"Are you ready for an economy that has high inflation and high unemployment at the same time? Well, welcome to "Stagflation 2011". Stagflation exists when inflation and unemployment are both at high levels at the same time. Of course we all know about the high unemployment situation already. Gallup's daily tracking poll says that the U.S. unemployment rate has been hovering around 10 percent all year so far. But now thanks to rapidly rising food prices and the exploding price of oil, rampant inflation is being added to the equation..."

at http://theeconomiccollapseblog.com/archives/stagflation-2011-why-it-is-here-and-why-it-is-going-to-be-very-painful

Links to global economy, financial markets and international politics analyses

Thursday, February 24, 2011

Tuesday, February 22, 2011

US housing double-dip, continued, again

"Ouch, nearly everywhere.

The Case-Shiller house price numbers are out for December — and as always, they show a three monthly average (in this case for October, November and December) with a two month lag.

From the release (emphasis ours):

New York, February 22, 2011 – Data through December 2010, released today by Standard & Poor’s for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, show that the U.S. National Home Price Index declined by 3.9% during the fourth quarter of 2010..."

at http://ftalphaville.ft.com/blog/2011/02/22/495126/us-housing-double-dip-continued-again/

The Case-Shiller house price numbers are out for December — and as always, they show a three monthly average (in this case for October, November and December) with a two month lag.

From the release (emphasis ours):

New York, February 22, 2011 – Data through December 2010, released today by Standard & Poor’s for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, show that the U.S. National Home Price Index declined by 3.9% during the fourth quarter of 2010..."

at http://ftalphaville.ft.com/blog/2011/02/22/495126/us-housing-double-dip-continued-again/

IEA: $100 OIL IS “VERY BAD” FOR GLOBAL ECONOMY, RISKS 2008 REPEAT

"Some analysts have estimated that the breaking point for oil is much higher than today’s prices, however, Nobuo Tanaka, executive director of the International Energy Agency says current prices are much closer to causing serious economic decline than most assume. In an interview with CNBC this morning Tanaka says supplies are plentiful, however, Libya will cause disruptions in the near-term. Tanaka says $100 oil is not sustainable and will contribute negatively to the economy and could actually cause a repeat of 2008:.."

at http://pragcap.com/iea-100-is-very-bad-for-global-economy-risks-2008-repeat

at http://pragcap.com/iea-100-is-very-bad-for-global-economy-risks-2008-repeat

CASE/SHILLER: THE HOUSING DOUBLE DIP CONTINUES

"This morning’s Case/Shiller housing data confirms what we have long feared - the housing double dip is here.

Data through December 2010, released today by Standard & Poor’s for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, show that the U.S. National Home Price Index declined by 3.9% during the fourth quarter of 2010. The National Index is down 4.1% versus the fourth quarter of 2009, which is the lowest annual growth rate since the third quarter of 2009, when prices were falling at an 8.6% annual rate. As of December 2010, 18 of the 20 MSAs covered by S&P/Case-Shiller Home Price Indices and both monthly composites were down compared to December 2009. Both Los Angeles and San Francisco reported negative annual rates of return in December, leaving San Diego and Washington DC as the only two cities where home prices are increasing on a year-over-year basis, +1.7% and +4.1%, respectively..."

at http://pragcap.com/caseshiller-the-housing-double-dip-continues

Data through December 2010, released today by Standard & Poor’s for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, show that the U.S. National Home Price Index declined by 3.9% during the fourth quarter of 2010. The National Index is down 4.1% versus the fourth quarter of 2009, which is the lowest annual growth rate since the third quarter of 2009, when prices were falling at an 8.6% annual rate. As of December 2010, 18 of the 20 MSAs covered by S&P/Case-Shiller Home Price Indices and both monthly composites were down compared to December 2009. Both Los Angeles and San Francisco reported negative annual rates of return in December, leaving San Diego and Washington DC as the only two cities where home prices are increasing on a year-over-year basis, +1.7% and +4.1%, respectively..."

at http://pragcap.com/caseshiller-the-housing-double-dip-continues

Gallup Economic Confidence Index Stuck at -26 Since February 2009

"After a quick jump from -60 in February 2009 to -26 in June 2009, the Gallup Weekly Confidence Index has been range-bound between -20 and -30 ever since. The confidence index now sits at -26, where it was two years ago..."

at http://globaleconomicanalysis.blogspot.com/2011/02/gallup-economic-confidence-index-stuck.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29

at http://globaleconomicanalysis.blogspot.com/2011/02/gallup-economic-confidence-index-stuck.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29

Weak 2 Year Auction Prices At 0.745%, Bid To Cover At Lowest Since May 2010, Primary Dealers Buy Most Since July 2009

"Today's $35 billion 2 Year bond auction priced at 0.745%, on top of the WI. Yet despite the seeming lack of weakness, the internals were not pretty, with the Bid To Cover coming at 3.03, the lowest since the 2.93 at the May 2010 2 Year auction. This alone would indicate a material weakness in the bidside. What is also troubling, is that just like in the 10 Year auction from earlier this month, the Direct Bidders declined notably, coming at just 6.81%, compared to an average of 15% in the last year, and the lowest since November 2009. And while Indirects came in roughly as expected, Primary Dealers took down 61.85% of the auction: the highest amount since July 2009. The dynamic of bond bidding are certain changing as there is a big rotation going on behind the scenes. Alas, there continues to be insufficient information to determine just where the bidding interest is disappearing from. That said, we expect the "UK holdings" in February when they are released some time in May, to be flat or even decline..."

at http://www.zerohedge.com/article/weak-2-year-auction-prices-0745-bid-cover-lowest-may-2010-primary-dealers-buy-most-july-2009?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

at http://www.zerohedge.com/article/weak-2-year-auction-prices-0745-bid-cover-lowest-may-2010-primary-dealers-buy-most-july-2009?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Monday, February 21, 2011

Programs! Programs! You Can't Tell Your Currency Wars Without a Program!

"The BBC's Paul Mason has a helpful list of all the currency wars worldwide currently under way.

China versus the USA: in which the US wants China to allow the RMB to rise against the dollar, weakening China's competitiveness by raising the price of Chinese exports.

There is the USA versus the Emerging Markets: in which the USA's quantitative easing policy is seen to be exporting inflation, again forcing the currencies of Brazil, South Korea and other export giants to rise against the dollar.

...There is the Euro versus the dollar. Analysts at Goldman Sachs estimated that the entire negative impact of European austerity programmes in 2010 could be offset by a fall in the Euro's exchange rate to parity with the dollar: to the extent that this does not happen, Europe bears the cost of its own crisis.

Then there is north Europe verus south Europe. The Eurozone is locked into one exchange rate but peripheral Europe has, over a nine year period lost competitiveness against the core industrialised and export-led countries above all Germany. Southern Europe cannot devalue, so it is being forced to impose an internal devaluation by the Eurozone authorities - which means massive austerity, wage cuts and the erosion of welfare state provision.

Then there is Japan versus America. When America did QE, so did Japan - in part justifying the move on the grounds that QE was an act of exchange rate competition.

Finally there is Britain versus the rest of the world. Sterling underwent a 25% devaluation during the Lehman crisis, stabilising at a net 20% fall against the currencies of its main trading partners. In this way Britain has offset the cost of the crisis, avoiding double-digit unemployment but amplifying the impact of the commodity price inflation that has now taken off..."

at http://paul.kedrosky.com/archives/2011/02/programs_progra.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+InfectiousGreed+%28Paul+Kedrosky%27s+Infectious+Greed%29

China versus the USA: in which the US wants China to allow the RMB to rise against the dollar, weakening China's competitiveness by raising the price of Chinese exports.

There is the USA versus the Emerging Markets: in which the USA's quantitative easing policy is seen to be exporting inflation, again forcing the currencies of Brazil, South Korea and other export giants to rise against the dollar.

...There is the Euro versus the dollar. Analysts at Goldman Sachs estimated that the entire negative impact of European austerity programmes in 2010 could be offset by a fall in the Euro's exchange rate to parity with the dollar: to the extent that this does not happen, Europe bears the cost of its own crisis.

