"The economic travails of much of the West are reaching a decisive stage as the year ends. In 2008, we predicted sluggish recovery and a long period of low growth for the West in a two-speed world. This picture does not now properly reflect the downside risks. The policy of "kicking the can down the road" is failing, as the intensifying crisis in the euro zone and the failure of the G20 summit in late October clearly demonstrate. As to December's European summit, we describe its impact later in this paper.

Such extreme uncertainty is challenging for companies trying to prepare their budgets for next yearóor, more fundamentally, trying to plot their strategic course. It helps to have a clear understanding of what may happen and why it may happen. So before we address the question of which scenarios to expect and how to prepare, let us remind ourselves about the root of the problem: the West is drowning in debt.

at http://www.marketoracle.co.uk/Article32397.html

Such extreme uncertainty is challenging for companies trying to prepare their budgets for next yearóor, more fundamentally, trying to plot their strategic course. It helps to have a clear understanding of what may happen and why it may happen. So before we address the question of which scenarios to expect and how to prepare, let us remind ourselves about the root of the problem: the West is drowning in debt.

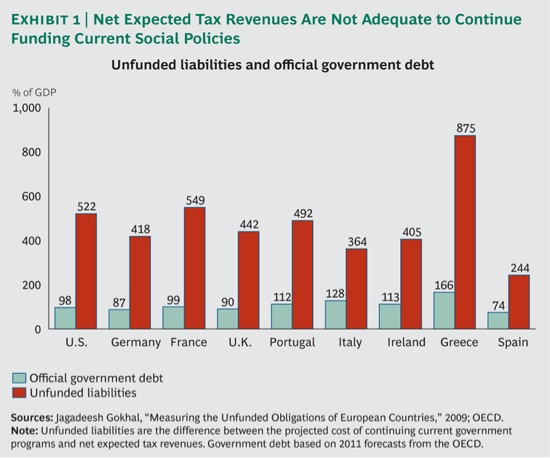

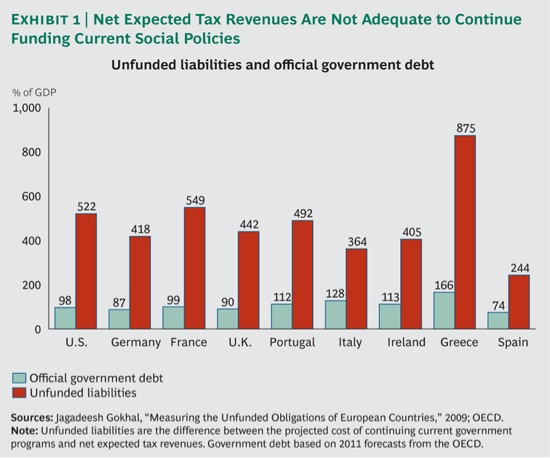

A World with Too Much Debt

Total debt-to-GDP levels in the 18 core countries of the Organisation for Economic Co-operation and Development (OECD) rose from 160 percent in 1980 to 321 percent in 2010. Disaggregated and adjusted for inflation, these numbers mean that the debt of nonfinancial corporations increased by 300 percent, the debt of governments increased by 425 percent, and the debt of private households increased by 600 percent. But the costs of the West's aging populations are hidden in the official reporting. If we included the mounting costs of providing for the elderly, the debt level of most governments would be significantly higher. (See Exhibit 1.)..."

at http://www.marketoracle.co.uk/Article32397.html