble in emerging market currencies. You could say that maybe that’s coincidence that the Federal Reserve started the ‘taper’ before those negative indicators started to become visible. I don’t think that was a coincidence. I think they knew that those negative indicators were coming, and the Fed is insulating itself using the ‘taper’ concept. Basically, what that means is the Fed is pulling back its QE because the effects of QE are diminishing. Stimulus has a shelf-life. Printing has a shelf-life for its effectiveness in manipulating markets and propping up stocks. I think we’ve hit the point where QE is no longer effective. The shelf-life is over. They are pulling the QE back now because they don’t want it to be known to the public that QE has become ineffective. They don’t want QE to be blamed for a stock market implosion. So, they are pulling it back because they know this downturn is coming.”

What about talk that the Fed is ‘tapering’ QE to intentionally cut the legs out from under the market? Smith explains, “Ultimately, the Fed is not pulling back from QE because the Fed wants to cut the legs out from under the market. I think the market is losing its legs regardless. They are pulling QE back because what happens if we have a stock market implosion while stimulus is running? I am saying the Fed is removing QE as part of the equation because it knows an implosion is going to happen, and they don’t want to be blamed.” Smith predicts that another $10 billion of QE, or money printing, will be cut at the next Fed meeting. Smith says, “The Fed is looking to end this by the end of the year, but maybe even faster.”

at http://usawatchdog.com/debt-default-will-kill-the-dollar-brandon-smith/

Germany, Russia, China, the US, Gold & World Dominance

"With gold drifting higher and the US Dollar Index barely clinging to the critical 80 level, today an acclaimed money manager spoke with King World News about Germany, Russia, the US, gold and global chess moves taking place involving world dominance. Below is what Stephen Leeb had to say in this fascinating and timely interview.

Leeb: “Right now we have gold and silver moving higher along with commodities. Usually I don’t spend time on geopolitical issues, but I want to cover this topic very briefly. Most of the time geopolitical issues are non-starters, but there are situations where you can really see things getting out of control...."

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/2/25_Germany,_Russia,_China,_the_US,_Gold_%26_World_Dominance.html

Leeb: “Right now we have gold and silver moving higher along with commodities. Usually I don’t spend time on geopolitical issues, but I want to cover this topic very briefly. Most of the time geopolitical issues are non-starters, but there are situations where you can really see things getting out of control...."

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/2/25_Germany,_Russia,_China,_the_US,_Gold_%26_World_Dominance.html

Tuesday, February 25, 2014

Boom Bust - Doug Casey on the Chinese Century

"From Boom Bust

Erin Ade talks to Doug Casey his assessment of China and why

he thinks that 21st Century is a Chinese century. In this segment, he explains

why he thinks central banks will lead to greater higher inflation and economic

volatility in the near future; extols gold and explains why you should buy it;

and warns why economic nationalism by governments could threaten economies

throughout the world. After the break, Casey talks about water scarcity, the

rising price of oil extraction, and how financialization and militarization

hurt the US economy."

at:

http://ausbullion.blogspot.com.tr/2014/02/boom-bust-doug-casey-on-chinese-century.html#sthash.yuCWMGvH.dpuf

Richard Russell - World To Witness A Terrifying Hyperinflation

"With continued chaos and uncertainty in global markets, today KWN is publishing an incredibly powerful piece that was written by a 60-year market veteran. The Godfather of newsletter writers, Richard Russell, is now warning that the world is going to witness a terrifying hyperinflation. He also discussed how this hyperinflation will impact major global markets, including stocks, gold, silver and other hard assets.

Russell: “I’ve been noting the prices being paid by the wealthy 5% of Americans and by foreigners may be a sign of things (prices) to come. Is the $19 billion that Facebook paid for What’sApp a hint of future prices? It occurred to me that the extraordinary prices being paid by today's wealthy could correspond to the hyperinflationary prices that we will see 3-5 years in the future. Thus I think today's wealthy are establishing the hyperinflationary prices that we may see in all items during the next 3-5 years.