Then there is north Europe verus south Europe. The Eurozone is locked into one exchange rate but peripheral Europe has, over a nine year period lost competitiveness against the core industrialised and export-led countries above all Germany. Southern Europe cannot devalue, so it is being forced to impose an internal devaluation by the Eurozone authorities - which means massive austerity, wage cuts and the erosion of welfare state provision.

Then there is Japan versus America. When America did QE, so did Japan - in part justifying the move on the grounds that QE was an act of exchange rate competition.

Finally there is Britain versus the rest of the world. Sterling underwent a 25% devaluation during the Lehman crisis, stabilising at a net 20% fall against the currencies of its main trading partners. In this way Britain has offset the cost of the crisis, avoiding double-digit unemployment but amplifying the impact of the commodity price inflation that has now taken off..."

at http://paul.kedrosky.com/archives/2011/02/programs_progra.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+InfectiousGreed+%28Paul+Kedrosky%27s+Infectious+Greed%29

Weber: Currency Union Damaged.

"The financial rescues of Greece and Ireland have damaged the foundations of Europe’s currency union, Deutsche Bundesbank President Axel Weber said Monday..."

at http://blogs.wsj.com/economics/2011/02/21/13413/?mod=WSJBlog&utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+wsj%2Feconomics%2Ffeed+%28WSJ.com%3A+Real+Time+Economics+Blog%29

at http://blogs.wsj.com/economics/2011/02/21/13413/?mod=WSJBlog&utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+wsj%2Feconomics%2Ffeed+%28WSJ.com%3A+Real+Time+Economics+Blog%29

Iceland Once Again Tells IMF, UK, Netherlands "Go to Hell"; "Ice Torture" Repayment Scheme Collapses

"Hats off to Iceland for a second time for telling the IMF, the UK, and Netherlands to "Go to Hell" over the most recent Icesave proposal, better thought of as Ice Torture..."

at http://globaleconomicanalysis.blogspot.com/2011/02/iceland-once-again-tells-imf-uk.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29

at http://globaleconomicanalysis.blogspot.com/2011/02/iceland-once-again-tells-imf-uk.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29

As BP Prepares To Evacuate Staff From A Burning Libya, Commodities Are Exploding

"Is this one of those "who could have possibly seen it coming" moments? As events in Libya overnight spiralled out of control, with dozens if not hundreds killed, the parliament buildng in Tripoli on fire, and output at one of the country's oil fields reported to have been stopped by a workers' strike, BP has said it will soon begin evacuating some of its personnel from the 9th largest producer of oil. And just to complete the total chaos, Iran warships are now going to pass the Suez on Tuesday instead of today, to the full glory of a fully open US stock market. The result: gold over $1,400; silver over $33.50; Crude front month over $93; Brent over $105; etc. Luckily, the US stock market is closed, meaning all this will be "priced in" by tomorrow, and the HFT levitation can resume tomorrow as if today never happened..."

at http://www.zerohedge.com/article/bp-prepares-evacuate-staff-burning-libya-commodities-are-exploding?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

at http://www.zerohedge.com/article/bp-prepares-evacuate-staff-burning-libya-commodities-are-exploding?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Saturday, February 19, 2011

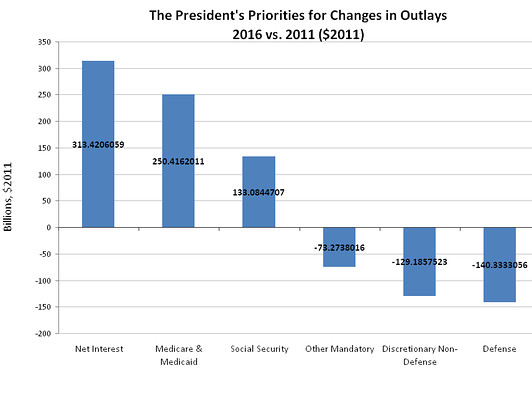

The Federal Fiscal Issue in One Chart.

"The bottom line: Spending on interest, Medicare and Medicaid and Social Security go up – a lot. Spending on nearly everything else goes down..."

at http://blogs.wsj.com/economics/2011/02/18/the-federal-fiscal-issue-in-one-chart/?mod=WSJBlog&utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+wsj%2Feconomics%2Ffeed+%28WSJ.com%3A+Real+Time+Economics+Blog%29

at http://blogs.wsj.com/economics/2011/02/18/the-federal-fiscal-issue-in-one-chart/?mod=WSJBlog&utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+wsj%2Feconomics%2Ffeed+%28WSJ.com%3A+Real+Time+Economics+Blog%29

Why World Needs Three Global Currencies

"Many nations have long regarded the dominant international role of the dollar as bestowing an "exorbitant privilege" on the United States. But the privilege has now become a burden. It is time for the United States to anticipate, and begin to build, an era in which there will be several global currencies to rival its own.

Seen from abroad, the dollar's role provides automatic financing for US external imbalances and enables it to live beyond its means. At home it is understandable that US politicians, with their short-run time horizons, welcome this opportunity to evade needed discipline. But such pressure from abroad can be constructive in promoting needed adjustment..."

at http://www.piie.com/publications/opeds/oped.cfm?ResearchID=1767&utm_source=feedburner&utm_medium=%24%7Bfeed%7D&utm_campaign=Feed%3A+%24%7Bupdate%7D+%28%24%7BPIIE+Update%7D%29

Seen from abroad, the dollar's role provides automatic financing for US external imbalances and enables it to live beyond its means. At home it is understandable that US politicians, with their short-run time horizons, welcome this opportunity to evade needed discipline. But such pressure from abroad can be constructive in promoting needed adjustment..."

at http://www.piie.com/publications/opeds/oped.cfm?ResearchID=1767&utm_source=feedburner&utm_medium=%24%7Bfeed%7D&utm_campaign=Feed%3A+%24%7Bupdate%7D+%28%24%7BPIIE+Update%7D%29

The Shadow Cast by US Debt

"Carmen Reinhart discusses how history teaches that large public and private debt impedes economic growth, a lesson that the United States must heed in the years ahead..."

at http://www.piie.com/publications/interviews/interview.cfm?ResearchID=1768&utm_source=feedburner&utm_medium=%24%7Bfeed%7D&utm_campaign=Feed%3A+%24%7Bupdate%7D+%28%24%7BPIIE+Update%7D%29

at http://www.piie.com/publications/interviews/interview.cfm?ResearchID=1768&utm_source=feedburner&utm_medium=%24%7Bfeed%7D&utm_campaign=Feed%3A+%24%7Bupdate%7D+%28%24%7BPIIE+Update%7D%29

European Sovereign Debt Crisis in Pictures; Nothing Solved Yet, Credit Stress Close to All Time Highs

"The ECB and EU want everyone to believe there will not be haircuts on sovereign government debt. The market refuses to believe that and so do I.

If there was no risk of default, then government bond yields would all be the same. Instead, please follow this progression of current yields on 10-year government debt..."

at http://globaleconomicanalysis.blogspot.com/2011/02/european-sovereign-debt-crisis-in.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29

If there was no risk of default, then government bond yields would all be the same. Instead, please follow this progression of current yields on 10-year government debt..."

at http://globaleconomicanalysis.blogspot.com/2011/02/european-sovereign-debt-crisis-in.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29

Japan's Debt Trap Has No Escape

"...As in the US, voters in Japan are fed up with taxes. However, Japanese revenues are not only running dry, but in reverse.

Proving that government stupidity has no upper bounds, Mike "In Tokyo" notes Japan Wasted $78 Billion on Global Warming Research in six years.

Given a 200% Debt-to-GDP ratio, the world's worst aging demographics, and with Social Security consuming 53% of government spending, Japan is in a debt trap with no possible escape.

Japan's debt crisis is rapidly coming to a head, and few are even watching..."

at http://globaleconomicanalysis.blogspot.com/2011/02/japans-social-security-panel-wants-to.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29

Proving that government stupidity has no upper bounds, Mike "In Tokyo" notes Japan Wasted $78 Billion on Global Warming Research in six years.

Given a 200% Debt-to-GDP ratio, the world's worst aging demographics, and with Social Security consuming 53% of government spending, Japan is in a debt trap with no possible escape.

