September 5 – (King World News) – The Global Collapse Is Now Accelerating

The major indexes are up nearly 200% since the March 2009 low. Today Wall Street has plenty of cheerleaders, but a lot less to cheer about: Stocks are far less attractive than they were on that day in 2009 and this bear has a lot longer to run…

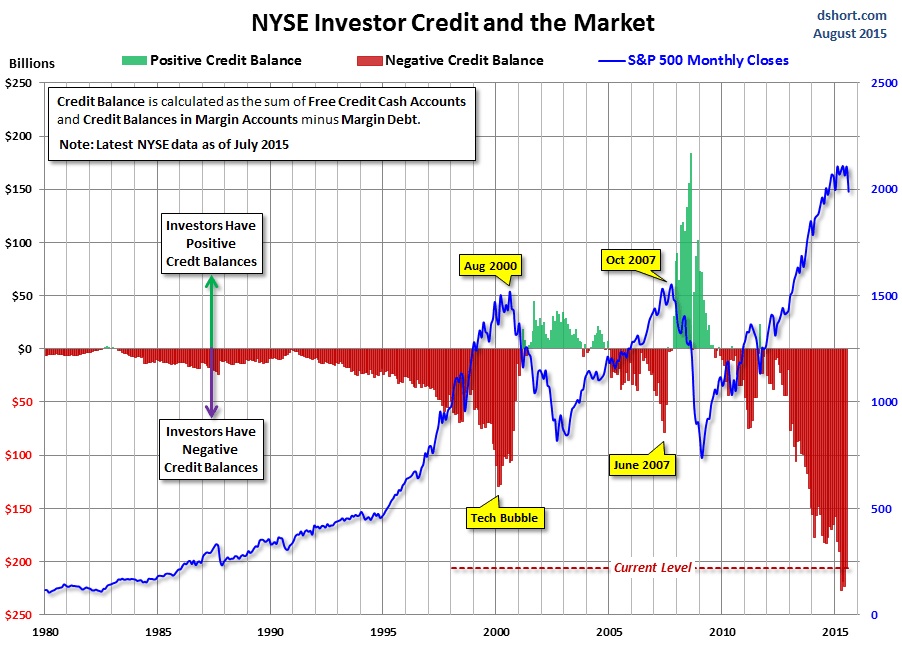

First, stocks that were over-hated in 2009 are now over-loved. This is evidenced by margin debt which is at all-time highs (notice extreme negative credit balance shown in red for the years 2000, 2007 and the extremes of 2015!).

Earlier in the year margin debt had risen over $30 billion or 6.5% to $507 billion and was equal to a record 2.87% of U.S. GDP. This surpasses the previous all-time high of 2.78% set in March 2000 – the top of the last largest stock market bubble in history.

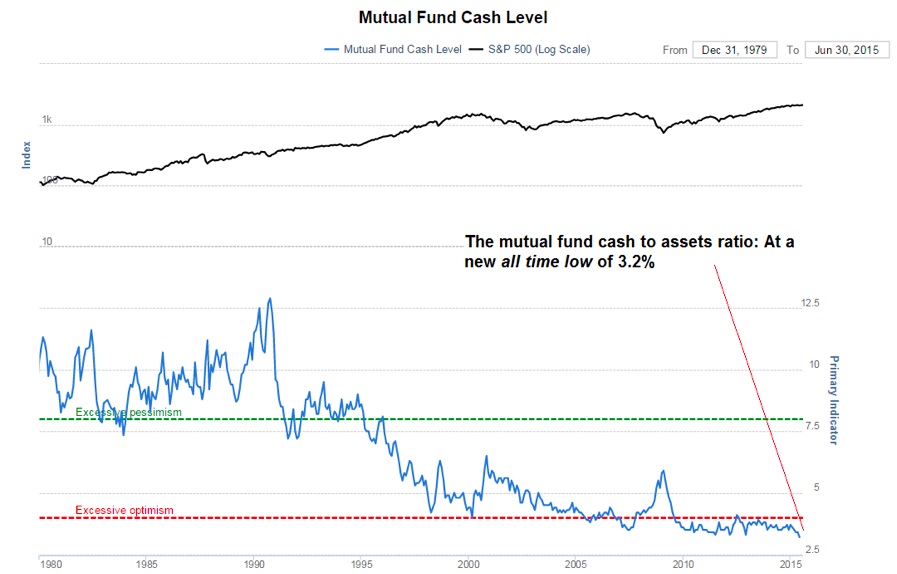

And despite the assurance of every mutual fund manager on TV that they have boatloads of cash ready to deploy at these “discounted” levels, in early August cash levels at mutual funds sank to their lowest level in history, 3.2% (see chart below). As a percentage of stock market capitalization, fund cash levels are also nearing the record low set in 2000 when the NASDAQ peaked and subsequently crashed by around 80%.

Next, stocks are overvalued by almost every metric. My favorite metric, the Price to Sales Ratio, estimates the price of stocks over sales of the S&P 500 for 2015 at 1.66. In 2006 the Price to Sales Ratio was 1.49 and in 2007 it was 1.43. Compare this to 2008 when the ratio was .87 and in 2009 when it was 1.23..."

at http://kingworldnews.com/danger-the-global-collapse-is-now-accelerating/

No comments:

Post a Comment