If this is true, we should see the entire stock market moving higher, as it discounts future hyperinflationary prices. If hyperinflation is to be our future, the one tangible currency, gold, should be our best protection. If hyperinflation is in our future, then gold and the stock market should now be discounting it. The fact that we have not had a 10% correction in the stock market since 2011 speaks of the stubborn bullishness of this stock market.

If I’m correct in that hyperinflation is in our future, we should shortly see new highs in the various stock market indices and a further parade of record prices for tangibles at auctions and in the news. Also, if hyperinflation is in our future, then gold and silver are dirt cheap today.

I dreamed last night ... In my dream I was telling people that the whole stock market will shortly be lifting up from an oversold base. I was telling people that the prices of everything will be rising until at some point hyperinflation finally takes over. At that point the trillions of dollars that the Fed has injected into the banking system will suddenly seize the market and all tangibles in its grip. The price level of everything will levitate to meet the astounding levels that we now see in auction prices and in the news..."

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/2/25_Richard_Russell_-_World_To_Witness_A_Terrifying_Hyperinflation.html

Monday, February 24, 2014

US Army Will Be Slashed To Smallest Size Since World War II

"WASHINGTON (Reuters) - The Pentagon said on Monday it would slash the Army to pre-World War Two levels, eliminate the popular A-10 aircraft and reduce military benefits in order to meet 2015 spending caps, setting up an election-year fight with Congress over defense priorities.

Defense Secretary Chuck Hagel, discussing the Pentagon's plan for meeting its new spending caps ahead of the formal budget presentation on March 4, advanced a number of ideas that have been attempted in the past but rejected by Congress or are likely to be unpopular in a congressional election year.

As the United States winds down the war in Afghanistan and looks to cut billions in defense spending, the Pentagon plans to continue shifting its focus to the Asia-Pacific and will no longer need a land Army of the size currently planned, Hagel said.

The department plans to reduce the size of the Army to between 440,000 and 450,000 soldiers, he said. The Armyis currently about 520,000 soldiers and had been planning to draw down to about 490,000 in the coming year.

A reduction to 450,000 would be the Army's smallest size since 1940 before the Second World War, when it had a strength of 267,767 troops, according to Army figures. The Army's previous post-Second World War low was 479,426 in 1999.

The planned cut in Army strength comes as the Defense Department is in the process of reducing projected spending by nearly a trillion dollars over a 10-year period.

A two-year budget deal in Congress in December gave the department some relief from the cuts, but still forced it to reduce spending in the 2014 fiscal year by $30 billion.

The Pentagon's budget for the 2015 fiscal year is $496 billion, about the same as 2014 but still lower than had envisioned last year.

(Reporting by David Alexander, Andrea Shalal and Phil Stewart; Editing by Sandra Maler)"

at http://www.businessinsider.com/us-army-will-be-slashed-to-smallest-size-since-world-war-ii-2014-2#ixzz2uGiAF7oS

A World of Manipulated Markets

"The following is excerpted from The Money Bubble, by James Turk and John Rubino

“There are no markets anymore, just interventions.”

— Chris Powell, Gold Anti-Trust Action Committee

— Chris Powell, Gold Anti-Trust Action Committee

Once upon a time, a handful of countries sometimes described as “capitalist” claimed to operate on the principal that consenting adults should be free to buy, sell, build and consume what they wanted, with little interference or guidance from the authorities. The idea, derived from Adam Smith’s 1776 classic Wealth of Nations, was that all of these self-interested actions would in the aggregate form an “invisible hand” capable of guiding society towards the greatest good for the greatest number of people. Coincidentally, the political framework for such a society was envisioned the same year on the other side of the Atlantic, when Thomas Jefferson penned in the American Declaration of Independence that in addition to life and liberty, there was a third inalienable right for every individual – the pursuit of happiness. The resulting “market-based” societies were messy but brilliant, producing more progress in two centuries than in the previous 50.

But those days are long gone. After four decades of unrestrained borrowing, the developed world is in a constant state of near-collapse and governments everywhere feel compelled (or perhaps liberated) to tinker with markets, sometimes overtly and sometimes secretly, but of late with an increasingly heavy hand. The system that is evolving does not yet have a modern name but certainly looks like the central planning that failed so miserably for the Soviet Union and Social Democratic Europe in decades past. What follows is a brief overview of the manipulations that now dominate the global economy.

