"Gold is moving from West to East.

You may read about the roots of this phenomenon here.

This chart is from Nick Laird at Sharelynx.com.

Related: Germany Leads Western Gold Buying

Links to global economy, financial markets and international politics analyses

Sunday, May 31, 2015

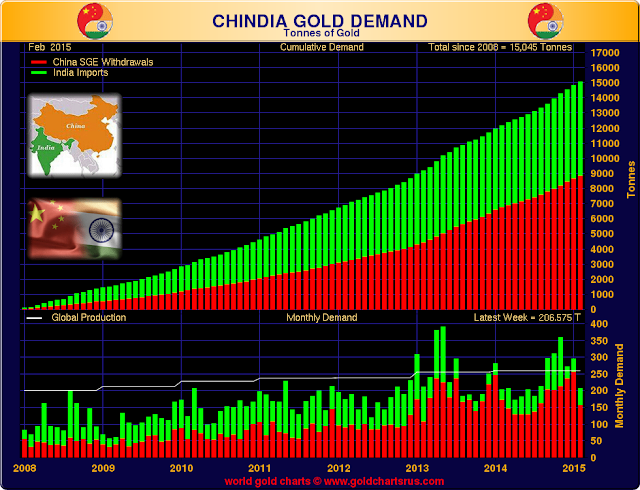

Chindia: The Steady Increase in Gold Demand From China and India

"It is an interesting phenomenon that is often overlooked and underappreciated outside of the certain small circles of those who watch these sorts of things.

Gold is flowing from West to East. What it means and will mean is worth considering.

In the bottom portion it is easily seen that the monthly offtake is steadily increasing. And it is also apparent that China is outpacing India in the accumulation of gold.

These charts are from Nick Laird, who chronicles all things gold and silver, at Sharelynx.com.

Gold is flowing from West to East. What it means and will mean is worth considering.

In the bottom portion it is easily seen that the monthly offtake is steadily increasing. And it is also apparent that China is outpacing India in the accumulation of gold.

These charts are from Nick Laird, who chronicles all things gold and silver, at Sharelynx.com.

A Recession Within A Recession

"On Friday, the federal government announced that the U.S. economy contracted at a 0.7 percent annual rate during the first quarter of 2015. This unexpected shrinking of the economy is being primarily blamed on “harsh” weather during the first three months of this year and on the strengthening of the U.S. dollar. Most economists are confident that U.S. GDP will rebound back into positive territory when the numbers for the second quarter come out, but if that does not happen we will officially meet the government’s criteria for being in another “recession”. To make sure that the numbers for Q2 will look “acceptable”, the Bureau of Economic Analysis is about to change the way that it calculates GDP again. They are just going to keep “seasonally adjusting” the numbers until they get what they want. At this point, the government numbers are so full of “assumptions” and “estimates” that they don’t really bear much resemblance to reality anyway. In fact, John Williams of shadowstats.com has calculated that if the government was actually using honest numbers that they would show that we have continually been in a recession since 2005. That is why I am referring to this as a “recession within a recession”. Most people can look around and see that economic conditions for most Americans are not good, and now they are about to get even worse.

For quite a while I have been warning that another economic downturn was coming. Well, now we have official confirmation from the Obama administration that it is happening. The following is an excerpt from the statement that the Bureau of Economic Analysis released on Friday…"

at http://theeconomiccollapseblog.com/archives/a-recession-within-a-recession

Man Asked To Speak To Chinese Officials Issues Warning About The Most Important Move Of The Decade And China’s Golden Agenda

"...The upcoming five year review of the International Monetary Fund’s Special Drawing Rights (SDR) basket will formally be placed on the IMF agenda in October. This summer, China will be part of the negotiations to include the renminbi in a basket of the IMF’s de facto currency alongside the dollar, the yen, the euro and sterling. The move that would see it recognized as an official reserve currency is more than symbolic, it is a major step in making the renminbi more liquid since it would trigger a reallocation of investors’ global portfolios.

China has liberalized restrictions as part of that process, such as removing the administrative cap on bank deposit rates to outsiders and lessening restrictions on inflows into its fixed income market. China has also swiftly removed capital controls with some thirty central banks. Beijing sponsored institutions like the Asian Infrastructure Investment Bank (AIIB) with 57 founding member countries and CIC were set up in part to offset Western hegemonic institutions.

Importantly the renminbi has been one of the few currencies to hold its value against the dollar. The United States is the largest holder of gold in the world at 8,100 tonnes but the holding is pale in comparison to their indebtedness. Currently the US dollar makes up almost 63 percent of the world central bank holdings while the Euro is at 22 percent.