Japan's debt crisis is rapidly coming to a head, and few are even watching..."

at http://globaleconomicanalysis.blogspot.com/2011/02/japans-social-security-panel-wants-to.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29

Portuguese Government Pleads for Help as Yields Soar to Record Level; Portugal Needs Bailout by April; Pressure Mounts for Haircuts

"Portuguese government debt yields hit fresh news highs today, prompting Portugal to beg for action from the ECB. Here are charts of 5- and 10-year yields..."

at http://globaleconomicanalysis.blogspot.com/2011/02/portuguese-government-pleads-for-help.html

at http://globaleconomicanalysis.blogspot.com/2011/02/portuguese-government-pleads-for-help.html

What Is Wrong With The U.S. Economy? Here Are 10 Economic Charts That Will Blow Your Mind

"The 10 economic charts that you are about to see are completely and totally shocking. If you know anyone that still does not believe that the United States is in the midst of a long-term economic decline, just show them these charts..."

6 Charts Which Prove That Central Banks All Over The Globe Are Recklessly Printing Money

"If the U.S. dollar is being devalued so rapidly, then why does it sometimes increase in value against other global currencies? Well, it is because everybody is recklessly printing money now. The 6 charts which you are about to see below prove this. The truth is that it is not just the U.S. Federal Reserve which has been printing money like there is no tomorrow. Out of control money printing has also been happening in the UK, in the EU, in Japan, in China and in India. There are times when one particular global currency will fall faster than the others, but the reality is that they are all being rapidly devalued. Unfortunately, this is a recipe for a global economic nightmare..."

at http://theeconomiccollapseblog.com/archives/6-charts-which-prove-that-central-banks-all-over-the-globe-are-recklessly-printing-money

at http://theeconomiccollapseblog.com/archives/6-charts-which-prove-that-central-banks-all-over-the-globe-are-recklessly-printing-money

Tuesday, February 15, 2011

Derivatives Industry Report Collapses

"The credibility of a major report commissioned by the “Derivative End Users Coalition” – run by big banks against implementing the Dodd-Frank reforms – just collapsed.

As Andrew Ross Sorkin reports in the New York Times, the report has no meaningful substance – it is destroyed by the critique of Joe Stiglitz – and the consulting company (Keybridge Research) behind the report sought misleading credibility through falsely claiming affiliations with substantive academics.

At the end of Sorkin’s article is a remarkable admission by Mr. Wescott, the president of Keybridge, conceding these facts.

“When I told Mr. Wescott of Keybridge about Mr. Stiglitz’s comments, he replied that ‘the client had asked us’ to put the report together. ‘It was a hypothetical study.’”

at http://baselinescenario.com/2011/02/15/derivatives-industry-report-collapses/

As Andrew Ross Sorkin reports in the New York Times, the report has no meaningful substance – it is destroyed by the critique of Joe Stiglitz – and the consulting company (Keybridge Research) behind the report sought misleading credibility through falsely claiming affiliations with substantive academics.

At the end of Sorkin’s article is a remarkable admission by Mr. Wescott, the president of Keybridge, conceding these facts.

“When I told Mr. Wescott of Keybridge about Mr. Stiglitz’s comments, he replied that ‘the client had asked us’ to put the report together. ‘It was a hypothetical study.’”

at http://baselinescenario.com/2011/02/15/derivatives-industry-report-collapses/

Marc Faber : inflation will dominate the short-term scene, gold and silver among the more desirable holdings in the event a major war breaks out

"The US public debt could be much higher if unfunded liabilities like Medicare are included," Investment guru Dr. Marc Faber said on 14 Feb 2011 in Bangkok as reported by The Bangkok Post newspaper "There are not many options. The US will need to keep printing money for the time being." Marc Faber explained that he sees gold and silver as wise investments in case of a war in the middle east or elsewhere :

"If there is a war, gold and silver would be desirable investments to hold," he said

"There will be times like the 1990s until 2008 when gold outperformed stocks and vice versa in 2009. But the key is flexibility. We don't know how the world will look in 10 years' time."

"Inflation will be an issue in Asia and the Western world. I think governments around the world will increase interest rates sufficiently to combat inflation." he added..."

at http://marcfaberchannel.blogspot.com/2011/02/marc-faber-inflation-will-dominate.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MarcFaberBlog+%28Marc+Faber+Blog%29

"If there is a war, gold and silver would be desirable investments to hold," he said

"There will be times like the 1990s until 2008 when gold outperformed stocks and vice versa in 2009. But the key is flexibility. We don't know how the world will look in 10 years' time."

"Inflation will be an issue in Asia and the Western world. I think governments around the world will increase interest rates sufficiently to combat inflation." he added..."

at http://marcfaberchannel.blogspot.com/2011/02/marc-faber-inflation-will-dominate.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MarcFaberBlog+%28Marc+Faber+Blog%29

Monday, February 14, 2011

China Takes Tentative Steps Towards Global Currency

"The move of the yuan as a global currency is a very important one in the long run, as it will have potentially dramatic effects on the U.S. dollar as the sole reserve currency but for now things are going along at a snail pace. In the interim, the Chinese currency is essentially pegged to the U.S. dollar (for better or worse). Until the % of growth in China from exports is reduced, and they are far more reliant on internal consumption I don't see this loose peg changing anytime soon. Longer term, with 3 ugly ducklings (euro, dollar, yen) dominating the world's FX markets, the cart will eventually be turned over when a country (or region) coming from a position of fiscal strength rather than weakness enters the fray. Via NYT:

Now that it has passed Japan to become the world’s second-largest economy after the United States, China is considering the next step as a world power: making its money a global currency. No one expects that to happen immediately. And even the Chinese government is wary of making some of the free-market moves that would enable the renminbi to take its place alongside the dollar, euro and Japanese yen as a fully convertible reserve currency.

Still, over the last year Beijing has begun to gradually loosen its tight currency controls. For the first time, for example, American companies like McDonald's and Caterpillar have been allowed to finance their China projects by selling renminbi-denominated bonds in Hong Kong.

Meanwhile, in Russia, Vietnam and Thailand, some cross-border trades with China can now be settled in renminbi, so that trading partners do not have to convert in and out of dollars. One pilot program lets Russian companies like Sportmaster, a retail chain based in Moscow, buy or sell goods using Chinese currency.

And in New York, the Chinese government has permitted an overseas branch of Bank of China to accept deposits in renminbi. That enables depositors outside China to bet on a currency that is widely expected to appreciate against the dollar over the next few years.

“This is all encouraging the internationalization of the renminbi,” Kelvin Lau, an economist at Standard Chartered Bank who is based in Hong Kong, said of Beijing’s recent moves. “They want to make the Chinese currency a popular currency.”

at http://www.marketoracle.co.uk/Article26280.html

Now that it has passed Japan to become the world’s second-largest economy after the United States, China is considering the next step as a world power: making its money a global currency. No one expects that to happen immediately. And even the Chinese government is wary of making some of the free-market moves that would enable the renminbi to take its place alongside the dollar, euro and Japanese yen as a fully convertible reserve currency.

Still, over the last year Beijing has begun to gradually loosen its tight currency controls. For the first time, for example, American companies like McDonald's and Caterpillar have been allowed to finance their China projects by selling renminbi-denominated bonds in Hong Kong.

Meanwhile, in Russia, Vietnam and Thailand, some cross-border trades with China can now be settled in renminbi, so that trading partners do not have to convert in and out of dollars. One pilot program lets Russian companies like Sportmaster, a retail chain based in Moscow, buy or sell goods using Chinese currency.

And in New York, the Chinese government has permitted an overseas branch of Bank of China to accept deposits in renminbi. That enables depositors outside China to bet on a currency that is widely expected to appreciate against the dollar over the next few years.

“This is all encouraging the internationalization of the renminbi,” Kelvin Lau, an economist at Standard Chartered Bank who is based in Hong Kong, said of Beijing’s recent moves. “They want to make the Chinese currency a popular currency.”

at http://www.marketoracle.co.uk/Article26280.html

Budget Still Out of Control

"You can argue that the dialogue around cutting the budget going forward is a good start, but increasing the deficit to $1.6 billion from an initial $1.4 billion is the wrong direction. Bloomberg details:

President Barack Obama will send Congress a $3.7 trillion budget that would reduce deficits by $1.1 trillion over a decade, setting up a battle with Republicans who have already deemed the plan insufficient to reduce federal debt.

