Since the gold price peak in 2011 the Federal Reserve has “generously” supplied the world with trillions of dollars of newly created digital and paper debt, all backed by nothing but faith and credit. Bonds have rallied and the S&P is higher by 50% or so. The Japanese Central Bank has similarly produced trillions of yen, bought stocks and bonds, and extended their recession several more years.

Yes, the past four years have been a repeat of the age of stocks, debt, and leverage, but only the financial and political elite experienced good times. Debt is massively higher and gold is still bumping around a bottom.

- Gold dropped from about $405 in January 1996 to $253 in July 1999: 38% in 42 months.

- Gold dropped from about $1900 in August 2011 to $1070 in July 2015: 44% in 47 months. The drop is similar to the 1996-1999 collapse.

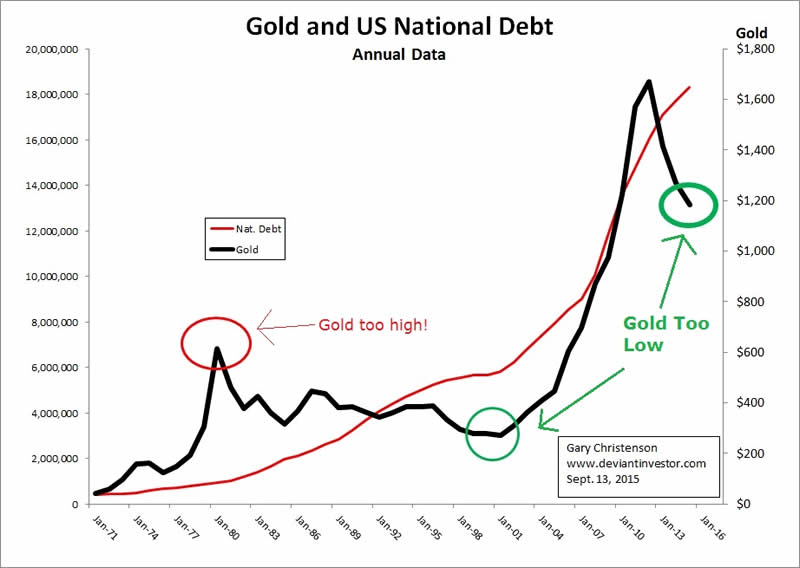

The US national debt has steadily increased. Examine the following two graphs regarding gold and the national debt.

WHAT THESE GRAPHS SHOW:

- Gold prices increase with national debt, with notable exceptions such as 2001 and 2015 – circled in green. Those exceptional prices did/will correct higher to match the upward trend in national debt.

- Gold prices in 2015 are clearly low compared to long term national debt, as they were in 2001. Expect gold prices to rise substantially to compensate for the past four years of declining prices.

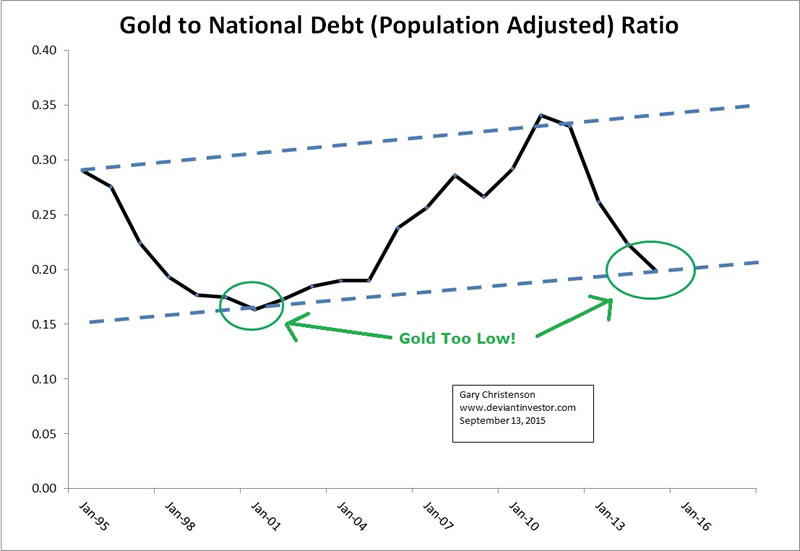

- The ratio of gold to population adjusted national debt for the past 20 years shows that gold prices rise along with both population and the inexorably increasing national debt. Currently the ratio is at the low end of its multi-decade range. Gold prices will rise more rapidly than population and the national debt for several, probably many, years..."

at http://www.marketoracle.co.uk/Article52392.html

No comments:

Post a Comment