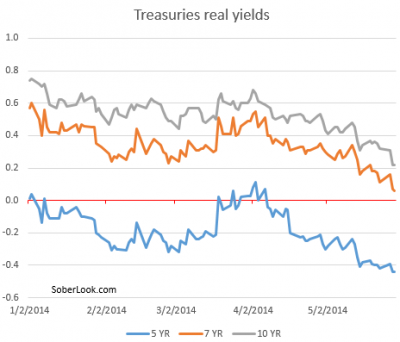

This is telling us that the monetary policy in the US has become even more accommodative – in spite of the Fed’s taper.

At least in theory, low or negative real yields make gold more attractive. And as US inflation picks up (see chart), real yields could move even lower. Moreover, if the ECB embarks on a new round of aggressive easing (see post), the euro area monetary stance will become highly accommodative as well.

The recent weakness in gold price is inconsistent with these looser monetary conditions in the US and potentially in the Eurozone. If you have a view on the topic, please answer this single-question survey. Results will be published shortly."

at http://pragcap.com/gold-weakness-is-inconsistent-with-loose-monetary-conditions-in-the-us#jr9z2czXDfDilySw.99

No comments:

Post a Comment