The deficit for the current fiscal year is forecast to hit a record $1.6 trillion -- 10.9 percent of gross domestic product -- up from $1.4 trillion the administration estimated previously, according to documents released this morning by the administration..."

at http://econompicdata.blogspot.com/2011/02/budget-still-out-of-control.html

President Barack Obama will send Congress a $3.7 trillion budget that would reduce deficits by $1.1 trillion over a decade, setting up a battle with Republicans who have already deemed the plan insufficient to reduce federal debt.

The deficit for the current fiscal year is forecast to hit a record $1.6 trillion -- 10.9 percent of gross domestic product -- up from $1.4 trillion the administration estimated previously, according to documents released this morning by the administration..."

at http://econompicdata.blogspot.com/2011/02/budget-still-out-of-control.html

Japan's Lost Decade(s)

"BusinessWeek details the latest:

Japan’s gross domestic product fell less than estimated in the fourth quarter in a pullback that may prove temporary as overseas demand revives production after the nation fell behind China as the world’s second-largest economy.

The annualized 1.1 percent drop in GDP in the three months through December was driven by a slowing in exports and fading of government stimulus programs, Cabinet Office figures showed today in Tokyo. The median forecast of 26 economists surveyed by Bloomberg News was for a 2 percent drop..."

at http://econompicdata.blogspot.com/2011/02/japans-lost-decades.html

Japan’s gross domestic product fell less than estimated in the fourth quarter in a pullback that may prove temporary as overseas demand revives production after the nation fell behind China as the world’s second-largest economy.

The annualized 1.1 percent drop in GDP in the three months through December was driven by a slowing in exports and fading of government stimulus programs, Cabinet Office figures showed today in Tokyo. The median forecast of 26 economists surveyed by Bloomberg News was for a 2 percent drop..."

at http://econompicdata.blogspot.com/2011/02/japans-lost-decades.html

Shifting Fortunes: China vs. Japan

"The WSJ reports that China passed Japan as the second-largest economy after the United States. Japan’s full-year GDP was $5.47 trillion — about 7% smaller than the $5.88 trillion that China reported.

The financial markets reflect a constant state of competition where the winners and losers are sorted out. One of the benefits of relative strength is that typically the relative strength charts reveal these leadership changes long before they hit the headlines... "

at http://systematicrelativestrength.com/2011/02/14/shifting-fortunes-china-vs-japan/

The financial markets reflect a constant state of competition where the winners and losers are sorted out. One of the benefits of relative strength is that typically the relative strength charts reveal these leadership changes long before they hit the headlines... "

at http://systematicrelativestrength.com/2011/02/14/shifting-fortunes-china-vs-japan/

Sunday, February 13, 2011

The Future Public Debt Trajectory, Projections and Drastic Measures

"“From this exercise, we are able to come to a number of conclusions. First, in our baseline scenario, conventionally computed deficits will rise precipitously. Unless the stance of fiscal policy changes, or age-related spending is cut, by 2020 the primary deficit/GDP ratio will rise to 13% in Ireland; 8–10% in Japan, Spain, the United Kingdom and the United States; [Wow! Note that they are not assuming that these issues magically go away in the United States as the current administration does using assumptions about future laws that are not realistic.] and 3–7% in Austria, Germany, Greece, the Netherlands and Portugal. Only in Italy do these policy settings keep the primary deficits relatively well contained—a consequence of the fact that the country entered the crisis with a nearly balanced budget and did not implement any real stimulus over the past several years.

“But the main point of this exercise is the impact that this will have on debt. The results [in Figure 6.1] show that, in the baseline scenario, debt/GDP ratios rise rapidly in the next decade, exceeding 300% of GDP in Japan; 200% in the United Kingdom; and 150% in Belgium, France, Ireland, Greece, Italy and the United States. And, as is clear from the slope of the line, without a change in policy, the path is unstable.

“This is confirmed by the projected interest rate paths, again in our baseline scenario. [Figure 6.1] shows the fraction absorbed by interest payments in each of these countries. From around 5% today, these numbers rise to over 10% in all cases, and as high as 27% in the United Kingdom. Seeing that the status quo is untenable, countries are embarking on fiscal consolidation plans. In the United States, the aim is to bring the total federal budget deficit down from 11% to 4% of GDP by 2015. In the United Kingdom, the consolidation plan envisages reducing budget deficits by 1.3 percentage points of GDP each year from 2010 to 2013 (see e.g. OECD [2009a]).

“To examine the long-run implications of a gradual fiscal adjustment similar to the ones being proposed, we project the debt ratio assuming that the primary balance improves by 1 percentage point of GDP in each year for five years starting in 2012. The results are presented in [Figure 6.1]. Although such an adjustment path would slow the rate of debt accumulation compared with our baseline scenario, it would leave several major industrial economies with substantial debt ratios in the next decade..."

at http://www.marketoracle.co.uk/Article26263.html

“But the main point of this exercise is the impact that this will have on debt. The results [in Figure 6.1] show that, in the baseline scenario, debt/GDP ratios rise rapidly in the next decade, exceeding 300% of GDP in Japan; 200% in the United Kingdom; and 150% in Belgium, France, Ireland, Greece, Italy and the United States. And, as is clear from the slope of the line, without a change in policy, the path is unstable.

“This is confirmed by the projected interest rate paths, again in our baseline scenario. [Figure 6.1] shows the fraction absorbed by interest payments in each of these countries. From around 5% today, these numbers rise to over 10% in all cases, and as high as 27% in the United Kingdom. Seeing that the status quo is untenable, countries are embarking on fiscal consolidation plans. In the United States, the aim is to bring the total federal budget deficit down from 11% to 4% of GDP by 2015. In the United Kingdom, the consolidation plan envisages reducing budget deficits by 1.3 percentage points of GDP each year from 2010 to 2013 (see e.g. OECD [2009a]).

“To examine the long-run implications of a gradual fiscal adjustment similar to the ones being proposed, we project the debt ratio assuming that the primary balance improves by 1 percentage point of GDP in each year for five years starting in 2012. The results are presented in [Figure 6.1]. Although such an adjustment path would slow the rate of debt accumulation compared with our baseline scenario, it would leave several major industrial economies with substantial debt ratios in the next decade..."

at http://www.marketoracle.co.uk/Article26263.html

Gold is as Good as Cash and Wields More Power

"Gold is now functioning as collateral to compensate for potential losses in the portfolios of financial institutions.

One month ago, I proposed there may be an underlying economic basis for gold to reach $4,000 per ounce in the next decade. This scenario is looking more probable given these recent developments.

Currently, the price of gold has ranged between $1,300 to $1,400.

Natalie Dempster, director of government affairs at the World Gold Council (WGC), recently told The Wall Street Journal, "Gold is increasingly being used as collateral around the world. All these moves reflect a growing recognition of gold's role as a high-quality, liquid asset.

According to the World Gold Council (WGC), daily trading volume for gold is $100 billion. It is more liquid than most European government bond markets. This increased liquidity for gold has increased its demand as a form of collateral.

Moreover, the WGC has been in talks with the Basel Committee on Bank Supervision to include gold as tier-1 capital, along with government bonds and international currencies. These assets represent the safest capital reserves to function as collateral for more risky investments. The Basel Committee is charged with creating international regulations to ensure a more stable financial system around the world.

Exchanges around the globe, including New York, Chicago (Chicago Mercantile Exchange), and Europe have accepted gold as a form of collateral. Recently, JPMorgan was added to this list, and considering the possibility is LCH Clearnet, a consortium of the London Clearing House and the Paris-based Clearnet..."

at http://www.marketoracle.co.uk/Article26266.html

One month ago, I proposed there may be an underlying economic basis for gold to reach $4,000 per ounce in the next decade. This scenario is looking more probable given these recent developments.

Currently, the price of gold has ranged between $1,300 to $1,400.