Standing in China’s way is the lack of sufficient gold reserves at only 1.1 percent of reserves according to the last update in 2009. We believe that China’s current and seemingly insatiable purchases of gold is a key part of a move to make the renminbi an international currency and attractive as a store of value. Making the renminbi a reserve currency would require China to disclose its gold holdings which is a paltry 1,059 tonnes. In fact, for China to hold just 10 percent of its reserves in gold, equivalent to other industrialized countries’ holdings, China would need to purchase the next three year’s world output.

Bloomberg has estimated that China has already tripled their reserves. China remains the largest producer and consumer of gold, importing 410 tonnes in the first two months of this year alone. Chinese and Indian consumer demand make up more than half of global consumer demand, according to the World Gold Council.

China needs a lot more gold. The Shanghai Gold Exchange (SGE) has already overshadowed Comex with some 50 tonnes delivered in only one week. As a potential source for gold, China has created a $16 billion gold investment fund through the country’s Shanghai Gold Exchange with some 60 member countries to fund gold mining projects across the Silk Road as part of China’s golden agenda.

Gold's Breakout Will Be The Most Important Move This Decade

If China questions the US and its currency, then others too may have doubts. What damages trust in the United States, damages the world. After the financial meltdown, investors wonder who they can trust. We believe foreign investors have become more and more cautious about financing America’s profligacy, particularly at nominal rates.

The recent bond crash is a warning signal. Another is gold’s breakout and quadruple bottom. Gold is an alternative investment to the dollar. It is a store of value when everything else seems risky. We believe that gold’s inevitable breakout from its trading range will be the most important global movement in the current decade."

at http://kingworldnews.com/man-asked-to-speak-to-chinese-officials-issues-warning-about-the-most-important-move-of-the-decade-and-chinas-golden-agenda/

Ominous Warnings From The IMF And Billionaire Paul Singer Dramatically Increase Fear Levels

"With oil surging nearly 3.5 percent, today a legend in the business sent King World News a powerful piece discussing ominous warnings from the IMF and billionaire Paul Singer that have dramatically increase fear levels.

From Art Cashin's notes: "Greece – Not Quite A Reassurance – The IMF head raised a few eyebrows with a new interview:

“A Greek exit is a possibility,” Lagarde told the German newspaper in an advance extract of an interview due to be published on Friday. She said such a scenario would not be “a walk in the park” for the Eurozone but would “probably not be an end to the euro,” she said.

Lagarde also said it is very unlikely that a deal between Greece and its creditors could happen in the coming days. “It is very unlikely that we will reach a comprehensive solution in the next few days,” Lagarde said. “[There] is a vast field to plow,” she added.

The IMF chief noted that after positive signs from Athens about 10 days ago, talks have stalled during the past week and warned that no loans will be disbursed if there is no reform agreement in place. “We have rules. We have principles. There cannot be a half evaluation. This evaluation cannot be rushed.”

With this in mind, the paper argued it is practically impossible to have a disbursement of the rest of the funds by the end of June because this would require an agreement between Athens and all the institutions.

Another Strong Caution – Another large hedge fund manager has come out to call the sovereign bond markets around the globe a massive short target. Here's a taste courtesy of CNBC:

Billionaire investor Paul Singer says he has spotted the next big thing to bet against: bonds.

"Today, six and a half years after the collapse of Lehman, there is a Bigger Short cooking. That Bigger Short is long-term claims on paper money, i.e., bonds," Singer wrote in a letter to investors of his hedge fund firm Elliott Management obtained by CNBC.com.

"Bigger Short" is a play on "The Big Short," the book by Michael Lewis describing how a tiny group of investors made huge sums of money for their contrarian bets against mortgage-backed securities before the collapse of the housing market in 2007 and 2008.

"Central bankers have chosen, and doubled down on, a palliative (super-easy money and QE), which is unprecedented and extreme, and whose ultimate effects are unknowable," Singer wrote of governments stimulating markets, in part through the purchase of bonds.

Consensus – Could be a rumormongers delight as a potential Greek deadline looms next week. Monetary base is not growing so market is doing its own tightening ahead of the Fed. Big rebalance due on the bell, as previously noted. Stick with the drill – stay wary, alert and very, very nimble..."

at http://kingworldnews.com/ominous-warnings-from-the-imf-and-billionaire-paul-singer-dramatically-increase-fear-levels/

We Are Now Living In A World Headed Toward Bursting Financial Bubbles And Disaster

"On the heels of another volatile trading week in major markets, today one of the top economists in the world sent King World News an incredibly powerful piece warning we are now living in a world that is headed toward bursting financial bubbles and disaster. Below is the fantastic piece from Michael Pento.