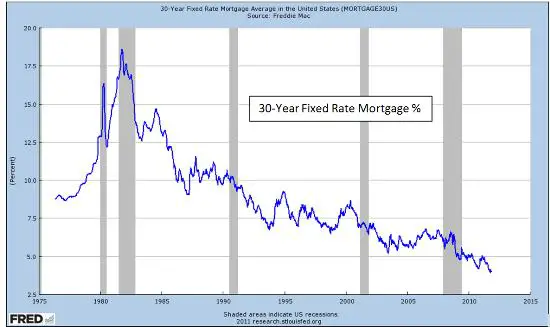

Artificially-low interest rates. Interest rates are, in effect, the price of money and as such they’re a crucial signal to virtually everyone in every market. When rates are high, that’s an incentive to save, because the resulting yield is attractive. Low rates, meanwhile, are a signal that money is cheap and borrowing is potentially more profitable than saving.

Prior to the World War II interest rates were set mostly by supply and demand. When there were lots of productive uses for a limited supply of money, demand for it went up and interest rates rose, and vice versa. Market participants had a fair idea of what the economy was asking for and government generally let them respond to these signals. (The term “laissez faire,” French for “let [them] do,” is aptly used to describe this version of capitalism.)

When the Fed began playing a bigger role in the economy in the 1950s and 60s, it chose as its main policy tool the Fed Funds Rate, the rate at which it lent short-term money to banks. Long-term interest rates (i.e., the bond market) remained free to fluctuate according to the supply and demand for loans. But following the crisis of 2008 the Fed and other central banks expanded their focus from short-term rates to all rates, including long-term. Today, the Fed intervenes aggressively “across the yield curve,” pushing short rates down to zero and buying enough bonds to push long-term rates down to historically-low levels.

These interventions have preempted the market’s price-signaling mechanism, encouraging borrowing and speculation and discouraging saving…

Dishonest interest rates. While governments have been actively depressing rates, the world’s major banks have been manipulating the London Interbank Offered Rate (Libor) for their own ends. Libor is the reference rate for trillions of dollars of loans world-wide. And in a scandal that is still escalating as this is written in late 2013, it has been revealed that the banks responsible for setting this rate have been arbitrarily moving it around and then trading on the advance knowledge of the movement, enhancing their profits and yearend bonuses. Other banks lied about the rates at which they were borrowing to make them appear less fragile during the 2008 financial crisis, misleading market participants as well as government regulators. Meanwhile, many of the loans based on sham Libor rates disadvantaged the entity on one side of the transaction, costing, in the aggregate, hundreds of billions of dollars.

Artificially-high stock prices. Until very recently share prices, by general consensus, were set purely by market forces (though they were influenced somewhat by the Fed’s control of short term-interest rates and government tax and spending laws). Whether the market went up or down was not generally seen as a pressing policy matter for the federal government or central bank. Then in 1988 – presumably in response to the previous year’s flash-crash that had sliced about 30 percent from US stock prices in a single month – the Reagan Administration created the Working Group on Financial Markets to either prevent or manage such events in the future.

This shadowy organization came to be known as “Plunge Protection Team (PPT),” and is now thought by many to funnel government money into the market to boost share prices when it perceives the need. The origin of this idea goes back to 1989 when former Federal Reserve Board member Robert Heller told the Wall Street Journal that, “Instead of flooding the entire economy with liquidity, and thereby increasing the danger of inflation, the Fed could support the stock market directly by buying market averages in the futures market, thereby stabilizing the market as a whole.” In August 2005, Canadian hedge fund Sprott Asset Management released a report arguing that the PPT was indeed manipulating stock prices.

