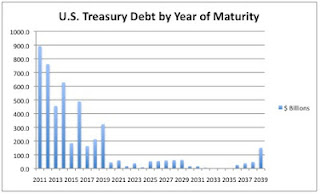

A look at the debt maturity graph below (chart 1) tells us that most of the U.S. debt is short term debt payable within 5 years. The scary part is that it is such a huge amount (approx. 2.5 trillion U.S. dollars)….Even more scary is that the U.S. treasury is not transparent about its debt maturity report. Chart 1 was published in February 2010 and hasn’t been updated since then. Also, Ben Bernanke is allegedly trying to make us believe that most of the debt is long term, which it is not (source: Ben Bernanke at Fed meeting on 7 June 2012).

Chart 1: U.S. Treasury Debt by Year of Maturity

Fed Holdings of U.S. Treasurys by Years of MaturityAt end of June 2011, foreign holdings of short term debt (less than 1 year) was 881 billion dollars amounting to 87% of the total (the Fed holding the balance)….This is the most crucial and important debt…[because] interest rates…rise….when a country is in a default…[that is,] short-term debt securities have higher yields than long-term debt securities….[Because of that fact] Marc Faber…[is of the opinion] that one day foreigners invested in U.S. debt will not be paid back. They are holding all the short term debt, while the Fed is holding the long term debt.

Chart 2: Fed Holdings of U.S. Treasuries (billion US dollar)

Average Maturity Date of Treasury Debtat http://www.munknee.com/2012/06/foreigners-beware-u-s-treasury-maturity-dates-are-alarming/

No comments:

Post a Comment