Natalie Dempster, director of government affairs at the World Gold Council (WGC), recently told The Wall Street Journal, "Gold is increasingly being used as collateral around the world. All these moves reflect a growing recognition of gold's role as a high-quality, liquid asset.

According to the World Gold Council (WGC), daily trading volume for gold is $100 billion. It is more liquid than most European government bond markets. This increased liquidity for gold has increased its demand as a form of collateral.

Moreover, the WGC has been in talks with the Basel Committee on Bank Supervision to include gold as tier-1 capital, along with government bonds and international currencies. These assets represent the safest capital reserves to function as collateral for more risky investments. The Basel Committee is charged with creating international regulations to ensure a more stable financial system around the world.

Exchanges around the globe, including New York, Chicago (Chicago Mercantile Exchange), and Europe have accepted gold as a form of collateral. Recently, JPMorgan was added to this list, and considering the possibility is LCH Clearnet, a consortium of the London Clearing House and the Paris-based Clearnet..."

at http://www.marketoracle.co.uk/Article26266.html

Series: True Money Supply

"The True Money Supply (TMS) was formulated by Murray Rothbard and represents the amount of money in the economy that is available for immediate use in exchange. It has been referred to in the past as the Austrian Money Supply, the Rothbard Money Supply and the True Money Supply. The benefits of TMS over conventional measures calculated by the Federal Reserve are that it counts only immediately available money for exchange and does not double count. MMMF shares are excluded from TMS precisely because they represent equity shares in a portfolio of highly liquid, short-term investments which must be sold in exchange for money before such shares can be redeemed. For a detailed description and explanation of the TMS aggregate, see Salerno (1987) and Shostak (2000). The TMS consists of the following: Currency Component of M1, Total Checkable Deposits, Savings Deposits, U.S. Government Demand Deposits and Note Balances, Demand Deposits Due to Foreign Commercial Banks, and Demand Deposits Due to Foreign Official Institutions..."

at

at

What Part Of Bernanke's Secret FCIC Interview Constitutes A Disclosure Of National Secrets?

"Now that the FCIC has declassified all of its interviews with the people responsible, or profiting, for the housing crisis (among which are those of John Paulson, Hank Paulson, Lloyd Blankfein, Dick Fuld, Jonathan Egol (the man who helped Fab Tourre construct Abacus), Alan Greenspan and of course Agent Orange himself - Angelo Mozilo), there is one interview strangely withheld. That of the man largely at the heart of everything - Ben Bernanke. From Bloomberg: "The Financial Crisis Inquiry Commission, created by Congress to investigate and report on the causes of the market meltdown late last decade, won’t publicly release its full 2009 interview with Federal Reserve Chairman Ben S. Bernanke, a commission spokesman said. The interview is quoted in the congressionally authorized panel’s final report, which cites the November 17, 2009, “closed-door” session in 11 footnotes. The Fed chief discussed a range of topics including the central bank’s failures and why the government rescued Bear Stearns Cos. and let Lehman Brothers Holdings Inc. go bankrupt, the FCIC report shows." And yet, it appears to contain information so sensitive it would once again rain fire and brimstone on everyone, and like an audio medusa, lead to widespread petrifying contagion everywhere it was heard. Once again we discover that the Fed has learned nothing from the Pittman episode, nor from the Paul campaign to bring some transparency to its actions. We do learn, however, that the Fed continues to believe it is above the people, and that the information it is privy to will never be voluntarily released to those whom it supposedly serves courtesy its three mandates, all of which have the words "Russell" and "36,000" in them..."

at http://www.zerohedge.com/article/what-part-bernankes-secret-fcic-interview-constitutes-disclosure-national-secrets?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

at http://www.zerohedge.com/article/what-part-bernankes-secret-fcic-interview-constitutes-disclosure-national-secrets?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

The One Chart Von Bernankestein Will Never Admit To Seeing

"Charting Austrian Money Supply, the Fed's outright security holdings, and commodity prices. Any questions?

(no snow was abused as a strawman excuse for the Fed's mandate of "price stability" in the making of this chart)..."

at http://www.zerohedge.com/article/one-chart-von-bernankestein-will-never-see?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

(no snow was abused as a strawman excuse for the Fed's mandate of "price stability" in the making of this chart)..."

at http://www.zerohedge.com/article/one-chart-von-bernankestein-will-never-see?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Marc Faber : We will have more volatility in 2011 than in 2010

"Marc Faber : ....We will have more volatility in 2011 than in 2010. It is futile to say which asset class would do the best. Maybe, for the next two weeks, this asset class will do the best and maybe for the following two weeks, that asset class will do better. There will be a lot of group rotations...."

at http://marcfaberchannel.blogspot.com/2011/02/marc-faber-more-volatility-in-2011-than.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MarcFaberBlog+%28Marc+Faber+Blog%29

at http://marcfaberchannel.blogspot.com/2011/02/marc-faber-more-volatility-in-2011-than.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MarcFaberBlog+%28Marc+Faber+Blog%29

Saturday, February 12, 2011

What Dissension in the Fed's Ranks Means

"A remarkable thing happened this week. Truly remarkable. But just in case it got lost amid the Egyptian chaos … coverage of the subzero temperatures up north … or the after-analysis of the Super Bowl, I’m going to shout it from the rooftops for you:

A couple of Federal Reserve officials actually stood up and said “Enough is enough!”

Hard to believe, I know. But both Richmond Federal Reserve Bank President Jeffrey Lacker and Dallas Fed President Richard Fisher essentially said this week that the days of “QE Forever!” are over..."

at http://www.marketoracle.co.uk/Article26236.html

A couple of Federal Reserve officials actually stood up and said “Enough is enough!”

Hard to believe, I know. But both Richmond Federal Reserve Bank President Jeffrey Lacker and Dallas Fed President Richard Fisher essentially said this week that the days of “QE Forever!” are over..."

at http://www.marketoracle.co.uk/Article26236.html

Shocking New IMF Report: The U.S. Dollar Needs To Be Replaced As The World Reserve Currency And SDRs "Could Constitute An Embryo Of Global Currency"

"The IMF is trying to move the world away from the U.S. dollar and towards a global currency once again. In a new report entitled "Enhancing International Monetary Stability—A Role for the SDR", the IMF details the "problems" with having the U.S. dollar as the reserve currency of the globe and the IMF discusses the potential for a larger role for SDRs (Special Drawing Rights). But the IMF certainly does not view SDRs as the "final solution" to global currency problems. Rather, the IMF considers SDRs to be a transitional phase between what we have now and a new world currency. In this newly published report, the IMF makes this point very clearly: "In the even longer run, if there were political willingness to do so, these securities could constitute an embryo of global currency." Yes, you read that correctly. The SDR is supposed to be "an embryo" from which a global currency will one day develop. So what about the U.S. dollar and other national currencies? Well, they would just end up fading away..."

at http://theeconomiccollapseblog.com/archives/shocking-new-imf-report-the-u-s-dollar-needs-to-be-replaced-as-the-world-reserve-currency-and-that-sdrs-could-constitute-an-embryo-of-global-currency

at http://theeconomiccollapseblog.com/archives/shocking-new-imf-report-the-u-s-dollar-needs-to-be-replaced-as-the-world-reserve-currency-and-that-sdrs-could-constitute-an-embryo-of-global-currency

Marc Faber : Bernanke and he Bureau of Labor Statistics is continuously lying about the inflation

"Marc Faber : " I have very large subscription base and I ask my readers whoever thinks that the cost of living is going up by less than 5 percent per anum to please send me an email ...I did not one single email and I guarantee you also for your family and for every family in the US that The annual cost of living increases are more than 5% today and the Bureau of Labor Statistics is continuously lying about the inflation rate, including Mr. Bernanke. He’s a liar. Inflation is much higher than what they publish.I think that inflation is between 5% and 8% per annum in the US, and in Western Europe, a little bit lower, also 4-5% per annum.”..Marc Faber estimates that inflation in the US was currently Is Running Up To 8 per cent , and between 4 and 5 per cent in Europe..."

at http://marcfaberchannel.blogspot.com/2011/02/marc-faber-bernanke-and-he-bureau-of.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MarcFaberBlog+%28Marc+Faber+Blog%29

at http://marcfaberchannel.blogspot.com/2011/02/marc-faber-bernanke-and-he-bureau-of.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MarcFaberBlog+%28Marc+Faber+Blog%29

Thursday, February 10, 2011

Saudi oil reserves may be overstated by 40%

"Stuart Staniford calls attention to this story from the Guardian:

The U.S. fears that Saudi Arabia, the world's largest crude oil exporter, may not have enough reserves to prevent oil prices escalating, confidential cables from its embassy in Riyadh show.