May 30 – (King World News) – For the first time in its country’s history, Portugal sold 6 month T-bills at a negative yield. The 300 million euros ($333 million) worth of bills due in November 2015 sold at an average yield of minus 0.002%. A negative yield means investors buying these securities will get back less money from the government than they paid when the debt matures…."

at http://kingworldnews.com/bursting-bubbles-and-a-world-headed-for-disaster/

Wednesday, May 27, 2015

Gold Daily and Silver Weekly Charts - How Unusual: Precious Metals Hit on Option Expiration

"June is a big, active month for gold on the Comex.

And today was the option expiration for the precious metal June contracts.

Le voilà, comme prévu.

What else might we have expected? Honesty? Price discovery? A market clearing price between users and suppliers?

These are markets that have been willfully overwhelmed and misdirected by speculation. There are no fundamentals in The Bucket Shop, just what is essentially full time market rigging, with little to no product changing hands between long term investors and suppliers.

These are markets that have been willfully overwhelmed and misdirected by speculation. There are no fundamentals in The Bucket Shop, just what is essentially full time market rigging, with little to no product changing hands between long term investors and suppliers.

And similarly, like healthy nourishment in a snack cake, so there is still little to no recovery in The Recovery™.

When the reckoning for this protracted folly and organized plunder finally comes, they will all be so amazed.

It is so very modern to think that things are just as we say they are, because we say so. And nowhere is this psychosis more apparent than in modern economics and money.

It is the ultimate tyranny of selfishness and egoism, and will last as long as the masters can keep extending their power and their will, crushing all dissent and all others in their path,

And then comes the downfall, the sickening plunge, and the moment of terrible lucidity when the music stops. And the illusion dies.

Have a pleasant evening.

Who Would Win A Conflict In The South China Sea: The Infographic

"As regular readers are no doubt aware, the US and China areracing towards a maritime conflict stemming from Beijing’s construction of what Washington has condescendingly called “sand castles” in the Spratly archipelago.

at http://www.zerohedge.com/news/2015-05-27/who-would-win-conflict-south-china-sea-infographic

Atop these man-made islands are cement plants, air strips, and soon-to-be lighthouses, as China boldly asserts its territorial claims on what are heavily-contested waters though which trillions in seaborne freight pass each year.

Now, with Beijing set to enforce what is effectively a no-fly zone over its new sovereign ‘territory’ we bring you the following graphic from WSJ which shows that when it comes to sheer size, China’s air force and Navy are beyond compare.

China’s promise to beef up its naval capabilities to prevent further “meddling” and “provocative actions” by rivals in the South China Sea is a daunting prospect for most of its neighbors, which already view Beijing’s fast-improving armed forces with trepidation...As a recent Pentagon review of China’s military modernization drive noted, “China is investing in capabilities designed to defeat adversary power projection and counter third-party—including U.S.—intervention during a crisis or conflict.” In practice, that means hundreds of ballistic and cruise missiles positioned near the coast to deter Japanese or American warships from coming anywhere near Chinese territory. China has a substantial submarine fleet as well, piling on more risk for enemy ships."

at http://www.zerohedge.com/news/2015-05-27/who-would-win-conflict-south-china-sea-infographic

Is The 505 Trillion Dollar Interest Rate Derivatives Bubble In Imminent Jeopardy?

"All over the planet, large banks are massively overexposed to derivatives contracts. Interest rate derivatives account for the biggest chunk of these derivatives contracts. According to the Bank for International Settlements, the notional value of all interest rate derivatives contracts outstanding around the globe is a staggering 505 trillion dollars. Considering the fact that the U.S. national debt is only 18 trillion dollars, that is an amount of money that is almost incomprehensible. When this derivatives bubble finally bursts, there won’t be enough money in the entire world to bail everyone out. The key to making sure that all of these interest rate bets do not start going bad is for interest rates to remain stable. That is why what is going on in Greece right now is so important. The Greek government has announced that it will default on a loan payment that it owes to the IMF on June 5th. If that default does indeed happen, Greek bond yields will soar into the stratosphere as panicked investors flee for the exits. But it won’t just be Greece. If Greece defaults despite years of intervention by the EU and the IMF, that will be a clear signal to the financial world that no nation in Europe is truly safe. Bond yields will start spiking in Italy, Spain, Portugal, Ireland and all over the rest of the continent. By the end of it, we could be faced with the greatest interest rate derivatives crisis that any of us have ever seen..."

at http://theeconomiccollapseblog.com/archives/is-the-505-trillion-dollar-interest-rate-derivatives-bubble-in-imminent-jeopardy

at http://theeconomiccollapseblog.com/archives/is-the-505-trillion-dollar-interest-rate-derivatives-bubble-in-imminent-jeopardy

Rising Gold Price Could Set Off Derivative Nightmare-Bill Murphy

"Bill Murphy, Chairman of GATA (Gold Anti-Trust Action Committee), says precious metal prices have been relentlessly rigged by central banks and governments. Murphy contends, “If gold were to just to have kept pace with inflation, forget all the QE, it would be double what it is today. That’s how artificially low the price of gold is today, and also silver. Once they lose control of silver, it will go from $22 to $100 per ounce very fast.”

