"Randy Wray’s latest piece at the Levy Institute is a must read:

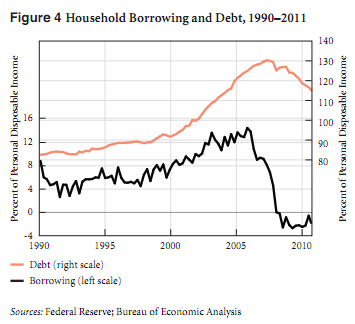

“The conditions that held in 2007 have been replicated, and the next GFC is just waiting for a trigger. The bailout has increased the linkages among the top four or five banks, making the system even more fragile.We’ve lost eight million jobs, opening a demand gap of about $1 trillion.Although some households have defaulted on their debts, and others have repaid portions of theirs, most of the household debt held in 2007 still exists (Figure 4).”

“Against this background, there are multiple events that could trigger a new, potentially deeper crisis. Should information leak out that one of the major US banks is insolvent (a proposition believed by many analysts), another massive liquidity crisis would be likely. Alternatively, the problems could start in Europe and ripple into the United States: for example, there is a plausible path that can be traced from US money market mutual fund holdings of eurobank assets (i.e., $3 trillion of extremely short-term liabilities that are like deposits but not insured) to a new global financial shock. Last time, the US government extended its guarantee to all of them; Dodd-Frank now outlaws such intervention. So the appearance of a problem among eurobanks could bring down that whole market—which is about twice the size of the US subprime mortgage market that brought on the global financial crisis last time.

Far-reaching reform along the Minskyan lines traced above will likely be conceivable only in the aftermath of the next crisis. Unfortunately, that opportunity may be right around the corner.”at http://pragcap.com/waiting-for-the-next-crash-minskyan-lessons-we-failed-to-learn