The cables, released by WikiLeaks, urge Washington to take seriously a warning from a senior Saudi government oil executive that the kingdom's crude oil reserves may have been overstated by as much as 300bn barrels-- nearly 40%.

Stuart also notes that in his own independent forensic analysis conducted in May 2007 (to which we called the attention of Econbrowser readers at the time), he estimated that remaining reserves in Ghawar (by far the Saudis' biggest and most important oil field) were overstated by 40%."

at http://www.econbrowser.com/archives/2011/02/saudi_oil_reser.html

The U.S. fears that Saudi Arabia, the world's largest crude oil exporter, may not have enough reserves to prevent oil prices escalating, confidential cables from its embassy in Riyadh show.

The cables, released by WikiLeaks, urge Washington to take seriously a warning from a senior Saudi government oil executive that the kingdom's crude oil reserves may have been overstated by as much as 300bn barrels-- nearly 40%.

Stuart also notes that in his own independent forensic analysis conducted in May 2007 (to which we called the attention of Econbrowser readers at the time), he estimated that remaining reserves in Ghawar (by far the Saudis' biggest and most important oil field) were overstated by 40%."

at http://www.econbrowser.com/archives/2011/02/saudi_oil_reser.html

Moody’s on massive financial defaults

"You probably knew this already — but the chart’s still striking.

That’s the amount of bonds and loans which Moody’s-rated financial firms have defaulted on, during each of the last major crises. In the most recent one, 72 firms defaulted on $318bn worth of debt. 41 banks also defaulted on deposits (most of these were deposit freezes in the Ukraine). Unsurprisingly, 69 of the over 100 financial firms that defaulted in the 2008-2010 period were banks..."

at http://ftalphaville.ft.com/blog/2011/02/10/485346/moodys-on-massive-financial-defaults/

That’s the amount of bonds and loans which Moody’s-rated financial firms have defaulted on, during each of the last major crises. In the most recent one, 72 firms defaulted on $318bn worth of debt. 41 banks also defaulted on deposits (most of these were deposit freezes in the Ukraine). Unsurprisingly, 69 of the over 100 financial firms that defaulted in the 2008-2010 period were banks..."

at http://ftalphaville.ft.com/blog/2011/02/10/485346/moodys-on-massive-financial-defaults/

Rogoff and Rajan Discuss Risks of Currency War.

"The biggest risk facing the U.S. is that it succumb to a trade war with its trading partners, Harvard University economist Kenneth Rogoff said Thursday.

Speaking at a seminar sponsored by the Council on Foreign Relations, Rogoff said that despite all the talk of “currency wars,” the world has so far kept trade relatively free since the economic crisis of 2008-2009. (Read a related interview with Rogoff.)

But he warned that if high unemployment in the U.S. persists, policymakers in the Washington will find it hard to resist pressure for sanctions against China and other countries.

“There are a lot of angry voters out there,” Rogoff said. He was speaking along with Raghuram Rajan of the University of Chicago Booth School of Business in a session dedicated to the topic of “currency wars.”

Rajan said the term, which harks back to the 1930s but was revived by Brazilian Finance Minister Guido Mantega last year when he complained that the Federal Reserve’s monetary stimulus was forcing other currencies to appreciate, is a bit of misnomer. Countries aren’t really engaged in real conflicts yet and, while they complain about the Fed’s stimulative policies, their central banks’ failure to let their currencies rise is amplifying its effect and contributing to “higher and higher rates” of inflation across the emerging-market world..."

at http://blogs.wsj.com/economics/2011/02/10/rogoff-and-rajan-discuss-risks-of-currency-war/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+wsj%2Feconomics%2Ffeed+%28WSJ.com%3A+Real+Time+Economics+Blog%29

Speaking at a seminar sponsored by the Council on Foreign Relations, Rogoff said that despite all the talk of “currency wars,” the world has so far kept trade relatively free since the economic crisis of 2008-2009. (Read a related interview with Rogoff.)

But he warned that if high unemployment in the U.S. persists, policymakers in the Washington will find it hard to resist pressure for sanctions against China and other countries.

“There are a lot of angry voters out there,” Rogoff said. He was speaking along with Raghuram Rajan of the University of Chicago Booth School of Business in a session dedicated to the topic of “currency wars.”

Rajan said the term, which harks back to the 1930s but was revived by Brazilian Finance Minister Guido Mantega last year when he complained that the Federal Reserve’s monetary stimulus was forcing other currencies to appreciate, is a bit of misnomer. Countries aren’t really engaged in real conflicts yet and, while they complain about the Fed’s stimulative policies, their central banks’ failure to let their currencies rise is amplifying its effect and contributing to “higher and higher rates” of inflation across the emerging-market world..."

at http://blogs.wsj.com/economics/2011/02/10/rogoff-and-rajan-discuss-risks-of-currency-war/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+wsj%2Feconomics%2Ffeed+%28WSJ.com%3A+Real+Time+Economics+Blog%29

CHART OF THE DAY: Guess How Ugly The Unemployment Rate Would Be At 2000 Participation Levels

"The decrease in the participation rate in the U.S. economy has left our understanding of what the real unemployment rate is a little cloudy. The latest unemployment report showed huge revisions, but little reality, as to where we really stand.

Albert Edwards of Societe Generale has put together this chart to provide a little context. It shows what the U.S. unemployment number would look life if we were at the peak participation rate of 67%, which occurred around 2000.

At that participation rate, unemployment would be about 4 percentage points higher than the current headline figure of 9%. Edwards says that 4% is the equivalent of 6.7 million more unemployed people.

So if the participation rate increased 3% (from its current 64% to 67%), unemployment would actually be 13%. That gap is partially made up of long-term, structurally unemployed construction workers left behind after the housing bust, and is a significant number..."

at http://www.businessinsider.com/chart-of-the-day-american-unemployment-2011-2?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+clusterstock+%28ClusterStock%29#ixzz1DaNtmIoS

Albert Edwards of Societe Generale has put together this chart to provide a little context. It shows what the U.S. unemployment number would look life if we were at the peak participation rate of 67%, which occurred around 2000.

At that participation rate, unemployment would be about 4 percentage points higher than the current headline figure of 9%. Edwards says that 4% is the equivalent of 6.7 million more unemployed people.

So if the participation rate increased 3% (from its current 64% to 67%), unemployment would actually be 13%. That gap is partially made up of long-term, structurally unemployed construction workers left behind after the housing bust, and is a significant number..."

at http://www.businessinsider.com/chart-of-the-day-american-unemployment-2011-2?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+clusterstock+%28ClusterStock%29#ixzz1DaNtmIoS

Foreclosures, house prices, and the real economy

"But our estimates suggest that foreclosures lead to more abrupt declines in these outcomes than would be observed in the absence of foreclosures, and these declines are likely to be more painful in the midst of a severe recession. This is consistent with the amplification mechanisms emphasised in Kiyotaki and Moore (1997) and Krishnamurthy (2003). We believe that these results demonstrate a direct connection between a financial friction – forced sales induced by foreclosures – and a reduction in residential investment and durable consumption during and after the recession of 2007 to 2009.

Our estimates of the effect of foreclosures on residential investment and auto sales can partially explain both the magnitude and length of the recession of 2007 to 2009. For example, the sharp rise in foreclosures began relatively late in the recession and continues into 2010. If we combine this fact with the finding in Leamer (2007) that residential investment is among the most powerful components leading the US out of recession, it is possible to argue that foreclosures have likely contributed to the length of the recession and sluggishness of the recovery. Similar arguments apply to our findings on auto sales.