Murphy claims that one reason precious metal prices are suppressed is central banks are afraid of what Murphy calls “a derivative nightmare” touched off by a rising gold and silver prices. Murphy explains, “We saw some of this before in 2008. There is counter-party risk all over the place, and it could set off like a nuclear reaction where there is one default after another. Derivatives have exploded to $250 trillion, or just pick a number. They don’t know what the outcome could be if they start getting this kind of reaction. So, they are maniacal in trying to keep the gold and silver prices in line.”

at http://usawatchdog.com/rising-gold-price-could-set-off-derivative-nightmare-bill-murphy/

U.S. Scared To Death As China Just Secured Larger Flow Of Gold As Part Of Its Plan To Back The Yuan With Gold

"Today one of the top money managers in the world warned King World News that the United States is now scared to death as the Chinese have just signed a historic deal to further increase the flow of physical gold into China as part of their plan to back the yuan with gold. He also warned it will be "game over" for the United States dollar and U.S. world dominance once this nightmare unfolds.

Stephen Leeb: “The Chinese are planning to make gold an active and meaningful part of the monetary system. This will send the price of gold skyrocketing….

“This is why I keep telling KWN readers that they should own a meaningful amount of physical gold. Meanwhile, not one United States bank sells any physical gold. Whereas over in China and the Middle East, virtually every bank sells physical gold.

China's State-Owned Company Signs Historic Deal To Secure Larger Flow Of Gold

Eric, you pointed out to me before this interview began that China’s state-owned gold company, Zijin Mining Group, just signed two deals, one of them with Barrick Gold — the largest gold mining company in the world. This deal with Barrick Gold is to secure an even greater flow of gold into China..."

at http://kingworldnews.com/u-s-scared-to-death-as-china-just-secured-larger-flow-of-gold-into-china-as-part-of-plan-to-back-the-yuan-with-gold/

Rising Dollar and the New Silk Road Gold Fund

"...Gold Positioning and the Gold Fund

The managed money net combined gold positions jumped a whopping 140% to 86,672 contracts during the week ending May 19 with the short contracts declining 29% and the long contracts rising 26%. Still, the net positions only rose back to the level in early March. In India, the government has announced further details on its gold monetization scheme. The bigger news is China’s establishment of a new gold fund to raise about $16 billion to develop gold mining projects along the New Silk Road and to facilitate other central banks to purchase gold for their reserves."

The managed money net combined gold positions jumped a whopping 140% to 86,672 contracts during the week ending May 19 with the short contracts declining 29% and the long contracts rising 26%. Still, the net positions only rose back to the level in early March. In India, the government has announced further details on its gold monetization scheme. The bigger news is China’s establishment of a new gold fund to raise about $16 billion to develop gold mining projects along the New Silk Road and to facilitate other central banks to purchase gold for their reserves."

at http://news.sharpspixley.com/article/rising-dollar-and-the-new-silk-road-gold-fund/231248/

Sunday, May 24, 2015

The Happiness Industry: How Government and Big Businesses Manipulate Your Moods For Profit

"Yves here. We’ve long focused on the role of propaganda in creating the consent, or at least the appearance of consent, for policies that often serve very narrow interests. This post discusses a broader phenomenon, how businesses and governments try to foster more intense involvement while at the same time implementing programs that create disengagement and anomie.

One thing I find intriguing is the emphasis in the US on “happiness” which I see as an illusory goal. Happiness American style is giddiness or euphoria and is by nature a fleeting state. Contentment is more durable and more attainable, but being content is the opposite of the dissatisfaction, insecurity, and anxiety that is what drives most people to perform.

