Prudent Bear’s Doug Noland publishes a quarterly analysis of the Fed’s Z.1 report of US credit market activity. This is always a must-read, but last Friday’s was truly extraordinary. Among other big, ominous trends, Noland notes the following:

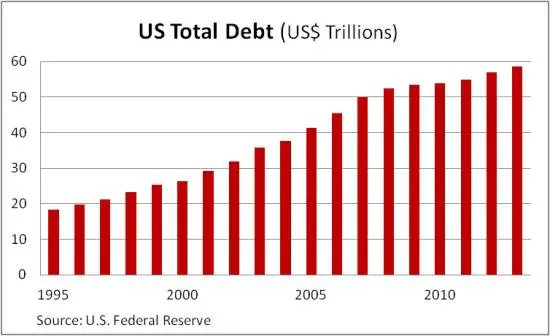

• Total (financial and non-financial) Credit jumped $484bn during Q1 to a record $59.399 TN, or 347% of GDP.

• Total Non-Financial Debt (NFD) expanded at a 5.0% rate.

• Corporate borrowings grew at a robust 9.3% pace

• Federal government debt mounted at a 7.1% rate

• Consumer credit rose at a 6.6% rate

• Household net worth surged $7.98 TN, or 10.8%, over the past year.

• Over the past four years, household holdings of financial assets have surged $22.0 TN, or 49%, to a record $67.2 TN.

What’s happening? The short answer is that zero interest rates have finally begun to work their magic. Corporations, for instance, are using the proceeds from low-rate bonds to buy back stock on a vast scale. See Zero Hedge’s Here’s the mystery and completely indiscriminate buyer of stocks in the First Quarter.

And now cheap credit is leading consumers to start buying cars and using plastic. Here’s an excerpt from a Financial Sense article asking how US consumer spending could be rising while incomes are not:..."

at http://dollarcollapse.com/credit-bubble-2/the-bubble-is-back/

No comments:

Post a Comment