Leamer (2007) identifies durables as the part of consumer spending with the strongest negative affect on economic growth during recessions . Under the assumption that our results on auto sales extend to the entire durable goods share of the economy (23.6 % of GDP in 2008), foreclosures can explain the relatively sluggish growth in durables well into 2010. Given that the 2007 to 2009 recession and its aftermath have been closely related to depressed levels of durable consumption and residential investment, our results thus highlight an important role for foreclosures and house prices in understanding weakness in the economy..."

at http://www.voxeu.org/index.php?q=node/6091

Our estimates of the effect of foreclosures on residential investment and auto sales can partially explain both the magnitude and length of the recession of 2007 to 2009. For example, the sharp rise in foreclosures began relatively late in the recession and continues into 2010. If we combine this fact with the finding in Leamer (2007) that residential investment is among the most powerful components leading the US out of recession, it is possible to argue that foreclosures have likely contributed to the length of the recession and sluggishness of the recovery. Similar arguments apply to our findings on auto sales.

Leamer (2007) identifies durables as the part of consumer spending with the strongest negative affect on economic growth during recessions . Under the assumption that our results on auto sales extend to the entire durable goods share of the economy (23.6 % of GDP in 2008), foreclosures can explain the relatively sluggish growth in durables well into 2010. Given that the 2007 to 2009 recession and its aftermath have been closely related to depressed levels of durable consumption and residential investment, our results thus highlight an important role for foreclosures and house prices in understanding weakness in the economy..."

at http://www.voxeu.org/index.php?q=node/6091

What Did Bank CEOs Know And When Did They Know It?

"One view of executives at our largest banks in the run-up to the crisis of 2008 is that they were hapless fools. Not aware of how financial innovation had created toxic products and made the system fundamentally unstable, they blithely piled on more debt and inadvertently took on greater risks.

The alternative view is that these people were more knaves than fools. They understood to a large degree what they and their firms were doing, and they kept at it up to the last minute – and in some cases beyond – because of the incentives they faced.

New evidence in favor of the second interpretation has just become available, thanks to the efforts of Sanjai Bhagat and Brian Bolton. These researchers went carefully through the compensation structure of executives at the top 14 US financial institutions during 2000-2008.

The key finding is that CEOs were “30 times more likely to be involved in a sell trade compared to an open market buy trade” of their own bank’s stock and “The dollar value of sales of stock by bank CEOs of their own bank’s stock is about 100 times the dollar value of open market buys” (p.4).

If the CEOs had really believed in what their banks were doing, they would have wanted to hold this stock – or even buy more. Disproportionately more sales than purchases strongly suggests that the CEOs felt their stock was more likely overvalued than undervalued.

The problem runs deeper, as Professors Bhagat and Bolton explain. Given the compensation structure of CEOs – particularly the fact that they can sell stock with very little restriction – they have an incentive to take on excessive levels of risk. When the outcomes are good, as they may be for a while in an up market, the CEO can turn his or her stock into cash. When the outcomes are bad, the CEO doesn’t care so much because he (or she) already has cash – and some form of government bailout or other support may be forthcoming.

Bhagat and Bolton argue that if this incentive problem is important, we should see CEOs make a great deal of money while long-term buy-and-hold shareholders lose money..."

at http://baselinescenario.com/2011/02/10/what-did-bank-ceos-know-and-when-did-they-know-it/

The alternative view is that these people were more knaves than fools. They understood to a large degree what they and their firms were doing, and they kept at it up to the last minute – and in some cases beyond – because of the incentives they faced.

New evidence in favor of the second interpretation has just become available, thanks to the efforts of Sanjai Bhagat and Brian Bolton. These researchers went carefully through the compensation structure of executives at the top 14 US financial institutions during 2000-2008.

The key finding is that CEOs were “30 times more likely to be involved in a sell trade compared to an open market buy trade” of their own bank’s stock and “The dollar value of sales of stock by bank CEOs of their own bank’s stock is about 100 times the dollar value of open market buys” (p.4).

If the CEOs had really believed in what their banks were doing, they would have wanted to hold this stock – or even buy more. Disproportionately more sales than purchases strongly suggests that the CEOs felt their stock was more likely overvalued than undervalued.

The problem runs deeper, as Professors Bhagat and Bolton explain. Given the compensation structure of CEOs – particularly the fact that they can sell stock with very little restriction – they have an incentive to take on excessive levels of risk. When the outcomes are good, as they may be for a while in an up market, the CEO can turn his or her stock into cash. When the outcomes are bad, the CEO doesn’t care so much because he (or she) already has cash – and some form of government bailout or other support may be forthcoming.

Bhagat and Bolton argue that if this incentive problem is important, we should see CEOs make a great deal of money while long-term buy-and-hold shareholders lose money..."

at http://baselinescenario.com/2011/02/10/what-did-bank-ceos-know-and-when-did-they-know-it/

Wednesday, February 9, 2011

Why Another Financial Crash is Certain

"On August 9, 2007, an incident took place at a bank in France that touched-off a financial crisis that that would eventually wipe out more than $30 trillion in capital and thrust the world into the deepest slump since the Great Depression. The event was recounted in a speech by Pimco's managing director Paul McCulley, at the 19th Annual Hyman Minsky Conference on the State of the U.S. and World Economies. Here's an excerpt from McCulley's speech:

"If you have to pick a day for the Minsky Moment, it was August 9. And, actually, it didn’t happen here in the United States. It happened in France, when Paribas Bank (BNP) said that it could not value the toxic mortgage assets in three of its off-balance sheet vehicles, and that, therefore, the liability holders, who thought they could get out at any time, were frozen. I remember the day like my son’s birthday. And that happens every year. Because the unraveling started on that day. In fact, it was later that month that I actually coined the term “Shadow Banking System” at the Fed’s annual symposium in Jackson Hole.

“It was only my second year there. And I was in awe, and mainly listened for most of the three days. At the end....I stood up and (paraphrasing) said, ‘What’s going on is really simple. We’re having a run on the Shadow Banking System and the only question is how intensely it will self-feed as its assets and liabilities are put back onto the balance sheet of the conventional banking system.’”...

...So, between $4 to $7 trillion vanished in a flash after Lehman Brothers blew up. How many millions of jobs were lost because of inadequate regulation? How much was trimmed from output, productivity, and GDP? How many people are on now food stamps or living in homeless shelters or struggling through foreclosure because unregulated financial institutions were allowed to carry out credit intermediation without government supervision or oversight?

Ironically, the New York Fed doesn't even try to deny the source of the problem; deregulation. Here's what they say in the report: "Regulatory arbitrage was the root motivation for many shadow banks to exist."

What does that mean? It means that Wall Street knows that it's easier to make money by eliminating the rules....the very rules that protect the public from the predation of avaricious speculators.

The only way to fix the system is to regulate all financial institutions that act like banks. No exceptions..."

at http://www.marketoracle.co.uk/Article26172.html

"If you have to pick a day for the Minsky Moment, it was August 9. And, actually, it didn’t happen here in the United States. It happened in France, when Paribas Bank (BNP) said that it could not value the toxic mortgage assets in three of its off-balance sheet vehicles, and that, therefore, the liability holders, who thought they could get out at any time, were frozen. I remember the day like my son’s birthday. And that happens every year. Because the unraveling started on that day. In fact, it was later that month that I actually coined the term “Shadow Banking System” at the Fed’s annual symposium in Jackson Hole.

“It was only my second year there. And I was in awe, and mainly listened for most of the three days. At the end....I stood up and (paraphrasing) said, ‘What’s going on is really simple. We’re having a run on the Shadow Banking System and the only question is how intensely it will self-feed as its assets and liabilities are put back onto the balance sheet of the conventional banking system.’”...

...So, between $4 to $7 trillion vanished in a flash after Lehman Brothers blew up. How many millions of jobs were lost because of inadequate regulation? How much was trimmed from output, productivity, and GDP? How many people are on now food stamps or living in homeless shelters or struggling through foreclosure because unregulated financial institutions were allowed to carry out credit intermediation without government supervision or oversight?

Ironically, the New York Fed doesn't even try to deny the source of the problem; deregulation. Here's what they say in the report: "Regulatory arbitrage was the root motivation for many shadow banks to exist."

What does that mean? It means that Wall Street knows that it's easier to make money by eliminating the rules....the very rules that protect the public from the predation of avaricious speculators.