By William Davies, a Senior Lecturer at Goldsmiths, University

of London, where he is Director of the Political Economy Research Centre. His

weblog is at www.potlatch.org.uk. Originally published at Alternet

of London, where he is Director of the Political Economy Research Centre. His

weblog is at www.potlatch.org.uk. Originally published at Alternet

The following is an excerpt from Davies’ new book The Happiness Industry: How the Governmen and Big Business Sold Us Well-Being (Verso Books, 2015)

Since the 1960s, Western economies have been afflicted by an acute problem in which they depend more and more on our psychological and emotional engagement (be it with work, with brands, with our own health and well-being) while finding it increasingly hard to sustain this. Forms of private disengagement, often manifest as depression and psychosomatic illnesses, do not only register in the suffering experienced by the individual; they are increasingly problematic for policy-makers and managers, becoming accounted for economically.

Yet evidence from social epidemiology paints a worrying picture of how unhappiness and depression are concentrated in highly unequal societies, with strongly materialist, competitive values. Workplaces put a growing emphasis on community and psychological commitment, but against longer-term economic trends towards atomization and insecurity. We have an economic model which mitigates against precisely the psychological attributes it depends upon.

In this more general and historical sense, then, governments and businesses ‘created the problems that they are now trying to solve.’ Happiness science has achieved the influence it has because it promises to provide the longed-for solution. First of all, happiness economists are able to put a monetary price on the problem of misery and alienation. The opinion-polling company Gallup, for example, has estimated that unhappiness of employees costs the US economy $500 billion a year in lost productivity, lost tax receipts and health-care costs. This allows our emotions and well-being to be brought within broader calculations of economic efficiency.Positive psychology and associated techniques then play a key role in helping to restore people’s energy and drive. The hope is that a fundamental flaw in our current political economy may be surmounted, without confronting any serious political–economic questions.

Psychology is very often how societies avoid looking in the mirror. The second structural reason for the surging interest in happiness is somewhat more disturbing, and concerns technology. Until relatively recently, most scientific attempts to know or manipulate how someone else was feeling occurred within formally identifiable institutions, such as psychology laboratories, hospitals, workplaces, focus groups, or some such. This is no longer the case. In July 2014, Facebook published an academic paper containing details of how it had successfully altered hundreds of thousands of its users’ moods, by manipulating their news feeds. There was an outcry that this had been done in a clandestine fashion. But as the dust settled, the anger turned to anxiety: would Facebook bother to publish such a paper in future, or just get on with the experiment anyway and keep the results to themselves?

Monitoring our mood and feelings is becoming a function of our physical environment. In 2014, British Airways trialled a ‘happiness blanket’, which represents passenger contentment through neural monitoring. As the passenger becomes more relaxed, the blanket turns from red to blue, indicating to the airline staff that they are being well looked after. A range of consumer technologies are now on the market for measuring and analyzing well-being, from wristwatches, to smartphones, to Vessyl, a ‘smart’ cup which monitors your liquid intake in terms of its health effects. One of the foundational neoliberal arguments in favor of the market was that it served as a vast sensory device, capturing millions of individual desires, opinions and values, and converting these into prices. It is possible that we are on the cusp of a new post-neoliberal era in which the market is no longer the primary tool for this capture of mass sentiment. Once happiness monitoring tools flood our everyday lives, other ways of quantifying feelings in real time are emerging that can extend even further into our lives than markets.

Concerns about privacy have traditionally seen it as something which needs to be balanced against security. But today, we have to confront the fact that a considerable amount of surveillance occurs to increase our health, happiness, satisfaction or sensory pleasures. Regardless of the motives behind this, if we believe that there are limits to how much of our lives should be expertly administered, then there must also be limits to how much psychological and physical positivity we should aim for. Any critique of ubiquitous surveillance must now include a critique of the maximization of well-being, even at the risk of being less healthy, happy and wealthy.

To understand these trends as historical and sociological does not in itself indicate how they might be resisted or averted. But it does have one great liberating benefit of diverting our critical attention outward upon the world, and not inward upon our feelings, brains or behavior. It is often said that depression is ‘anger turned inwards.’ In many ways, happiness science is ‘critique turned inwards’, despite all of the appeals by positive psychologists to ‘notice’ the world around us. The relentless fascination with quantities of subjective feeling can only possibly divert critical attention away from broader political and economic problems. Rather than seek to alter our feelings, now would be a good time to take what we’ve turned inwards, and attempt to direct it back out again. One way to start would be by turning a skeptical eye upon the history of happiness measurement itself."

at http://www.nakedcapitalism.com/2015/05/the-happiness-industry-how-government-and-big-businesses-manipulate-your-moods-for-profit.html

China Establishes World's Largest Physical Gold Fund

"While many eagerly await the day when China will finally reveal its latest official gold holdings, a number which when made public will be orders of magnitude higher than its last 2009 disclosure of just over 1,000 tons, or less even than Russia, China continues to plough ahead with agreements and arrangements to obtain even more gold in the coming years.