Cheap mortgages, inflated home prices. For most of the 20th century, homes were bought with either cash or 30-year, fixed-rate mortgages. And because long-term interest rates were not set by the Fed, the price of money with which to buy a house was determined by the market. But after the 2008 financial crisis, when the Fed began forcing down long-term rates, cheap mortgages and rising home prices became government policy objectives. The Fed now buys mortgage backed bonds in addition to government bonds, which both lowers mortgage rates and funnels money into the mortgage market, generally making home loans easier to obtain. Here again, rising home prices are just a means to a positive wealth effect, which it is hoped will induce more borrowing and spending. And individuals are signaled by the market to buy the biggest house possible using the most aggressive mortgage possible.

Suppressed gold price. We cover gold in much greater detail in Section IV, but for now suffice it to say that because the metal is a competing form of money, when it rises in dollar terms it makes the dollar and the dollar’s managers look bad. So for nearly two decades the US, along with several other governments and their central banks, has been systematically intervening in the gold market to push down its exchange rate to the dollar. They do this by covertly dumping central bank gold onto the market and instructing large commercial banks to sell huge numbers of gold futures contracts into thinly traded markets. Together, these secret machinations have held gold’s exchange rate far below where a free market would have taken it. Gold’s ability to signal market participants that inflation is rising and/or national currencies are being mismanaged is being short-circuited. As a result, market participants who might otherwise be converting those currencies into hard assets are not doing so.

All of the above. The Exchange Stabilization Fund (ESF) was established in 1934 to enable carte blanche market intervention by the federal government, outside of Congressional oversight. As Dr. Anna J. Schwartz, at the time a Distinguished Fellow of the American Economic Association, explained in a 1998 speech, “The ESF was conceived to operate in secrecy under the exclusive control of the Secretary of the Treasury, with the approval of the President, [quoting here from the 1934 legislation] ‘whose decisions shall be final and not subject to review by any other officer of the United States’.”

The ESF now functions as a “slush fund” available to the Treasury Department for wide-ranging, frequently-secret market interventions. It provides “stabilization” loans to foreign governments. It influences currency exchange rates – including that of gold. It was used to offer insurance to money market funds. Most recently it was drained to provide the government some breathing room during the late 2013 debt ceiling impasse. As for the stock market, well, why not? Perhaps the ESF is the real – or at least another – Plunge Protection Team.

Distorted Signals and Lost Trust

What happens when market signals are distorted by the government? In a word, “malinvestment.” Factories are built that produce the wrong things, houses are bought that cost more than their owners can afford, bank CDs are cashed in to buy stocks just before a market correction, gold and other hard assets are converted to paper currency when they should be accumulated and held long-term. The market, in short, stops directing capital to its most productive uses and wealth creation grinds to a halt.

What happens when market signals are distorted by the government? In a word, “malinvestment.” Factories are built that produce the wrong things, houses are bought that cost more than their owners can afford, bank CDs are cashed in to buy stocks just before a market correction, gold and other hard assets are converted to paper currency when they should be accumulated and held long-term. The market, in short, stops directing capital to its most productive uses and wealth creation grinds to a halt.

Along the way, people begin to notice that the markets they thought were more-or-less honest are being secretly manipulated for the benefit of others, and trust begins to erode. The next chapter explains what happens then..."

at http://dollarcollapse.com/the-economy/a-world-of-manipulated-markets/

Jim Rogers is holding on to his gold position in anticipation of an inevitable market bubble

"Jim Rogers is holding on to his gold position in

anticipation of an inevitable market bubble and substantial gains. Safe as

money in the bank? Not so says the self-made billionaire; the threat of pension

fund and savings confiscation is just one more reason to add precious metals

investments to a diversified portfolio.

GoldSeek Radio interviews JIM ROGERS - Feb 18, 2014"

at http://www.jimrogersinvestments.com/2014/02/jim-rogers-is-holding-on-to-his-gold.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FWOHK+%28Jim+Rogers+Blog%29

China Lunar Year Gold Rush

at http://ausbullion.blogspot.com.tr/2014/02/china-lunar-year-gold-rush.html

Sunday, February 23, 2014

Maguire - China’s Gold Buying “Enormous” Right Now

"With gold getting a weekly close above the important $1,320 level, today London metals trader Andrew Maguire told King World News that despite rumors to the contrary, China’s gold buying is “enormous” right now. Below is what Maguire had to say in Part I of a timely and powerful series of interviews that will be released today.