The only way to fix the system is to regulate all financial institutions that act like banks. No exceptions..."

at http://www.marketoracle.co.uk/Article26172.html

Steve Forbes: If printing money was the way to wealth then we should legalize counterfeiting

"Steve Forbes : If printing money was the way to wealth then we should legalize counterfeiting , but the government does not like competition that's way Peter Schiff added . On the Peter Schiff Show, Steve Forbes declared: "If printing money was the way to wealth, then we should legalize counterfeiting"

at http://marcfaberchannel.blogspot.com/2011/02/steve-forbes-if-printing-money-was-way.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MarcFaberBlog+%28Marc+Faber+Blog%29

at http://marcfaberchannel.blogspot.com/2011/02/steve-forbes-if-printing-money-was-way.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MarcFaberBlog+%28Marc+Faber+Blog%29

Tuesday, February 8, 2011

Gold Game Changer: J.P. Morgan Accepts Bullion as Money

"J.P. Morgan Chase & Co. announced on February 7, 2011 that it will accept physical gold as collateral for investors that want to make short-term borrowings of cash or securities.

Presenting gold to satisfy demands for performance bond collateral has been allowed on the London CME in a limited way since October 2009. As of November 22, 2010, the Intercontinental Exchange Inc. (ICE) has accepted gold bullion as collateral on all credit default swaps and energy transactions.

I don't recall the G-20 declaring gold a new currency. Yet JPMorgan Chase and a couple of financial market exchanges have effectively declared that gold is an alternative currency.

In other words, gold is money..."

at http://www.marketoracle.co.uk/Article26148.html

Presenting gold to satisfy demands for performance bond collateral has been allowed on the London CME in a limited way since October 2009. As of November 22, 2010, the Intercontinental Exchange Inc. (ICE) has accepted gold bullion as collateral on all credit default swaps and energy transactions.

I don't recall the G-20 declaring gold a new currency. Yet JPMorgan Chase and a couple of financial market exchanges have effectively declared that gold is an alternative currency.

In other words, gold is money..."

at http://www.marketoracle.co.uk/Article26148.html

Outstanding Contraction!: Commercial Paper Outstanding January 2011

"...Although the Federal Reserve was able to artificially bring CP rates down significantly since the shocking 615 basis point spread blowout (A2/P2 spread) of late 2008, they have apparently not been successful in preventing an overall contraction in the CP market.

The Federal Reserve calculates and published the total amount of CP outstanding every week and by mid-January commercial paper outstanding had fallen to a new series low (data tracked back as far as 2001) though in recent weeks the trend has moderated a bit dropping 11.27% on a year-over-year basis to $996.20 billion, a level that is still notably lower than even the worst periods of the last two recessions..."

at http://paper-money.blogspot.com/2011/02/outstanding-contraction-commercial.html

The Federal Reserve calculates and published the total amount of CP outstanding every week and by mid-January commercial paper outstanding had fallen to a new series low (data tracked back as far as 2001) though in recent weeks the trend has moderated a bit dropping 11.27% on a year-over-year basis to $996.20 billion, a level that is still notably lower than even the worst periods of the last two recessions..."

at http://paper-money.blogspot.com/2011/02/outstanding-contraction-commercial.html

$32 Billion 3 Year Auction Prices At 1.349% As Foreign Bid Plunges And Fed Indirectly Pockets 62% Of Issue

"Today's 3 Year bond auction priced without much fanfare, and luckily so: while it came at 1.349%, slightly weaker than expected (1.345%), compared to last auction's 1.027%, ot a 30% jump in interest in one month, it is the internals that were most disturbing. The Bid To Cover was strong enough at 3.01, compared to 3.06 previously, and 3.14 LTM average, yet what was remarkable was the takedown. And as we have been warning for a while now, it was the Indirect Bids (the Chinas of the world) that basically decided to take a raincheck on the auction. The Indirect takedown was just 27.6% of total, with $8.8 billion of the $32 billion going to Indirects (nonetheless the hit rate was 57%). This is the lowest Indirect takedown since May of 2007! And while the direct bid was a subpar 10.1%, it was the Primary Dealers that saved the day: at 62.3%, or $20 billion of the entire auction, the Fed essentially monetized two thirds of the entire auction de novo. And remember this Cusip: QH6: we can guarantee that within a month, the Fed will buy back at least 50%, or $10 billion, of the Primary Dealer take down portion..."

at http://www.zerohedge.com/article/32-billion-3-year-auction-prices-1349-foreign-bid-plunges-and-fed-indirectly-pockets-62-issu?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

at http://www.zerohedge.com/article/32-billion-3-year-auction-prices-1349-foreign-bid-plunges-and-fed-indirectly-pockets-62-issu?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Monday, February 7, 2011

Bond Market, The Most Dangerous Bubble of All

"If you agree that the tech bubble of the 1990s and the housing bubble of the 2000s were extreme, then you must not ignore a bubble that could be the most dangerous of all — grossly overvalued bonds.

That’s precisely the bubble we have right now! And in just a moment, I’ll tell you why it’s going to bust. But first, consider …

...What Will Trigger a Bond Market Bust?

Take your pick (one or more) …

Trigger #1. Inflation and Inflation Fears. Inflation has been so low for so long, that the complacency on Wall Street and Washington is bordering on the pathological.

Trigger #2. Deficit Inaction. When the Congressional Budget Office recently announced that THIS year’s deficit would hit nearly $1.5 trillion, bond prices fell and interest rates rose.

Trigger #3. Dollar Collapse.Three out of every five dollars financing the U.S. federal deficit now come from foreign investors. Only two out of five come from domestic investors (other than the U.S. government itself)..."

at http://www.marketoracle.co.uk/Article26136.html

That’s precisely the bubble we have right now! And in just a moment, I’ll tell you why it’s going to bust. But first, consider …

...What Will Trigger a Bond Market Bust?

Take your pick (one or more) …

Trigger #1. Inflation and Inflation Fears. Inflation has been so low for so long, that the complacency on Wall Street and Washington is bordering on the pathological.

Trigger #2. Deficit Inaction. When the Congressional Budget Office recently announced that THIS year’s deficit would hit nearly $1.5 trillion, bond prices fell and interest rates rose.

Trigger #3. Dollar Collapse.Three out of every five dollars financing the U.S. federal deficit now come from foreign investors. Only two out of five come from domestic investors (other than the U.S. government itself)..."

at http://www.marketoracle.co.uk/Article26136.html

Negative Annualized Stock Market Returns for the Next 10 Years or Longer? It's Far More Likely Than You Think

"Market cheerleaders keep ratcheting up expected earnings, failing to note that much of the recent earnings growth is simply not sustainable.

Reasons for Unsustainable Earnings Growth

•Much of the recent earnings growth is directly related to federal stimulus that will eventually end.

•Much of the earnings in the financial sector are a mirage, based on assets not marked-to-market and insufficient loan loss reserves. The Fed and the FASB have repeatedly postponed rules changes for the benefit of banks and other financial institutions.

•Earnings in both the financial and nonfinancial sectors have margins outside historical norms, based on very low headcounts and outsourcing..."

at http://globaleconomicanalysis.blogspot.com/2011/02/negative-annualized-stock-market.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29

Reasons for Unsustainable Earnings Growth

•Much of the recent earnings growth is directly related to federal stimulus that will eventually end.

•Much of the earnings in the financial sector are a mirage, based on assets not marked-to-market and insufficient loan loss reserves. The Fed and the FASB have repeatedly postponed rules changes for the benefit of banks and other financial institutions.

•Earnings in both the financial and nonfinancial sectors have margins outside historical norms, based on very low headcounts and outsourcing..."

at http://globaleconomicanalysis.blogspot.com/2011/02/negative-annualized-stock-market.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29

Fed Succeeds in Fostering Massive Speculation in Junk Bonds and Equities

"Another day, another market high. The longer this goes on, the bigger the next crash. In the meantime the Fed is openly bragging about its efforts even though Bernanke Warns of "Rapid and Painful Response to a Looming Fiscal Crisis"..."

at http://globaleconomicanalysis.blogspot.com/2011/02/fed-succeeds-in-fostering-massive.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29