Exhibit A: two weeks ago, Xinhua reported that China National Gold Group Corporation announced it has signed an agreement with Russian gold miner Polyus Gold to deepen ties in gold exploration. The companies will cooperate in mineral resource exploration, technical exchanges and materials supply, the largest gold producer of China said.

Polyus Gold is the largest gold producer in Russia and one of the world's top 10 gold miners.The agreement between the two gold miners is one of many deals signed between China and Russia in energy, transportation, space, finance and media exchanges during President Xi Jinping's visit to Russia from May 8 to May 10."China's Belt and Road Initiative brings unprecedented opportunities for the gold industry. There is ample room for cooperation with neighboring countries, and we have advantages in technique, facilities, cash, and talents," said Song Xin, general manager of China National Gold Group Corporation.

In light of such developments, it is little wonder there has been increasing chatter in recent months that Russia and China are setting the stage for a gold-backed currency, in preparation for the day the Dollar reserve hegemony finally ends (a hegemony whose demise is accelerating with every incremental physical gold repatriation such as those of Germany, the Netherlands, and now Austria).

And now, Exhibit B: overnight Xinhua also reported that a gold sector fund involving countries along the ancient Silk Road has been set up in northwest China's Xi'an City during an ongoing forum on investment and trade this weekend. (read more about the "New Silk Road" which could change global economics forever here). The fund, led by Shanghai Gold Exchange (SGE), is expected to raise an estimated 100 billion yuan (16.1 billion U.S. Dollars) in three phases. The amount of capital allocated to nothing but physical gold purchases (without plans for financial paper intermediation a la western ETFs) will be the largest in the world.

The billions of dollars in allocated funding will come from roughly 60 countries that have invested in the fund, which will in turn facilitate gold purchase for the central banks of member states to increase their holdings of the precious metal, according to the SGE.

As Xinhua notes, China is the world's largest gold producer, and also a major importer and consumer of gold. Among the 65 countries along the routes of the Silk Road Economic Belt and the 21st-Century Maritime Silk Road, there are numerous Asian countries identified as important reserve bases and consumers of gold.

"China does not have a big say in gold pricing because it accounts for a small share of international gold trade," said Tang Xisheng of the Industrial Fund Management Co. "Therefore, the Chinese government seeks to increase the influence of RMB in gold pricing by opening the domestic gold market to international investors."

As a reminder, the reason why China has been aggressively building out and expanding its Shanghai Gold Exchange is precisely that: to shift the global gold trading center away from London (and certainly the US where only paper gold is relevant these days) and to its own native soil: China's ambition is nothing short of becoming the world's new gold trading hub.

In other to do that, it is already setting up the regional infrastructure to facilitate such a goal: according to Tang, the fund will invest in gold mining in countries along the Silk Road, which will increase exploration in countries such as Afghanistan and Kazakhstan.

The good news for China is that with the BIS and virtually all "developed" central banks in desperate need of keeping the price of gold as low as possible while they debase their own paper currencies to unprecedented levels over fears of faith in fiat evaporating, China's gold fund will be able to procure gold for its members at a very reasonable price until such time as the lack of physical gold supply can no longer be swept away by mere paper shorting of the yellow metal."

at http://www.zerohedge.com/news/2015-05-24/china-establishes-worlds-largest-physical-gold-fund

Leader Of Germany’s Gold Repatriation Movement Confirms Austria To Repatriate 50% Of Its Gold Held Abroad, 80% Of Which Is Held In London

"Today Peter Boehringer, who led the movement to repatriate Germany's gold, notified King World News that he has seen credible reports that Austria intends to repatriate 50% of its gold reserves held abroad, 80% of which are held in London.

This is a huge blow to the West's fractional reserve gold system, which is leveraged 100/1. The fractional reserve gold system is operated out of London and is supported by the United States. It will be interesting to see how the gold market trades in coming weeks as London will have to send a large amount of gold back to Austria. It's the leverage that makes coming up with the physical gold so tricky..."

at http://kingworldnews.com/leader-of-germanys-gold-repatriation-movement-confirms-austria-to-repatriate-50-of-its-gold-held-abroad-80-of-which-is-held-in-london/

This is a huge blow to the West's fractional reserve gold system, which is leveraged 100/1. The fractional reserve gold system is operated out of London and is supported by the United States. It will be interesting to see how the gold market trades in coming weeks as London will have to send a large amount of gold back to Austria. It's the leverage that makes coming up with the physical gold so tricky..."

at http://kingworldnews.com/leader-of-germanys-gold-repatriation-movement-confirms-austria-to-repatriate-50-of-its-gold-held-abroad-80-of-which-is-held-in-london/

Billionaire Eric Sprott On The Shocking Financial Dangers Facing The World Today

"Today billionaire Eric Sprott spoke with King World News about the shocking financial dangers facing the world today.