Eric King: “What kind of tonnage have we been seeing taken out of the gold market by China and others?”

Maguire: “Eric, it’s enormous. People were saying, ‘Once we get to $1,300 they (China) are going to back off.’ They have not backed off. In fact, it (their physical gold buying) has accelerated...."

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/2/21_Maguire_-_Chinas_Gold_Buying_Enormous_Right_Now.html

Man Who Ran First QE Owns Gold & Warns Of Coming Inflation

"Today the man who ran the first QE program for the Fed told King World News that he owns gold and warned of coming inflation. This was the former Fed member who also set up the Fed’s massive trading room, and who is the former Managing Director at Morgan Stanley, Andrew Huszar. Below is what Huszard had to say in Part II of this remarkable series of interviews.

Eric King: “When I interviewed David Stockman, who was put in place by (President) Reagan when the US was facing collapse in the early 1980s, he was referring to the Fed trading room and he said, ‘That trading room is a weapon of financial mass destruction.’ You’ve got these guys at the controls, and I think Stockman’s point is well taken that it is a potential weapon of financial mass destruction. Is he wrong, or is there some truth to that?”

Huszar: “...I don’t even think we have begun to see the costs of this experiment. And I think (that with) the Fed trying to exit from the buying phase, we are just in the third inning of a game where we really don’t know what the result is going to be. So I agree with you....

“This activism that we’ve seen over the last 15 or so years, over time we are going to look back and think this was a pretty bad idea.”

Eric King: “Andrew, both of us have a position in gold. I’m just curious why you have a position in gold. Why the investment in gold?”

Huszar: “I look at what the Fed has done basically since the beginning of the millennium, and I see a central bank that’s effectively been pumping cash into the market in different ways. I think on some level that initially helped feed the run-up in gold..."

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/2/21_Man_Who_Ran_First_QE_Owns_Gold_%26_Warns_Of_Coming_Inflation.html

Maguire - Shocking Information In The War On Gold & Silver

"Eric King: “What is really going on with Chinese demand, Andrew?”

Maguire: “We have now started to get the official data regarding Chinese demand through the Lunar holiday, which absolutely confirms the reports of very strong demand that I’ve been receiving from my Chinese wholesale contacts during the entire holiday period. Chow Tai Fook, the world’s largest jewelry chain, reported that between the 17th of January and February 3rd, same store sales increased by 15%!

This confirms exactly what I had been reporting to you during the Chinese holiday period. And it contradicts a well-followed and respected analyst report that was picked up by the mainstream media saying that Chinese sales were down because premiums were down. Then, going as far to say they expect Chinese wholesalers to dump (gold) inventory once the holiday was over.

The data we got directly after the new year shows these well connected banks were yet again talking their own book, while trying to continue to wrong-foot the ‘Muppets.’ Directly after the Chinese New Year was over, a very large restocking (actually) began to replenish inventories, which is the complete inverse of the misinformation the mainstream media said would be happening.

It draws attention to just how much misinformation is disseminated from ‘informed sources’ and picked up by the mainstream media. These same (bullion) banks have managed to transfer their gross COMEX short positions into wrong-footed hot money hedge funds that went hook-line-and-sinker, all-in short to record levels after Goldman Sachs and others called it a slam dunk sell.”

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/2/22_Maguire_-_Shocking_Information_In_The_War_On_Gold_%26_Silver.html

Maguire - The Reason Why Silver May Be Set To Skyrocket

"Today London metals trader Andrew Maguire spoke with King World News about the massive amount of gold being smuggled into India and the reason why silver may now be set to skyrocket. Below is what Maguire had to say in Part III of this incredibly powerful series of interviews.

Maguire: “Here is the problem, and why these banks are willing to throw all credibility out of the window (with wrong-footed bearish calls on gold): They are heavily underwater in their physical positions in London, and they are desperate to replace these disappearing inventories....

Maguire: “Here is the problem, and why these banks are willing to throw all credibility out of the window (with wrong-footed bearish calls on gold): They are heavily underwater in their physical positions in London, and they are desperate to replace these disappearing inventories....

