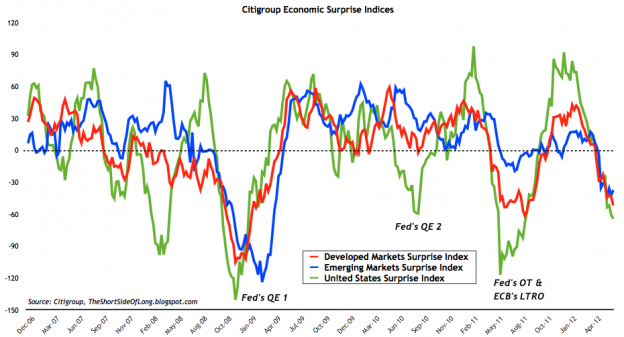

The latest readings here show a large reversal from the highs. Analysts are finally starting to follow the data lower so there’s a sort of self equilibrating factor at work in this index. But the following comments bring up an equally interesting point as this index moves lower. Over the last few years the deep moves lower have tended to coincide with policy actions. If there’s one thing we know from recent years it’s that the market is like a crying baby who needs that pacifier in its mouth every time anything starts to go remotely wrong. And central banks have always been there to give it to them. The market obviously let out a wailing scream last week after Ben Bernanke failed to follow-thru with the big QE3 pacifier. But if this index is any indication of what’s to come we are likely on the verge of increasingly aggressive policy talk and action (Via Short Side of Long & Abnormal Returns):

“Economic data has been weakening meaningfully relative to economist’s expectations in every major global region, according to theCitigroup Economic Surprise Indices. Previous instances where economic data disappointed on similar scale, have led to central bank intervention and it is definitely possible we might see that occur again prior to both the US and German elections. Having said that, previous “money printing programs” have only helped the private sector business activity modestly at best, while we have not been able to reached escaped velocity within the current business expansion. In other words, the expansion has failed to become self sustaining. Therefore, ever summer economy weakens, global investors start asking if we are edging closer to another recession?”

at http://pragcap.com/citis-economic-surprise-index-takes-a-dive

No comments:

Post a Comment