"The ECB's LTRO was a stunning success. Or was it? Certainly rates dropped in

Italy and Spain. However, all that really happened is the ECB became the buyer

of first resort in which banks front-ran the trade, buying sovereign bonds for

sure profit, plowing back into the same problem that created the European

mess.

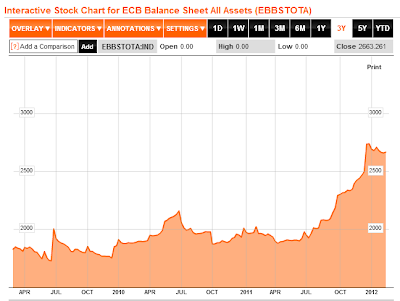

The ECB's balance sheet skyrocketed in the process, and banks that plowed into those 3-Year LTROs (long term refinance operations) at cheap rates will face a huge rollover problem when the program ends, if not substantially before then.

Should something go wrong (and it will), then the ECB (or rather EMU member countries, especially Germany) will be on the hook for losses.

Consider the enormous mess over the past few weeks caused by a measly 40 billion euro holding of Greek debt by the ECB. Now take a look at the ECB's Balance Sheet expansion recently.

ECB Balance Sheet

Since July 8 2011, the ECB's balance sheet has expanded from 1.92 trillion Euros to 2.66 trillion Euros, a rise of 740 billion euros. €489 billion of that that was taken by 523 banks in the ECB's long-term-refinance-operation LTRO..."

at http://globaleconomicanalysis.blogspot.com/2012/02/liquidity-floodgate-set-to-backfire.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29

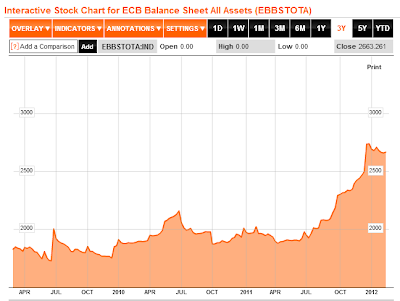

The ECB's balance sheet skyrocketed in the process, and banks that plowed into those 3-Year LTROs (long term refinance operations) at cheap rates will face a huge rollover problem when the program ends, if not substantially before then.

Should something go wrong (and it will), then the ECB (or rather EMU member countries, especially Germany) will be on the hook for losses.

Consider the enormous mess over the past few weeks caused by a measly 40 billion euro holding of Greek debt by the ECB. Now take a look at the ECB's Balance Sheet expansion recently.

ECB Balance Sheet

Since July 8 2011, the ECB's balance sheet has expanded from 1.92 trillion Euros to 2.66 trillion Euros, a rise of 740 billion euros. €489 billion of that that was taken by 523 banks in the ECB's long-term-refinance-operation LTRO..."

at http://globaleconomicanalysis.blogspot.com/2012/02/liquidity-floodgate-set-to-backfire.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29