“They are extremely worried about the shift in bearish sentiment, and they are doing their utmost trying to stop this from taking off.

Now, we’ve been getting a lot of two-way information regarding India. ... The World Gold Council estimates gold smuggling to be 20 to 30 tons per month, but my wholesaler says this is a ‘gross underestimation,’ and could be as high as ’50 tons per month.’

Although this large scale smuggling has partially offset an enormous pent-up demand, once restrictions are eased, gold demand will explode (in India). As most Indian gold is sourced in London, this catch-up physical demand will have an immediate impact on price. Indians are used to a $1,450+ gold price already. So there is going to be little in the way of sticker-shock for them.

As far as silver is concerned, the most recent import data recorded Indian silver demanded from April 2013 to January 2014, was 1,497 tons. That is a record for this period during the last 5 years. This data is significant as it matches the strong April 2008 to January 2009 period, when silver reached a bargain price of $8.40 an ounce -- Indians know how to recognize a bargain.

This 100% confirms our reports of a ramp-up in wholesale silver bullion bars being airfreighted to India. Silver fundamentals are extremely bullish as is the current paper market structure. ... At the margin it is wholesale silver that is in short supply, not retail bars. And JP Morgan is leading the way now in stockpiling 1,000 ounce silver bars. It’s not rocket science to realize why they are doing this.”

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/2/23_Maguire_-_The_Reason_Why_Silver_May_Be_Set_To_Skyrocket.html

Friday, February 21, 2014

Liberal Politicians Launched the Idea of “Free Trade Agreements” In the 1960s to Strip Nations of Sovereignty

"Matt Stoller – who writes for Salon and has contributed to Politico, Alternet, Salon, The Nation and Reuters – knows his way around Washington.

at http://www.zerohedge.com/contributed/2014-02-21/liberal-politicians-launched-idea-%E2%80%9Cfree-trade-agreements%E2%80%9D-1960s-strip-nations

Stoller – a prominent liberal – has scoured the Congressional Record to unearth hidden historical facts. For example, Stoller has previously shown that the U.S. government push for a “New World Order” is no wacky conspiracy theory, but extensively documented in the Congressional Record.

Now, Stoller uses the Congressional Record to show that “free trade” pacts were always about weakening nation-states to promote rule by multinationals:

