But despite some pious noises about the burden that student loans place on young Americans, there’s been no willingness in the officialdom to do much about it. But that may finally be changing. The latest Federal Reserve data is grim.

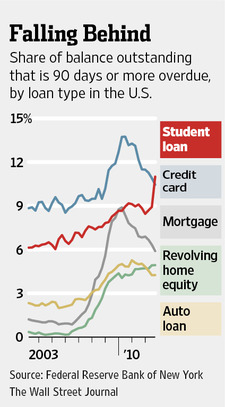

Student loan delinquencies are getting into nosebleed territory. The Wall Street Journal, citing New York Fed data, tells us that student debt outstanding increased 4.6% in the last quarter. Repeat: in the last quarter. Annualized, that’s a 19.7% rate of increase* during a period when other consumer borrowings were on the decline. And this growth is taking place while borrower distress is becoming acute. 11% of the loans were 90+ days delinquent, up from 8.9% at the close of last quarter. The underlying credit picture is certain to be worse, since many borrowers aren’t even required to service loans (as in they are still in school or have gotten a postponement, which is available to the unemployed for a short period). And it was the only type of consumer debt to show rising delinquency rates.

This is the new subprime: escalating borrowing taking place as loan quality is lousy and getting worse. And in keeping with parallel to subprime, one of the big reasons is, to use a cliche from that product, anyone who can fog a mirror can get a loan..."

at http://www.nakedcapitalism.com/2012/11/escalating-delinquency-rates-make-student-loans-look-like-the-new-subprime.html#7wkEfl2lAKM5qM5E.99

No comments:

Post a Comment