Eric Sprott: “Here we have this ludicrous situation in Greece, where the ECB had to put in $80 billion to support their banking system. I think the (total) assets of the banking system are about $135 billion. And yet the entire discussion is whether or not they will put $7.2 billion in to support the government. So obviously the bias is there — they care more about the banking system than they care about the government because they don’t want the domino effect to start..."

at http://kingworldnews.com/billionaire-eric-sprott-on-the-greatest-financial-dangers-facing-the-world-today/

We Have Officially Entered The Final Phase Of Every Market Bubble

"On the heels of another chaotic trading week in major markets, today one of the top economists in the world sent King World News an incredibly powerful piece warning that we have officially entered the final phase of every market bubble. Below is the fantastic piece from Michael Pento.

May 23 – (King World News) – At the beginning of every quarter Wall Street places its overly optimistic GDP forecasts on parade. And by the end of the quarter, those same carnival barkers line up a myriad of excuses as to why the numbers fell short. Port strikes, a stronger dollar and snowier winters (supposedly caused by global warming) are among their current favorites.

But the anemic data in the first quarter of 2015, followed by the not so much better data in the first month and a half of Q2, has rattled the optimism of not only the usual Wall Street cheerleaders, but even many at the Federal Reserve…."

at http://kingworldnews.com/we-have-officially-entered-the-final-phase-of-every-market-bubble/

Sunday, May 17, 2015

The Economist "Buries" Gold

"A Proven Contrary Indicator

In early May, the Economist has published an editorial on gold, ominously entitled “Buried”. We wanted to comment on it earlier already, but never seemed to get around to it. It is still worth doing so for a number of reasons.

The Economist is a quintessential establishment publication.It occasionally gives lip service to supporting the free market, but anyone who has ever read it with his eyes open must have noticed that 70% of the content is all about how governments should best centrally plan the economy, while most of the rest is concerned with dispensing advice as to how to expand and preserve Anglo-American imperialism. We are exaggerating a bit for effect here, but in essence we think this describes the magazine well. In other words, its economic stance is essentially indistinguishable from that of the Financial Times or most of the rest of the mainstream financial press.

Keynesian shibboleths about “market failure” and the need to prevent it, as well as the alleged need for governments to provide “public goods” and to steer the economy in directions desired by the ruling elite with a variety of taxation and spending schemes as well as monetary interventionism, are dripping from its pages in generous dollops. It never strays beyond the “acceptable” degree of support for free markets, which is essentially book-ended by Milton Friedman (a supporter of central banking, fiat money and positivism in economic science, who comes from an economic school of thought that was regarded as part of the “leftist fringe” in the 1940s as Hans-Hermann Hoppe has pointed out). Needless to say, the default expectation should therefore be that the magazine will be dissing gold – and indeed, it didn’t disappoint.

Another reason is that the magazine has one of the very best records as a contrary indicator whenever it comments on markets. If a market trend makes the cover page of the Economist, it is almost as good as if it were making the front page of the Mirroror the Daily Mail. If you do the exact opposite of what an Economist cover story prediction indicates you should do, you can actually end up being set for life.

A famous example was the “Drowning in Oil” cover story which was published about two months after a multi-decade low in the oil price had been established, literally within two trading days of the slightly higher retest low. The article predicted that crude oil would soon fall from then slightly over $10/bbl. to a mere $5/bbl. – a not inconsiderable decline of more than 50%. Instead it began to soar within a few days of the article’s publication and essentially didn’t stop until it had risen nearly 15-fold – a gain of almost 1,400%..."

at http://www.zerohedge.com/news/2015-05-16/economist-buries-gold

Stephen King Warns "The Second Great Depression Only Postponed, Not Avoided"

"Reading like his name-sake's horror novels, HSBC's Chief Economist Stephen King unleashes a torrent of truthiness about the Titanic-like economic ocean liner that is headed for an iceberg except this fragile ship doesn’t have lifeboats. As ValueWalk's Mark Melin notes, what is different with this economic recovery is that, unlike most, "the recovery phase has not marked a return to economic growth," nor has it ushered in a return to policy "normality." From King’s point of view, the normal recovery“typically allows policymakers to rebuild their stocks of ammunition, providing them with room to fight the next economic battle.” Problem is, under the regime of quantitative easing, the central bank central planners are now out of bullets as the economic recovery and the stock bull market is long in the tooth.