Political officials (liberal ones, actually) engaged in an actual campaign to get rid of countries with their pesky parochial interests, and have the whole world managed by global corporations. Yup, this actually was explicit in the 1960s, as opposed to today’s passive aggressive arguments which amount to the same thing.***Liberal internationalists, including people like Chase CEO David Rockefeller and former Undersecretary of State and an architect of 1960s American trade policies George Ball, began pressing for reductions in non-tariff barriers, which they perceived as the next set of trade impediments to pull down. But the idea behind getting rid of these barriers wasn’t about free trade, it was about reorganizing the world so that corporations could manage resources for “the benefit of mankind”. It was a weird utopian vision that you can hear today in the current United States Trade Representative Michael Froman’s speeches. I’ve spoken with Froman about this history, and Froman himself does not seem to know much about it. But he is captive of these ideas, nonetheless, as is much of the elite class. They do not know the original ideology behind what is now just bureaucratic true believer-ism, they just know that free trade is good and right and true.But back to the 1967 hearing. In the opening statement, before a legion of impressive Senators and Congressmen, Ball attacks the very notion of sovereignty. He goes after the idea that “business decisions” could be “frustrated by a multiplicity of different restrictions by relatively small nation states that are based on parochial considerations,” and lauds the multinational corporation as the most perfect structure devised for the benefit of mankind. He also foreshadows our modern world by suggesting that commercial, monetary, and antitrust policies should just be and will inevitably be handled by supranational organizations. [Background.]Here’s just some of that statement. It really is worth reading, I’ve bolded the surprising parts.“For the widespread development of the multinational corporation is one of our major accomplishments in the years since the war, though its meaning and importance have not been generally understood. For the first time in history man has at his command an instrument that enables him to employ resource flexibility to meet the needs of peopels all over the world. Today a corporate management in Detroit or New York or London or Dusseldorf may decide that it can best serve the market of country Z by combining the resources of country X with labor and plan facilities in country Y – and it may alter that decision 6 months from now if changes occur in costs or price or transport. It is the ability to look out over the world and freely survey all possible sources of production… that is enabling man to employ the world’s finite stock of resources with a new degree of efficiency for the benefit of all mandkind.But to fulfill its full potential the multinational corporation must be able to operate with little regard for national boundaries – or, in other words, for restrictions imposed by individual national governments.To achieve such a free trading environment we must do far more than merely reduce or eliminate tariffs. We must move in the direction of common fiscal concepts, a common monetary policy, and common ideas of commercial responsibility. Already the economically advanced nations have made some progress in all of these areas through such agencies as the OECD and the committees it has sponsored, the Group of Ten, and the IMF, but we still have a long way to go. In my view, we could steer a faster and more direct course… by agreeing that what we seek at the end of the voyage is the full realization of the benefits of a world economy.Implied in this, of course, is a considerable erosion of the rigid concepts of national sovereignty, but that erosion is taking place every day as national economies grow increasingly interdependent, and I think it desirable that this process be consciously continued. What I am recommending is nothing so unreal and idealistic as a world government, since I have spent too many years in the guerrilla warfare of practical diplomacy to be bemused by utopian visions. But it seems beyond question that modern business – sustained and reinforced by modern technology – has outgrown the constrictive limits of the antiquated political structures in which most of the world is organized, and that itself is a political fact which cannot be ignored. For the explosion of business beyond national borders will tend to create needs and pressures that can help alter political structures to fit the requirements of modern man far more adequately than the present crazy quilt of small national states. And meanwhile, commercial, monetary, and antitrust policies – and even the domiciliary supervision of earth-straddling corporations – will have to be increasingly entrusted to supranational institutions….We will never be able to put the world’s resources to use with full efficiency so long as business decisions are frustrated by a multiplicity of different restrictions by relatively small nation states that are based on parochial considerations, reflect no common philosophy, and are keyed to no common goal.” ***These ["free trade"] agreements are not and never have been about trade. You simply cannot disentangle colonialism, the American effort to create the European Union, and American trade efforts. After their opening statements, Ball and Rockefeller go on on to talk about how European states need to be wedged into a common monetary union with our trade efforts and that Latin America needs to be managed into prosperity by the US and Africa by Europe. Through such efforts, they thought that the US could put together a global economy over the next thirty years. Thirty years later was 1997, which was exactly when NAFTA was being implemented and China was nearing its entry into the WTO. Impeccable predictions, gents.

at http://www.zerohedge.com/contributed/2014-02-21/liberal-politicians-launched-idea-%E2%80%9Cfree-trade-agreements%E2%80%9D-1960s-strip-nations

China Starts To Make A Power Move Against The U.S. Dollar

"In order for our current level of debt-fueled prosperity to continue, the rest of the world must continue to use our dollars to trade with one another and must continue to buy our debt at ridiculously low interest rates. Of course the number one foreign nation that we depend on to participate in our system is China. China accounts for more global trade than anyone else on the planet(including the United States), and most of that trade is conducted in U.S. dollars. This keeps demand for our dollars very high, and it ensures that we can import massive quantities of goods from overseas at very low cost. As a major exporting nation, China ends up with gigantic piles of our dollars. They lend many of those dollars back to us at ridiculously low interest rates. At this point, China owns more of our national debt than any other country does. But if China was to decide to quit playing our game and started moving away from U.S. dollars and U.S. debt, our economic prosperity could disappear very rapidly. Demand for the U.S. dollar would fall and prices would go up. And interest rates on our debt and everything else in our financial system would go up to crippling levels. So it is absolutely critical to our financial future that China continues to play our game.

Unfortunately, there are signs that China has now decided to start looking for a smooth exit from the game. In November, I wrote about how the central bank of China has announced that it is "no longer in China’s favor to accumulate foreign-exchange reserves". That means that the pile of U.S. dollars that China is sitting on is not going to get any higher.

In addition, China has signed a whole host of international currency agreements with other nations during the past couple of years which are going to result in less U.S. dollars being used in international trade. You can read about many of these agreements in this article.

