"It’s not just the U.S. economy that is throttling growth back to stall speed,

but the global economy as a whole. One of the most powerful big picture concepts

that has taken place over the last decade is globalization, the

interconnectedness of the world economy, and right now it's skating on thin ice.

While the U.S. may have been the fire starter with its subprime crisis back in

2007-2008, this time it may be the Euro crisis that pulls the global economy

underwater. The heart of the matter in the eurozone and other developed

economies is too much debt relative to their productive output—a situation set

to intensify as a slowdown in growth (shrinking economies) exacerbates the debt

to gross domestic product (GDP) ratios as it becomes more difficult to service

debt with shrinking revenue.

You Go, I Go, We all Go

You Go, I Go, We all Go

As mentioned in the opening paragraph, investors and economists cannot look

at the U.S. in isolation as globalization has become a dominate theme over the

last decade. Over the last two years, corporations have had record earnings with

a large portion of revenue coming from overseas, also partly explaining why U.S.

markets have performed so well despite this being one of the worst recoveries

since the Great Depression. Large-cap blue chip names are benefitting from

globalization as they are increasing exposure towards faster growing foreign

markets

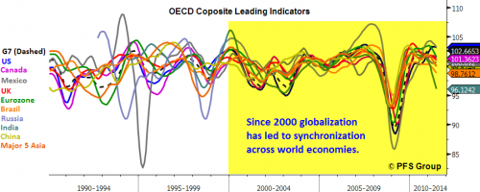

That said, globalization is also a double-edged sword. As you can see from

the figure below, starting from the early 2000s many global economies started to

synchronize, minimizing the previous benefits of diversifying their corporate

revenue bases geographically to shield from regional downturns. Now, the leading

economic indicators calculated by the OECD for various regions and countries

show we currently have an economic slowdown where everyone is getting dragged

over a cliff.

As highlighted in my last article, a number of major upcoming economic releases were

likely to disappoint, and a U.S. jobs report for August that showed zero job

growth is testament to that. However, we did not just have a disappointing

economic showing last week domestically, but also worldwide..."