at http://www.zerohedge.com/news/2015-05-16/stephen-king-warns-second-great-depression-only-postponed-not-avoided

Stephen King: Economy is like Titanic except without lifeboats

In his research piece titled “The world economy’s titanic problem: Coping with the next recession without policy lifeboats,” King notes it has been six years since the last recession. Without specifically saying it, those who follow quantitative market probability note that bullish stock market environments last, on average, 67 months. The current bullish economic environment, depending on where you call the low point, is nearly 72 months old..."

at http://www.zerohedge.com/news/2015-05-16/stephen-king-warns-second-great-depression-only-postponed-not-avoided

Belligerent US Refuses To Cede Control Over IMF In Snub To China

"One story that’s been covered extensively in these pages over the past several months is the emergence of the China-led Asian Infrastructure Investment Bank. The bank began to attract quite a bit of attention in early March when the UK decided, much to Washington’s chagrin, to make a bid for membership. The dominoes fell quickly after that and within a month it was quite clear that The White House’s effort to discourage its allies from supporting the new institution had failed in dramatic fashion.

at http://www.zerohedge.com/news/2015-05-17/belligerent-us-refuses-cede-control-over-imf-snub-china

Since then, China has been careful not to jeopardize the overwhelming support the bank has received. While Beijing is keen on expanding China’s regional influence and promoting the widespread use of the yuan, downplaying the idea that the new bank will become a tool of Chinese foreign policy is critical if it hopes to enjoy the long-term support of the many traditional US allies who have become early adopters so to speak. Similarly, China must be sensitive to the perception that the AIIB is the first step towards usurping the dollar as the world’s reserve currency and although Beijing has dispelled the notion of “yuan hegemony” as nonsensical, it’s clear that the renminbi will play a key role in loans made from the new bank.

So while the AIIB certainly represents an attempt on China’s part to realize its regional ambitions (what we’ve described as the establishment of a Sino-Monroe Doctrine) and carve out a foothold for the yuan on the global stage, it’s also a product of Washington’s failure to adapt to a changing world. That is, the establishment of new supranational lenders suggests the US-dominated multilateral institutions that have characterized the post-war world are proving unable (for whatever reason) to meet the needs of modernity.

Nowhere is this more apparent than the IMF, where reforms aimed at making the Fund more reflective of its membership have been stymied by Congressional ineptitude for years. As Bloomberg reports, the US has apparently learned very little from the AIIB experience:

The Obama administration signaled it won’t jeopardize the U.S. power to veto IMF decisions to achieve its goal of giving China and other emerging markets more clout at the lender, according to people familiar with the matter.That message was delivered at the International Monetary Fund’s spring meetings in Washington last month, the people said, where officials discussed how to overcome congressional opposition to a 2010 plan to overhaul the lender’s voting structure.A solution backed by Brazil would have enabled an end-run around Congress -- while potentially sacrificing the veto the U.S. has held since World War II. With that option off the table, the people said, IMF member nations are considering a watered-down proposal that risks alienating China and India, which are already challenging the postwar economic order by setting up their own lending and development institutions…The 2010 plan calls for increasing the emerging markets’ sway through a doubling of the IMF’s capital, with the U.S. contribution subject to approval by Congress. Without that approval, the plan wouldn’t have the support of the required 85 percent of members’ voting shares, because the U.S. has 16.7 percent. Voting rights are proportional to capital shares at the fund.China, the world’s second-largest economy, currently ranks sixth in its voting shares at the IMF, behind Japan, Germany, France and the U.K. Under the 2010 plan, China would jump to third, while India would climb to eighth from 11th and Brazil would move up four spots to 10th.The option backed by Brazil and other countries would have pushed through the changes without requiring Congress to ratify them. The catch was that the U.S. veto over major IMF decisions may have been at risk if Congress failed to react by approving the 2010 plan, because America’s voting share would potentially fall below the 15 percent threshold needed to maintain the power…The fund is now considering a capital increase of just 10 percent, said the people familiar with the matter, who asked not to be identified because the discussions are confidential. Most of the boost would go to emerging nations that are underrepresented based on the size of their economies.The solution is unlikely to satisfy some emerging economies because the capital increase is too small, said Truman, now a senior fellow at the Peterson Institute for International Economics in Washington.In a column last month, former U.S. Treasury Secretary Lawrence Summers cited Congress’s failure to pass the IMF reforms as one of the reasons why China is pushing to reshape the global economic order with new institutions such as the Asian Infrastructure Investment Bank..."

at http://www.zerohedge.com/news/2015-05-17/belligerent-us-refuses-cede-control-over-imf-snub-china

Subscribe to:

Posts (Atom)