This week, we learned that China started to dump U.S. debt during the month of December. Many have imagined that China would try to dump a flood of our debt on to the market all of a sudden once they decided to exit, but that simply does not make sense. Instead, it makes sense for China to dump a bit of debt at a time so that the market will not panic and so that they can get close to full value for the paper that they are holding.

As Bloomberg reported the other day, China dumped nearly 50 billion dollars of U.S. debt during the month of December...

China, the largest foreign U.S. creditor, reduced holdings of U.S. Treasury debt in December by the most in two years as the Federal Reserve announced plans to slow asset purchases.The nation pared its position in U.S. government bonds by $47.8 billion, or 3.6 percent, to $1.27 trillion, the largest decline since December 2011, according to U.S. Treasury Department data released yesterday.

This is how I would do it if I was China. I would try to dump 30, 40 or 50 billion dollars a month. I would try to make a smooth exit and try to get as much for my U.S. debt paper as I could.

So if China is not going to stockpile U.S. dollars or U.S. debt any longer, what is it going to stockpile?

It is going to stockpile gold of course. In fact, China has been voraciously stockpiling gold for quite some time, and their hunger for gold appears to be growing.

According to Bloomberg, more than 80 percent of the gold that was exported from Switzerland last month went to Asia...

Switzerland sent more than 80 percent of its gold and silver bullion and coin exports to Asia last month, the Swiss Federal Customs Administration said today in an e-mailed report. It imported most from the U.K.Hong Kong was the top destination at 44 percent on a value basis, with India at 14 percent, the Bern-based customs agency said in its first breakdown of the gold trade data since 1980. Singapore accounted for 8.6 percent of exports, the United Arab Emirates 7.9 percent and China 6.3 percent.

When China imports gold, most of it goes through Hong Kong. We know that imports of gold from Hong Kong into China are at an all-time record high, but we don't know exactly how much gold China has accumulated at this point because they quit reporting that to the rest of the world a number of years ago.

When it comes to global finance, China is playing chess and the United States is playing checkers. China knows that gold is a universal currency that will hold value over the long-term. As the paper currencies of the world race toward collapse, China could end up holding most of the real money and that would be a huge game changer when they finally reveal that fact...

The announcement of China's new gold hoard will send shockwaves through the financial markets, and make China and the Chinese yuan (their national currency) even bigger players at the international table.International banking expert James Rickards compared it to a game of Texas Hold 'Em poker:"You want a big pile of chips. The U.S. has a big pile of chips, Europe has a big pile of chips. The U.S. has 8,000 tonnes [metric tons] of gold, 17 members of the euro system have 10,000 tonnes. China at 1,000 tonnes is not a player, but at 5,000 tonnes, they are a player."

There are some really good points made in the quote above, but I do take exception with a couple of things. First of all, I believe that China now has far more than 5,000 tons of gold. Secondly, I seriously doubt that the U.S. still actually has 8,000 tons of gold or that Europe still actually has 10,000 tons of gold.

As China (and eventually the rest of the world) moves away from a U.S.-based financial system, the consequences are going to be dramatic.

For instance, right now the average rate of interest that the U.S. government pays on debt is just 2.477 percent. That is ridiculously low and it is way below the real rate of inflation. It is simply not rational for anyone to lend the U.S. government money so cheaply, and at some point we are going to see a dramatic shift.

When that day arrives, interest rates are going to rise dramatically. And if the average rate of interest on U.S. government debt rises to just 6 percent (and it has been much higher than that in the past), we will be paying out more than a trillion dollars a year just in interest on the national debt.

Even more frightening is what a rapidly changing interest rate environment would mean for our banking system. There are four large U.S. banks that each have exposure to derivatives in excess of 40trillion dollars. You can find the identity of those banks right here. Interest rate derivatives make up the biggest chunk of those derivatives contracts. As John Embry told King World News just the other day, when that bubble bursts the carnage is going to be unprecedented..."

at http://theeconomiccollapseblog.com/archives/china-starts-to-make-a-power-move-against-the-u-s-dollar

Subscribe to:

Posts (Atom)